|

4Q GDP roars ahead

|

|

February 25, 2000: 12:01 p.m. ET

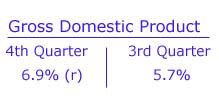

Economy grew 6.9% in period; biggest expansion in more than three years

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The U.S. economy capped off 1999 at a furious pace, posting its fastest quarter of growth in more than three years, as demand at home and abroad for U.S.-made goods remained robust and companies spent more stocking their shelves, the government unveiled Friday.

Separately, the National Association of Realtors reported that sales of existing homes declined a larger-than-expected 10.7 percent in January, the largest monthly decline in more than three years.

Gross domestic product grew at a 6.9 percent annual rate in the fourth quarter, the Commerce Department said, above the revised 6.5 percent increase expected by economists and well ahead of the 5.8 percent pace originally reported a month ago. It was the biggest gain since the second quarter of 1996, and dwarfed the third-quarter expansion of 5.7 percent.

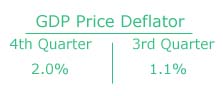

The GDP price deflator, a key inflation gauge, rose at a 2 percent annual rate, the same rate initially recorded a month ago and in line with economists' forecasts of a 2 percent gain. The price deflator rang in at 1.1 percent in the third quarter. For the entire year, the U.S. economy grew at a 4.1 percent pace, while the GDP price deflator advanced 1.6 percent.

A white-hot economy

Together, the numbers indicated what analysts, investors and Federal Reserve Chairman Alan Greenspan have marveled about: surging economic growth with no evidence of accelerating inflation. At the same time, analysts were quick to point out that the Fed's four interest rate increases since June will likely dampen economic output in the first quarter of 2000.

"This is corroborative evidence that the economy is white-hot," Wayne Ayers, chief economist with Fleet Boston Financial, told CNNfn's Before Hours. "For this late in the cycle, it's unprecedented, but we will probably see growth back off a bit in the first quarter." (237KB WAV) (237KB AIFF)

Wall Street registered little reaction to the numbers today, as investors concluded that Fed officials will likely raise rates by another quarter percentage point at their March 21st policy meeting to slow the economy down -- even with expectations that first-quarter growth won't match the fourth-quarter pace. Wall Street registered little reaction to the numbers today, as investors concluded that Fed officials will likely raise rates by another quarter percentage point at their March 21st policy meeting to slow the economy down -- even with expectations that first-quarter growth won't match the fourth-quarter pace.

GDP, which measures the amount of goods, services and investment produced, is considered the broadest measure of the nation's economy. The last time the economy grew above the 7-percent mark was the 7.2 percent rate recorded in the fourth quarter of 1987 -- the same period as the infamous Black Monday that hacked about $1 trillion off the value of U.S. stocks.

No signs of inflation

Higher rates make borrowing for consumers and businesses more expensive, ultimately slowing economic growth and keeping prices at levels that won't deter consumers from opening their wallets.

Indeed, even with no discernable signs of inflation in the U.S. economy, now in its 107th and record month of uninterrupted expansion, the Fed is still on the warpath to ensure the economy slows to a more sustainable pace that won't eventually trigger an upward surge in prices for goods and services.

Click here for the full text of the Commerce Department's GDP report

Higher productivity has allowed businesses to produce more without increasing expenses, keeping the cost of the final product low. At the same time, few analysts -- and Fed Chairman Greenspan, in particular - ever wholeheartedly agreed that strong growth without any significant gains in wages or prices could last forever.

"I cannot find (inflation) no matter where I look," Greenspan told Senators during the second leg of his semi-annual Humphrey-Hawkins testimony to Congress earlier this week. At the same time, "the type of economy that we are dealing with at this particular stage is, I suspect, one that none of us has seen before," he said. "Our basic purpose is to keep that process going."

Way too strong

The U.S. economy's rate of expansion during the past three years has been faster than what Fed officials have said can be sustained without a renewed inflation threat. Fed officials have stated at different intervals that a "comfortable" rate of growth is typically around 3 percent.

"While much of the growth surge reflects stellar productivity gains, this pace of growth is way too strong for the Fed," said Sherry Cooper, chief economist with brokerage Nesbitt Burns Inc. "While much of the growth surge reflects stellar productivity gains, this pace of growth is way too strong for the Fed," said Sherry Cooper, chief economist with brokerage Nesbitt Burns Inc.

A large increase in the government's measure of personal consumption expenditures -- what individuals spend -- rose at a 5.9 percent rate in the fourth quarter, helping boost total output during the quarter. Personal consumption expenditures account for two-thirds of overall economic activity.

A big jump in government spending on public works projects, such as building highways and schools, also lifted the quarterly total, Commerce said. Government spending rose at a revised 9.2 percent annual pace in the fourth quarter, the fastest rate of increase since the third quarter of 1986.

|

|

|

|

|

|

|