|

Palm a hit, but no homer

|

|

March 2, 2000: 11:44 a.m. ET

World's No.1 maker of handheld computers attracts investors on first day

By Staff Writer Tom Johnson

|

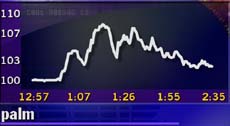

NEW YORK (CNNfn) - Shares of Palm Inc., the world's No. 1 provider of handheld computer devices, climbed more than 150 percent after its eagerly awaited market debut Thursday, although the stock closed down sharply from its highs of the day.

The Santa Clara, Calif.-based subsidiary of 3Com Corp. rose 56-1/6, or 150 percent, to 95-1/16 after being priced at 38 late Wednesday. Still the closing price is well off Palm's intraday high of 165. Shares of parent company, 3Com, also fell sharply after climbing earlier in the day, losing nearly 22 percent of their value during the same period.

Investors' waning enthusiasm for Palm (PALM: Research, Estimates) shares caught some analysts off guard, particularly given that many expected that the stock would finish the day ranked among the best first-day performers in market history. In the end, it wasn't even among the best-performing IPOs of the week.

"The dynamics of an IPO, especially one with the hype like this one, is always hard to predict right out of the gate," said Corey Ostman, chief technology officer with Alert! IPO, a research firm that tracks initial public offerings. "But this is a great company. It's one a lot of institutions are going to want to invest in." "The dynamics of an IPO, especially one with the hype like this one, is always hard to predict right out of the gate," said Corey Ostman, chief technology officer with Alert! IPO, a research firm that tracks initial public offerings. "But this is a great company. It's one a lot of institutions are going to want to invest in."

Analyst report helps dampen surge

Palm priced its initial offering late Wednesday, well above its upwardly revised $30-to-$32 per share expected price range, as investors scrambled to get a piece of what many believed would rank as one of the most successful IPOs ever to hit Wall Street.

But after its initial surge Palm's momentum sputtered, in part because of a research report published on the company Thursday, shortly before it started trading, analysts said.

The report, issued by ABN AMRO computer analyst Jonathan Ross, initiated coverage of Palm with a "buy" rating, but set a price target of $90 per share.

Ross called the price target "conservative," based on the assumption that Palm will grab at least one-third of the handheld computer market, which he valued at $155 billion. But, he noted Thursday's trading levels were in-line with the company's current business platforms.

"At this point, this seems to be what the fundamentals are telling us," Ross said. "This is a very comfortable [trading] range for us right now."

As Palm's stock deflated Thursday, shares of 3Com (COMS: Research, Estimates) plummeted as well, falling 22-5/16 to close 81-13/16. Earlier in the day, before Palm began trading, 3Com traded at a 52-week high of 117-1/4.

Investor interest in Palm's IPO pushed 3Com's stock up more than 130 percent since it announced the partial spin off in mid-December. 3Com Chief Executive Officer Eric Benhamou told CNNfn that his company plans to complete a total spin off of Palm to its shareholders within the next six months as planned. Investor interest in Palm's IPO pushed 3Com's stock up more than 130 percent since it announced the partial spin off in mid-December. 3Com Chief Executive Officer Eric Benhamou told CNNfn that his company plans to complete a total spin off of Palm to its shareholders within the next six months as planned.

"Our intention to continue with a spin off remain unchanged," he said.

Still, analysts said it will be interesting to see how investors treat 3Com from here on out given its plans to shed Palm, which currently has a market capitalization of $53.4 billion.

"It will be really interesting to see how the momentum plays out for both stocks the next few days," Ostman said.

Hype dominated Palm debut

Investor interest in Palm has been particularly high in recent weeks because 3Com sold a mere 4.1 percent of its 562.2 million outstanding shares to the public, raising $874 million. America Online (AOL: Research, Estimates), Nokia Corp. (NOK: Research, Estimates) and Motorola (MOT: Research, Estimates) were among the institutional investors able to secure Palm shares before the IPO.

"The interest is really not surprising that they priced so far above the range," said Peony Kao, an IPO analyst with Renaissance Capital. "Just look at the institutional investors this company was able to attract."

By most estimates, Palm currently controls roughly two-thirds of the handheld computer market. It achieved that position by fending off several competitors in the last few years, including Microsoft Corp. (MSFT: Research, Estimates), while shrewdly licensing its operating system to other potential rivals.

The eight-year-old company has sold more than 5 million of its Palm and older PalmPilot handheld computers, and forged into new territory by offering Internet and e-mail access in its latest model, the Palm VII. The eight-year-old company has sold more than 5 million of its Palm and older PalmPilot handheld computers, and forged into new territory by offering Internet and e-mail access in its latest model, the Palm VII.

Unlike most recent IPOs, Palm is profitable, having earned nearly $25 million on sales of $435 million during the first six months of its current fiscal year.

"The market is huge, not only for organizers ... but also in wireless access to the Internet," Palm's Chief Executive Officer Carl Yankowski told CNNfn's In The Money.

Palm looking to defend its turf

The company intends to use its IPO proceeds to pay 3Com a dividend and help market its Palm operating platform, keeping other potential rivals from joining Microsoft's quest to erode its market share.

Microsoft's latest attempt to challenge Palm's dominance will be the distribution of its PocketPC handheld computer software, expected to hit stores June 30. Hewlett-Packard Co. (HWP: Research, Estimates) and Compaq Computer Corp. (CPQ: Research, Estimates) are among the companies expected to make devices using the Microsoft system.

But Yankowski told CNNfn that Palm's licensing partnerships -- which includes companies like Nokia and Sony Corp. (SNE: Research, Estimates) -- remain strong, and the company hopes to add to its clientele base using some of the proceeds from the offering. (288K AIFF)(288K WAV)

"We control the licensing, so we can determine whom we license to in the future and we've got some great partnerships already," he said.

|

|

|

|

|

|

Palm, Inc.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|