|

U.S. blue chips rebound

|

|

February 22, 2000: 6:04 p.m. ET

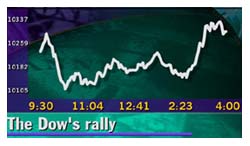

Dow stages late comeback as Merck, DuPont gain; Nasdaq falls as techs slip

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Solid gains for DuPont and Merck lifted the Dow Jones industrial average Tuesday, breaking a streak of three consecutive sessions of losses.

The Dow Jones industrial average rose 85.32 points to 10,304.84. It had fallen as much as 116 points earlier in the session.

Analysts said investors flocked to stocks perceived as bargains. Peter Cardillo, director of research at Westfalia Investments, expressed optimism that the Dow's recent slide may be ending. "We are having a good bounce, and that is encouraging. It's just what the market needs," he said.

Added Hugh Johnson, chief investment officer at First Albany: "We got down too far too fast. You reach a level that attracts buyers."

The S&P 500 index added 6.08 to 1,352.17, while the Nasdaq composite index, pressured by losses among biotechnology and Internet stocks, fell 29.62 to 4,382.12.

Breadth was negative. On the New York Stock Exchange, declines outnumbered advances 1,660 to 1,361 on trading volume of 975 million shares. On the Nasdaq, losers led gainers 2,468 to 1,803 with 1.77 billion shares changing hands.

In other markets, Treasury prices rose, with the 30-year bond gaining a full point, in price, lowering its yield to 6.08 percent from 6.15 percent late Friday. The dollar fell against both the yen and the euro.

DuPont, Merck lift the Dow

Although the Dow recently dropped into a correction -- considered a drop of 10 percent or more from an index's highs -- sharp gains to index components DuPont and Merck helped the blue chip index shake off earlier losses.

DuPont (DD: Research, Estimates) rose 2-1/2 to 54-3/16. The nation's largest chemical company predicted a double-digit rise in earnings in the near term.

Merck (MRK: Research, Estimates) gained 3-1/2 to 65-1/2 after the leading drug maker announced a plan to buy back an additional $10 billion of its own shares. The program follows the company's $5 billion stock repurchase plan approved in July 1998.

Other pharmaceutical stocks advanced, including Dow component Johnson & Johnson (JNJ: Research, Estimates), which added 1-3/16 to 78-5/8.

And Home Depot (HD: Research, Estimates), another Dow component, edged up 1/16 to 53-13/16 after reporting better-than-expected fourth-quarter earnings of $578 million, or 25 cents per diluted share. Analysts surveyed by research firm First Call Corp. had expected the world's largest home improvement retailer to post 24 cents.

But pressuring the blue-chip index was SBC Communications (SBC: Research, Estimates), falling 2 to 36-1/4. The telecommunications company agreed to acquire Sterling Commerce (SE: Research, Estimates), a leading provider of e-business solutions, for about $3.9 billion.

Sterling Commerce, one of the most actively traded issues on the New York Stock Exchange, soared 12, or 38 percent, to 43-9/16.

Also on the skids was Sotheby's Holdings (BID: Research, Estimates), plunging 2-1/8, or nearly 12 percent, to 15-5/8. The auction house said Monday its top executives resigned amid an antitrust probe.

Nasdaq loses ground

The tech-heavy Nasdaq composite index extended Friday's heavy loss. Analysts said they were not surprised the index is taking a breather since it has gained over 8 percent this year.

Biotechnology stocks, which had been firm in recent sessions, declined. Human Genome Sciences (HGSI: Research, Estimates) tumbled 25-3/4, or nearly 13 percent, to 174-1/2, and Amgen (AMGN: Research, Estimates) slumped 3-13/16 to 67-1/2.

Internet shares also suffered. Amazon.com (AMZN: Research, Estimates) fell 1-3/16 to 63-9/16, eBay (EBAY: Research, Estimates) declined 2-3/4 to 134-1/2, and Yahoo! (YHOO: Research, Estimates) retreated 2-5/16 to 153-13/16.

Many of the Nasdaq's key components ended in the red. Cisco Systems (CSCO: Research, Estimates), fell 1-7/8 to 123-15/16, Dell Computer (DELL: Research, Estimates), dropped 1/4 to 39-13/16 and Microsoft (MSFT: Research, Estimates) retreated 1-1/4 to 93-13/16.

But supporting the composite index was Nextel Communications (NXTL: Research, Estimates). Shares of the digital wireless phone company jumped 12-5/16, or more than 10 percent, to 131 after reporting a narrower-than-expected fourth-quarter loss and announced a two-for-one stock split.

Another technology standout was Texas Instruments (TXN: Research, Estimates), gaining 15, or more than 11 percent, to 149 on the New York Stock Exchange. The semiconductor maker Tuesday unveiled two new chips designed to help provide high-speed Internet access.

Investors eye Greenspan

Analysts said any upside potential for the market could be limited as market participants await remarks from Federal Reserve Chairman Alan Greenspan. The Fed chief is scheduled Wednesday to give the second part of his semi-annual Humphrey-Hawkins testimony on Capitol Hill. Last week Greenspan hinted that interest rates will continue to rise until the economy slows.

The Fed has raised short-term interest rates four times since last June in order to keep inflation in check. Analysts widely expect the central bank to hike rates again by a quarter percentage point when it meets next on March 21.

(Click here for a look at today's CNNfn hot stocks.)

(Click here for a look at today's CNNfn technology stocks.)

|

|

|

|

|

|

|