|

MGM, Mirage roll the dice

|

|

March 6, 2000: 7:50 p.m. ET

Casino operators ink $4.4B merger agreement; rival bids called unlikely

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - MGM Grand Inc. agreed to acquire rival casino operator Mirage Resorts Inc. for $4.4 billion in cash Monday, creating a gambling powerhouse that would dominate business along the Las Vegas Strip.

The deal seemingly ends nearly two weeks of speculation concerning the fate of Mirage, which was first approached by MGM late last month with an unsolicited "friendly" cash and stock offer that valued the gaming giant at $17 per share.

Mirage rejected that initial foray, potentially opening the door for additional suitors. But after weekend-long negotiations, the two sides emerged Monday with an offer calling for MGM (MGG: Research, Estimates) to exchange $21 in cash for each outstanding Mirage (MIR: Research, Estimates) share. MGM also agreed to assume roughly $2 billion in outstanding Mirage debt.

The deal also contains a $135 million break-up fee, according to a source with knowledge of the negotiations. That, combined with Mirage's decision to enter a definite merger agreement so quickly after MGM launched its initial bid, practically eliminates the likelihood of a competing bid, according to analysts and sources familiar with the matter.

A Vegas powerhouse

"I thought this deal would either happen quickly or go away quickly," said J Terrance Lanni, MGM's chairman. "We think this is just a great opportunity for our company and Mirage shareholders."

Combined, MGM and Mirage will control more than half of the high-end casino business along the famed Las Vegas Strip and boast annual revenue of nearly $3.8 billion, creating a nearly unrivaled force in the gambling business.

Company officials said the deal is expected to add to earnings immediately and promised "significant" cost savings through increased purchasing power and by combining duplicate facilities and functions. Stuart Linde, an analyst with Lehman Brothers, estimated the cost savings could reach $125 million annually.

"We said all along we wanted this to be an accretive acquisition that didn't hurt our investment credit ratings and we didn't stray from that," Lanni said.

"It's a very exciting deal that's good for Mirage's shareholders," said Jason Ader, a gaming analyst with Bear Stearns. "This will change the face of the gaming industry."

A done deal?

Ader and other analysts all but dismissed the possibility that another casino operator might make a competing bid for Mirage even though at least one, Harrah's Entertainment Inc. (HET: Research, Estimates), has openly expressed interest in entering the fray.

According to Monday's Wall Street Journal, the Memphis, Tenn.-based Harrah's, the world's second largest gaming company, hired Deutsche Bank last week to help it craft a deal for Mirage.

But one source close to the investment bank said it was not presently working with Harrah's on a potential deal and could not confirm if the bank had ever been hired to hash out a deal.

Even so, analysts doubted that Harrah's possesses the financial flexibility to go head-to-head with MGM's offer because it is digesting several recent acquisitions of its own. Working its stock into a potential deal doesn't help either because it currently trades below MGM's $21 per share offer.

Mirage spokesman Alan Feldman confirmed the company only had one formal offer to consider over the weekend.

"It looks like pretty much a done deal," said David Anders, an analyst with Credit Suisse First Boston. "Harrah's can't do an all-cash deal of that magnitude."

"They don't have the ability to get the synergies out of this that MGM does, particularly at the high end," Ader agreed.

A Harrah's spokesman said the company had no comment on the merger agreement. He would not elaborate as to whether Harrah's was still pondering a competing bid.

Still, investors remained a little wary. Mirage shares closed up 3-1/8 at 19, still well below the $21 per share price. MGM shares, meanwhile, closed up 1/2 at 19-1/2.

A premiere gambling name

The MGM-Mirage combination will boast more than 25,000 hotel rooms and nearly one billion square feet of gaming space in some of the country's most well known casinos, including The Mirage - featuring attractions such as dolphins and erupting volcanoes and Treasure Island motifs -- The Golden Nugget, the MGM Grand Las Vegas and the New York-New York Hotel and Casino.

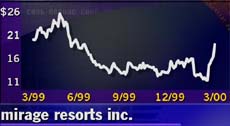

Combined, the two companies would boast assets exceeding $7.4 billion, with Mirage currently controlling more than 60 percent of that total. Mirage also generates an annual revenue stream of $2.4 billion, far exceeding MGM's $1.4 billion, but Mirage's financial stock performance has turned the company from an acquirer to the one being acquired.

The company's recent troubles have come largely from its inability to overcome the high costs associated with its aggressive expansion efforts. The Las Vegas-based casino chain added the $1.6 billion Bellagio casino/hotel in Las Vegas and the Beau Rivage, a beachfront casino resort in Biloxi, Miss. last year. The company's recent troubles have come largely from its inability to overcome the high costs associated with its aggressive expansion efforts. The Las Vegas-based casino chain added the $1.6 billion Bellagio casino/hotel in Las Vegas and the Beau Rivage, a beachfront casino resort in Biloxi, Miss. last year.

The Beau Rivage, in particular, had a difficult first year, causing Mirage to miss its second-quarter earnings estimate last year.

Will Wynn ride into the desert sunset?

The deal, which the companies hope to complete during the fourth quarter, also represents a changing of the guard of sorts along the Las Vegas Strip.

Mirage Chairman and Chief Executive Steve Wynn literally helped build the modern-day Las Vegas, beginning when he bought a small stake in The Golden Nugget in 1971. He went on to develop a reputation as one of Las Vegas' most flamboyant, if not eccentric, casino moguls.

But he drew the ire of shareholders and analysts in recent years for his confrontational manner and decision to sell off a sizable chunk of his Mirage holdings. He currently owns a 12 percent stake in the company.

It was that relationship that analysts said hindered the company's ability to seek out a better deal. If it lost MGM as a bidder, the company's stock price could sink to even lower depths.

"I think if Mirage left the door open too far, MGM would just walk away," Linde said.

"I was surprised, really," agreed Robin Farley, a gaming analyst with Deutsche Bank Alex Brown. "I really thought they would try to come up with an alternative [bid]. But I definitely think his strained relationship with the financial community hurt his bargaining position."

MGM's billionaire chairman, Kirk Kerkorian, meanwhile, is more of Hollywood fame, having invested in everything from movie studios to casinos. He actually has owned MGM Grand three times now, currently controlling a 60 percent stake in the company.

Kerkorian actually tested Mirage's waters once before, quietly buying a 4.9 percent stake in the company before selling it off for a substantial profit.

The proposed merger agreement does not specifically create a position for Wynn. Analysts said they weren't surprised by that development, given the difficulty two such strong-willed personalities would have working together.

"Steve did a great job at Mirage, but MGM is the acquiring entity here," Anders said.

A new era in the gaming industry

The MGM/Mirage merger would supplant Harrah's as the nation's second largest gaming concern behind Park Place Entertainment (PPE: Research, Estimates), which was spun off from Hilton Hotels Corp. (HLT: Research, Estimates) in 1998.

Together with Harrah's, the three entities will create a gambling triumvirate that will dominate slot machines from Atlantic City to California. However, most analysts said the new hierarchy will largely be good for the gaming industry and shareholders alike.

"Ultimately, there are going to be three large-cap gaming companies and that's good for pricing leverage, stock liquidity and information flow to investors," Linde said.

Farley said there likely will be more consolidation in the industry, particularly if new markets don't open allowing the current giants to expand even further.

|

|

|

|

|

|

|