|

Bonds drop as stocks rise

|

|

February 23, 2000: 3:32 p.m. ET

Equity strength pressures bonds; Greenspan testimony shrugged off

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury prices ended lower Wednesday as strength in U.S. equities lured investors away from bonds to more profit generating trades.

"It's clear what is irking the market is the spectacular recovery in equities, at least in the S&P and Nasdaq," said Patrick Dimick, senior U.S. economist at Warburg Dillon Read.

Analysts called the sell-off technical in nature, noting it came on the heels of solid gains for bonds the previous two sessions as investors fled a plunging stock market for the relative safety of government securities.

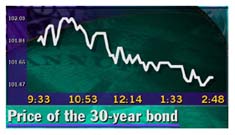

Shortly before 3 p.m. ET, the price of the 30-year Treasury bond fell 23/32 to 101-17/32. Its yield, which moves inversely to its price, rose to 6.13 percent from 6.08 percent Tuesday.

The 10-year Treasury note fell 1/2 point to 100-15/32, raising its yield 6.43 percent.

Market participants said there was little reaction to the testimony of Federal Reserve Chairman Alan Greenspan, who completed his semi-annual Humphrey-Hawkins speech. The central bank chief reiterated his concerns about inflationary imbalances and warned that further interest rate hikes may be needed until the economy slows.

With the U.S. economy in its record 107th month of expansion, the Fed has raised short-term interest rates four times since last June in an effort to keep inflation in check. Analysts widely expect the U.S. central bank to hike rates again by a quarter percentage point when it meets next on March 21.

Many expect another hike in May.

Supply concerns also contributed to losses. On Wednesday, the U.S. Treasury auctioned $12 billion two-year notes. In addition, some corporate issuance will enter the market this week, including a five-year American International Group (AIG: Research, Estimates) issue and a seven-year Household Finance, a subsidiary of Household International (HI: Research, Estimates). Corporate and agency bonds are seen as attractive as their higher yields could draw investors from Treasurys.

Euro focus

In the currency markets, analysts said investors focused on the euro. The single currency slipped from hitting a one-month high against the dollar early in the session on the back of profit taking. At around 3 p.m. ET, the euro fell to $1.0027 from $1.0051 Tuesday, a 0.24 percent gain in the dollar's value.

Meanwhile, the dollar traded at 111.29 yen against 110.72 yen Tuesday, a 0.51 percent gain in the dollar's value.

"Traders are consolidating their positions in dollar yen just below the five and one-half month high seen earlier this week," said Alex Beuselin, senior market analyst at Ruesch International.

|

|

|

|

|

|

|