|

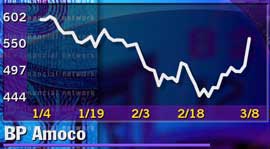

BP leads oil stock surge

|

|

March 8, 2000: 8:46 a.m. ET

Jump in crude prices lifts European producers before key Opec meeting

|

LONDON (CNNfn) - The market value of BP Amoco leapt more than $17 billion by midday Wednesday as the latest of a series of increases in oil prices drove up shares across the industry, though few analysts believed the price of crude will remain at its present level.

Shares in BP Amoco (BPA) the world's second-largest quoted oil firm by market value, jumped more than 10 percent to 557 pence in the wake of the jump in U.S. oil prices above $34 a barrel, their highest level in nine years. The stock price increase boosted BP's capitalization to 108 billion pounds ($170 billion)

Although oil prices slipped in European trade, investors poured into a sector which had fallen out of favor in recent months amid frenzied demand for telecommunications, technology and media stocks.

Shell Transport & Trading (SHEL), the London-listed arm of Anglo-Dutch oil producer Royal Dutch/Shell, rose 5 percent to 485 pence while Amsterdam-traded shares of Royal Dutch Petroleum also gained 5 percent. Spain's Repsol was almost 10 percent higher at 20.82 euros and in Paris, TotalFina (PFP) advanced 5.4 percent to 149.5 euros. Italy's ENI was the weakest of the European big five, though still rose 3 percent. Shell Transport & Trading (SHEL), the London-listed arm of Anglo-Dutch oil producer Royal Dutch/Shell, rose 5 percent to 485 pence while Amsterdam-traded shares of Royal Dutch Petroleum also gained 5 percent. Spain's Repsol was almost 10 percent higher at 20.82 euros and in Paris, TotalFina (PFP) advanced 5.4 percent to 149.5 euros. Italy's ENI was the weakest of the European big five, though still rose 3 percent.

The oil sector sub-index of the FTSE Eurotop 300, a broad index of the region's largest stocks, has fallen 5 percent since the end of last July, but investors rediscovered some interest in the industry because of a combination of booming oil prices and consolidation among the biggest companies.

Analysts said that BP's recent gains have been driven by optimism that its long-running bid to buy U.S. firm Atlantic Richfield may overcome the opposition of U.S. antitrust regulators. Press reports at the weekend said BP was is offering to divest Atlantic Richfield's Alaskan oil assets, which the U.S. watchdog said would pose an antitrust threat if the U>K.-based firm were to acquire them.

Europe's benchmark oil price, the three-month Brent future, lost 3.6 percent to trade at $30.75 a barrel at midday, weakened by a rise in European oil inventories, according to data released Wednesday.

Most analysts have said believe that oil prices will fall back as much as 20 percent over the next three months, with the price dictated by the key meeting of the Organisation of Petroleum Exporting Countries on Mar 27. Opec members are due to decide whether to maintain the production cuts that have crimped global fuel supplies, triggering a near four-fold jump in oil prices over the past 15 months.

|

|

|

|

|

|

Opec

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|