|

Income, spending gain

|

|

February 28, 2000: 11:27 a.m. ET

January income, spending up, but rate of savings also increased

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. personal income and spending rose in January while personal savings edged up slightly, the government reported Monday, suggesting Americans may be starting to put some of their extra earnings in the bank rather than into the tills of merchants.

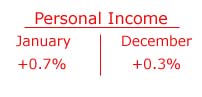

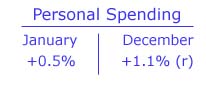

Personal income rose 0.7 percent in January, up from a 0.3 percent increase in December, while spending rose 0.5 percent, an indication of a slowing in spending compared with the revised 1.1 percent rise in December, the Commerce Department said. Both figures were in line with analysts' forecasts. The amount Americans put aside in savings, meantime, rose to a 1.4 percent pace last month from a revised record low of 1 percent in December.

The numbers suggest wages are creeping a little higher for U.S. workers, who aren't necessarily spending the excess money on goods and services as they were during the robust holiday shopping season in December. Consumer spending accounts for more than two-thirds of U.S. economic output and has been one of the principal drivers of the economy in recent years. The numbers suggest wages are creeping a little higher for U.S. workers, who aren't necessarily spending the excess money on goods and services as they were during the robust holiday shopping season in December. Consumer spending accounts for more than two-thirds of U.S. economic output and has been one of the principal drivers of the economy in recent years.

At the same time, economists were quick to point out that rising wages will likely fuel more spending in the months ahead as consumers enjoying the additional income will continue to spend much of what they earn.

Incomes rising smartly

"U.S. consumers are feeling the benefits of higher incomes and are spending more to reflect their good moods," said Sherry Cooper, chief economist with brokerage Nesbitt Burns Inc. "Buoyed by record confidence, income growth, and a super-tight jobs market, the consumer is showing no signs of slowing and should continue to propel the U.S. economy."

Of concern to both Fed policymakers and Washington lawmakers has been the country's low personal savings rate and high debt levels -- a combination many fear could lead to a crisis should a significant stock market correction or other economic shock force individuals to pay back what they owe.

That's one of several reasons Fed Chairman Alan Greenspan and the central bank's policy making arm have been raising interest rates -- to discourage consumers and businesses from borrowing more money and injecting that cash into the already white-hot economy. The Fed has lifted its benchmark Fed funds rate four times since last June; its next policy meeting is March 21.

And the so-called wealth effect, the recent phenomenon where stock market and other paper gains have made Americans feel more confident about their economic outlook, is expected to continue to fuel spending, according to economists. Greenspan last week turned the term "wealth effect" into a new Wall Street catchphrase when he alluded to it during testimony to Congress.

Spending like crazy

"With incomes outpacing spending I think American consumers will keep spending like crazy going into the New Year," said Sal Guatieri, an economist with Bank of Montreal in Toronto. "That's going to be taken into consideration by Greenspan, who's trying to slow things down."

To be sure, four quarter-point interest rate increases by the Fed has made keeping cash in the bank slightly more appealing for some individuals, as banks adjust the rate they pay their customers upward, leading some analysts to suggest that, wealth effect or not, spending will likely taper off.

"Consumers are spending like crazy, that's the bottom line," said David Resler, chief strategist with Nomura Securities. At the same time, "we're going to see slower growth in consumer spending in the next few months," he said. "Whether it's enough the keep the Fed from tightening again in May remains to be seen." "Consumers are spending like crazy, that's the bottom line," said David Resler, chief strategist with Nomura Securities. At the same time, "we're going to see slower growth in consumer spending in the next few months," he said. "Whether it's enough the keep the Fed from tightening again in May remains to be seen."

Nevertheless, Resler said he believes the Fed will raise rates again at its March 21 meeting, though may hold off lifting rates again after that if more evidence emerges that consumers are reigning in their spending. (507KB WAV) (507KB AIFF)

Much of the gains in personal income came from federal civilian and military pay increases, agricultural subsidies and other federal payments from the U.S. government, according to the Commerce Department. Incomes from wages and salaries paid by the private sector grew at a $28.5 billion annual rate in January, up marginally from December's $28.3 billion increase. Manufacturing payrolls increased by $5.2 billion after a decrease of $500 million in December.

|

|

|

|

|

|

|