|

Europe hit by Dow sell-off

|

|

March 7, 2000: 12:55 p.m. ET

Bank talks spur Frankfurt to record; London, Paris follow Dow down

|

LONDON (CNNfn) - Most European equity markets crumbled Tuesday, after a weak start on Wall Street left only Frankfurt's blue-chip gauge ahead, boosted by speculation of a multi-billion dollar merger between Deutsche Bank and Dresdner Bank.

London's benchmark index closed down 1.5 percent having spent most of the session in the black while Paris tumbled from three successive record closes to end down 1.6 percent. However, Frankfurt's index gained more than 1 percent.

The trigger for Europe's sharp reverse was a profit warning from consumer-goods maker Procter & Gamble that sent the Dow Jones industrial average down more than 2 percent to below 10,000. The drop overshadowed a Nasdaq advance that caused the tech-heavy index to pierce the 5,000 level for the first time before retreating.

In Frankfurt, the Xetra Dax closed up 89 points at 8,064.97, its second successive record close. Dresdner Bank jumped 21 percent and other financial-services providers followed its stock higher after the company confirmed it was in advanced cooperation talks with Deutsche.

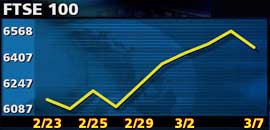

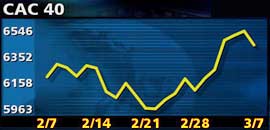

In London, the FTSE 100 closed down 101 points at 6,466.50, weakened by sell-offs in leading telecom and retail issues. The CAC 40 in Paris suffered the worst decline, ending off 104 points at 6,441.15 as auto and retail shares slipped sharply.

Among smaller markets, the SMI in Zurich closed 0.5 percent down while the AEX in Amsterdam ended off 0.4 percent.

The pan-European FTSE Eurotop 300, a broader gauge of Europe's largest stocks, fell 0.7 percent from its record close in the previous session to end at 1,636.01.

In currency markets, the euro tumbled in afternoon trade to end the European session at 96.55 cents, around 0.75 cent below its New York close Monday. The boost from a smaller-than-expected rise of 0.5 percent in German producer prices in January was outweighed by a rise in U.S. fourth-quarter productivity.

Deutsche talks spurs sector

In Frankfurt, Dresdner Bank (FDRB) shares closed up 21 percent at 56.50 euros, after climbing as high as 60 euros earlier in the session. Deutsche Bank (FDBK), Europe's largest bank by assets, climbed 7.2 percent after saying it was in talks with Dresdner on a wide-ranging cooperation pact. The two have scheduled a joint press conference Thursday. A merger would create the world's largest bank group with assets of almost 1.5 trillion euros.

Allianz (FALV), the insurer with stakes in both banks, soared 12.5 percent. Published reports said Allianz would acquire the combined retail banking business from a merged Deutsche-Dresdner. Commerzbank (FCBK), which is also seen as a takeover candidate, gained 8.9 percent, and HypoVereinsbank (FHVM), the No. 2-ranked bank in Germany, ended 8.8 percent higher. Allianz (FALV), the insurer with stakes in both banks, soared 12.5 percent. Published reports said Allianz would acquire the combined retail banking business from a merged Deutsche-Dresdner. Commerzbank (FCBK), which is also seen as a takeover candidate, gained 8.9 percent, and HypoVereinsbank (FHVM), the No. 2-ranked bank in Germany, ended 8.8 percent higher.

Outside the financial-services sector, utility merger partners Viag (FVIA) and Veba (FVEB) both were down 3 percent while retailer Metro (FMEO) gave up 6 percent. Software manufacturer Epcos (FEPC) lost 6 percent and tourism operator Preussag (FPRE) shed 5.5 percent.

Vodafone, BT weaken London

In London, electronics retailer Dixons (DXNS) slumped 17.5 percent amid intensifying competition in the U.K. Internet access market. Dixons owns Freeserve (FRE), the largest free access provider, which will face competition from services announced this week by AltaVista and cable firm NTL offering free or cheaper phone-line usage for Internet access.

Electricity generator PowerGen (PWG) lost 14 percent after gains in the previous session amid expectations of asset sales. Among market leaders, Vodafone AirTouch (VOD) gave up 4.1 percent after its 8 percent surge Monday, and British Telecommunications (BT-A) lost 8.8 percent.

Business-services company Hays (HSE) fell 6 percent while the P&G warning left Unilever (ULVR), its U.K.-based rival, nursing an 8.3 percent decline. Business-services company Hays (HSE) fell 6 percent while the P&G warning left Unilever (ULVR), its U.K.-based rival, nursing an 8.3 percent decline.

Oil stocks cushioned the FTSE's drop, as the price of Brent crude in London passed $30 a barrel for the first time since the Gulf war. BP Amoco (BP-A) rose 2.3 percent and Shell Transport & Trading (SHEL) gained 4.7 percent.

Media stocks were the best performers, with publisher Daily Mail & General Trust (DMGO) leading the FTSE 100 with a 7.9 percent gain. Sector rival Pearson (PSON) gained 4 percent and Carlton Communications (CCM) added 7.7 percent.

Outside the FTSE 100, security firm Williams (WLMS) rose 31 percent after selling its Yale and Chubb locks division to Sweden's Assa Abloy for $1.3 billion in cash and stock. Shares in Assa, the world's largest lock maker, surged 195 percent in Stockholm.

In Paris, retailer Casino (PCA) shed almost 6 percent as investors turned their backs on the sector, though the company beat expectations with a 21 percent rise in 1999 net earnings.

Automakers also lost most ground, with PSA Peugeot Citroën (PUG) down 5.8 percent after announcing production problems with a new model, while rival Renault (PRNO) lost 5.5 percent. Automakers also lost most ground, with PSA Peugeot Citroën (PUG) down 5.8 percent after announcing production problems with a new model, while rival Renault (PRNO) lost 5.5 percent.

France Telecom (PFTE), which last week shot up 25 percent in a day, weighed on the CAC with a 5 percent decline, and technology services provider Cap Gemini (PCAP) fell 4.8 percent.

Defense contractor Thomson-CSF (PHO) was the best performer, up 5.4 percent, while sector rival A

érospatiale-Matra (PARO) gained 3 percent. Luxury-goods maker LVMH (PMC) jumped 5.2 percent amid optimism about its 1999 results, due Wednesday.

Pay-TV operator Canal Plus (PCAN), which was scheduled to release its results after the market closed Tuesday, ended 1.6 percent ahead. Crédit Lyonnais (PCL) ended flat after posting a three-fold jump in full-year earnings for 1999 while TotalFina (PFP) rose 2 percent.

Dutch retailer Ahold rose 1.2 percent in Amsterdam after saying it agreed to pay $3.6 billion to buy U.S. Foodservice (UFS: Research, Estimates).

--from staff and wire reports

|

|

|

|

|

|

|