|

Occidental buys Altura

|

|

March 8, 2000: 7:40 a.m. ET

Company buys largest oil producer in Texas from BP Amoco, Shell

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Occidental Petroleum Corp. agreed Wednesday to acquire Altura Energy Ltd. Partnership for $3.6 billion, ending more than a month of negotiations to buy the largest oil producer in Texas.

Los Angeles-based Occidental said it will invest roughly $1.2 billion to acquire Altura's common equity from its joint owners, BP Amoco (BPA: Research, Estimates) and Royal Dutch/Shell (RD: Research, Estimates).

The deal will immediately increase Occidental's average daily oil production to roughly 417,000 barrels this year, a 36 percent increase, and add 50 cents per share to its 2000 earnings after accounting for the costs of the acquisition. The transaction is expected to close in April. In a separate deal, the partnership will borrow approximately $2.4 billion, which will offer creditors recourse to Altura's assets only.

Additionally, Occidental officials said they expect to arrest the projected decline curve in Altura's production by 2002 by tapping new reserves already identified in the area and accelerating the pace of exploratory drilling throughout the field.

"This really creates a new breed of core business for these guys," said Jay Wilson, an oil analyst with J.P. Morgan. "This is the kind of asset that they will be working for 30 years."

Steep price raises some eyebrows

Occidental's interest in the more than 900,000 acre Altura field first surfaced in late January after BP Amoco and Royal Dutch/Shell said they wanted to sell the partnership and concentrate more on overseas exploration.

That bid drew criticism from some analysts and investors, who questioned why Occidental, itself trying to clear more than $5 billion worth of debt off its books, would pursue a pricey transaction for what is considered a somewhat mature oil field.

Those fears were fanned even further Wednesday after Standard & Poor's cut its long-term ratings on Occidental debt as a result of the Altura deal. Two other main credit rating agencies, Duff & Phelps Rating Co. and Fitch IBCA, both maintained their debt ratings.

Some analysts still questioned Wednesday whether the company's money might have been better spent.

"Occidental is paying more than double what its own stock is valuing its existing reserves," said Fadel Gheit, an oil analyst with Fahnestock & Co., who has a "buy" rating on Occidental's stock. "So either they don't believe their reserves have much value, or they are paying too much. Either way, they are sending investors a very negative message here."

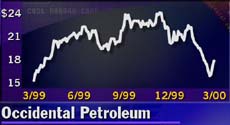

Indeed, since word of Occidental's interest in Altura first surfaced, the company's stock has shed nearly 20 percent of its value, trading as low as 15-3/4 last month. Indeed, since word of Occidental's interest in Altura first surfaced, the company's stock has shed nearly 20 percent of its value, trading as low as 15-3/4 last month.

Even the deal's completion Wednesday drew only a muted response from investors who pushed Occidental (OXY: Research, Estimates) shares up 1/4 to 18-1/16 by early afternoon.

Analysts said the stock price should rebound as the company proves it can generate a long-term return from the Altura field.

"The market has been spooked by the fact that these guys would overpay," Wilson said. "But I don't think this can be in any way interpreted as a worse case scenario."

Officials promise better production, cost savings

Occidental officials defended the Altura purchase in a conference call with analysts and reporters Wednesday, noting the deal's structure effectively allows the company to avoid incurring additional debt while significantly increasing earnings and cash flow.

"Creative, non-recourse project financing of this acquisition assures that we can accomplish our primary objective of achieving significant earnings growth and enhanced shareholder value without issuing stock or entering the long-term debt markets," chairman and CEO, Ray Irani, said.

Wilson noted Irani and his management team have a proven track record of acquiring mature oil fields and making them more productive and profitable.

"Those guys have a pretty good track record of going into mature fields and cutting costs and raising production," said Wilson, who has a "buy" rating on Occidental's stock.

In this case, Occidental President Dale Laurance said the company is confident it can achieve $50 million a year in cost savings and margin improvements at Altura. Company officials expect some job reductions as a result of the deal, but did not specify an exact number.

Occidental expects to eliminate approximately $500 million in debt off its own balance sheet this year, as well as at least $200 million in Altura debt.

Additionally, it will finance its $1.2 billion equity purchase through a previously announced $700 million divestiture of its nearly 30 percent stake in Canadian Occidental Petroleum Ltd. and by selling roughly $500 million worth of "non-strategic" assets.

Company officials would not elaborate on what those assets might be, but said it expects to complete the divestitures by the end of this year.

New oil fields identified

Laurance said the company already identified 50 new oil exploration opportunities within the Altura property, which has proved reserves of approximately 850 million barrels of oil equivalent, that should halt the field's anticipated decline curve.

"We see this as an area of significant opportunity," Laurance said. "Simply put, Altura was not really drilling all the wells they could drill out there that were economic to drill in their efforts to maximize short-term cash flow back into the company."

Accordingly, Occidental plans to more than triple the company's expenditures for exploration, a process it believes will put the field's daily production back at 1999's average production level of 150,000 barrels per day of oil equivalent by the end of 2001. Laurance said the company should then be able to maintain that level of production for "at least 10 years, and probably much longer."

Created in 1997 through a joint partnership between BP Amoco and Shell Exploration Production Co., Altura is the leading producer of oil in the Permian Basin area of west Texas and eastern New Mexico an area that accounts for 20 percent of total U.S. domestic oil production.

In addition, Altura averaged 18,000 barrels of natural gas liquids and 124 million cubic feet of gas per day last year.

Occidental officials said Altura will produce an average of 135,000 barrels of oil per day during the remaining nine months of 2000.

BP Amoco and Royal Dutch/Shell will retain a preferred interest in the partnership and issue $2 billion in long-term notes providing the partnership with additional credit support. Those notes will carry roughly the same rate as the $2.4 billion in bank loans, anticipated to be under 7 percent, company officials said.

|

|

|

|

|

|

|