|

Manufacturing picks up

|

|

March 1, 2000: 10:18 a.m. ET

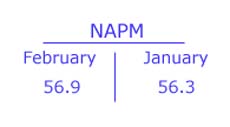

NAPM index rises to 56.9, first gain in five months; construction spending up

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. manufacturing activity accelerated at its fastest pace in four months during February, and prices paid for materials rose to a near five-year high, a trade report showed Wednesday, suggesting producers are churning out lots of goods and paying their suppliers more to do it.

Construction spending, meanwhile, advanced at a faster-than-expected pace, according to a separate, government-issued report.

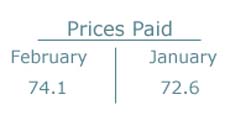

The National Association of Purchasing Management said its index of manufacturing activity rose to 56.9 in February from 56.3 in January, slightly above the unchanged reading expected by analysts polled by Briefing.com. The "prices paid" component -- a measure of costs -- rose to 74.1 from 72.6 in January, just shy of the record 74.5 registered in April 1995.

The numbers confirmed for investors that manufacturing activity is going strong, which could lead to higher prices as producers pass on their rising costs to consumers. They also suggested that rising prices for raw materials and other basic goods are placing pressure on producers to lift their prices.

Building price pressures?

"There are an awful lot of cost pressures in the system," said Brian Fabbri, chief economist of investment firm Paribas. "While they may not be manifest in final goods prices just yet, the numbers tell you that, unless companies find new ways to cut their costs, profit margins are going to be squeezed."

Both stocks and bonds shrugged off the numbers. Investors concluded that the U.S. economy likely will be reined in anyway by a fifth rate increase by the Federal Reserve Board. Fed officials are widely expected to announce another quarter-point move at their policy meeting scheduled for March 21.

At the same time, the report highlighted a growing concern among analysts, investors and Fed officials: eventually, strong demand for goods and services from spend-happy consumers at home and abroad will prompt companies to raise the prices they charge, igniting faster inflation.

"It suggests to us that the manufacturing sector of the economy is still developing at a giddy speed, and the price component looks problematic and is showing price pressure," said Jeff Cheah, an economist with Standard & Poor's MMS in Toronto. "While there's certainly no danger of hyper-inflation, there are some indications that prices may start to accelerate."

Ample productivity

One of the principal reasons the U.S. economy has been able to chug along at such a robust pace, without spurring higher prices, has been the notable improvement in worker productivity. Everything from faster computer chips to automated assembly lines to the ever-expanding use of the Internet is allowing people to work more efficiently and providing companies with the ability to streamline their operations and keep their costs low.

While most analysts and Fed Chairman Alan Greenspan agree with that assessment, few believe that productivity will keep prices in check forever. Speaking to Congress last week, Greenspan expressed concern that the country's tight labor markets have placed added pressure on employers to raise workers' wages. Higher wages compounds expenses for companies and also puts more cash in the pockets of consumers, fueling economic growth. While most analysts and Fed Chairman Alan Greenspan agree with that assessment, few believe that productivity will keep prices in check forever. Speaking to Congress last week, Greenspan expressed concern that the country's tight labor markets have placed added pressure on employers to raise workers' wages. Higher wages compounds expenses for companies and also puts more cash in the pockets of consumers, fueling economic growth.

"You have to believe the productivity trend is very real, but at one point will it begin to taper off?" Cheah said. "That's a question financial markets and the Federal Reserve have been looking at very closely." Based on today's report on other recent indicators, Cheah is now calling for three quarter-point rate increases from the Fed by June.

Higher energy costs

Productivity aside, producers have felt the indisputable pinch of rising energy costs. The price of crude oil rose as high as $25 a barrel at the end of last month, hitting profit margins among some manufacturers who rely on the commodity to produce their goods.

Today's report unceremoniously coincided with the U.S. economy's entry into its 108th and record month of uninterrupted expansion. Most analysts, including Paribas' Fabbri, agree that the economy will likely continue to chug along at a robust pace until at least the second half of the year, even with additional rate increases from the Fed. (273KB WAV) (273KB AIFF)

The NAPM, an organization that provides information and resources for the purchasing profession, surveys some 350 of its 45,000 members each month to track economic activity in 20 industries across the United States. Purchasing managers are the people who buy and sell the goods and services a company needs to produce its final products.

Its new orders index, which measures current demand, rose to 60.5 in February from 60.4 in January. Its production index, which measures current manufacturing output, rose to 61.3 from 55.9, while its index of order backlogs rose to 54 from 52. Its new orders index, which measures current demand, rose to 60.5 in February from 60.4 in January. Its production index, which measures current manufacturing output, rose to 61.3 from 55.9, while its index of order backlogs rose to 54 from 52.

Its suppliers' delivery index, which measures how much demand there is from customers to receive their goods, fell to 55 from 55.2. Its inventory index, another gauge of pent-up demand, dropped to 45.2 from 53.4, while its employment index, which measures companies' hiring plans as well as labor market conditions, rose to 53.2 from a revised 52.7 in January.

In a separate report, the Commerce Department said construction spending surged 2.7 percent in January to a record $751.8 billion, above December's revised 2.1 percent gain and well past the 0.3 percent estimate of analysts. The gain in construction spending came even as mortgage rates rose during the month and winter storms in the Northeast delayed building projects.

|

|

|

|

|

|

|