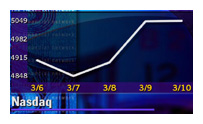

NEW YORK (CNNfn) - The Nasdaq composite eked out its 16th record of the year Friday, rising for the third time in three sessions, as money chased proven technology leaders such as Dell Computer, Microsoft and Qualcomm.

But the Dow Jones industrial average fell, unable to build on two days of gains, as investors dumped drug makers Merck and Johnson & Johnson, and financials J.P. Morgan and Citigroup, all seen as sensitive to higher interest rates.

The divergence between the blue chips and technology is symbolic: The Nasdaq finished above the key 5,000 mark, while the Dow ended below 10,000.

Analysts see the trend continuing.

"The Dow would do well to get back to its all-time high while the Nasdaq is in uncharted territory," said Donald Selkin, chief investment strategist at Joseph Gunnar. The Dow "has too many stocks whose time has past."

The Nasdaq rose 1.78 points to 5,048.64 Friday, a day after closing above the 5,000 mark for the first time in its 29-year history.

But the Dow, born in the 19th century and home to many so-called "old economy" stocks, shed 81.91 points, or nearly 1 percent, to 9,928.92.

For the week, the Dow is off 4.23 percent while the Nasdaq is up 2.73 percent.

Analysts say the Dow could face more pressure next week when economic reports are expected to show strong retail sales and a small pick-up in inflation. Strong data may give Federal Reserve inflation fighters one more reason to hike interest rates later this month.

The broader S&P 500, meanwhile, dipped 6.62 to 1,395.07 Friday. The index fell 0.9 percent this week.

More stocks fell than rose. Decliners on the New York Stock Exchange led advancers 1,715 to 1,220. Trading volume topped 1.1 billion shares. Nasdaq losers beat winners 2,317 to 1,954. More than 1.9 billion shares changed hands.

Nasdaq retains lead

The Nasdaq's quick ascent in recent weeks sent analysts scrambling to upwardly revise forecasts for the index.

Ralph Acampora, chief technical analyst for Prudential Securities, said the Nasdaq could hit 6,000 before the end of next year.

The pace would not be surprising. The Nasdaq, which doubled in little more than a year, first crossed the 4,000 mark just over two months ago, as investors chase high-growth stocks that they believe are impervious to higher interest rates.

The Federal Reserve hiked rates four times since June, and analysts expect tighter credit ahead. Against this backdrop, blue chips have tumbled, as stock investors fret that higher borrowing costs will stifle profitability.

"Rising rates won't hurt the new techies, but they might impact the 'old economy' customers," Larry Wachtel, market analyst at Prudential Securities, wrote in a note to clients Friday.

Leading the Nasdaq higher, Dell Computer (DELL: Research, Estimates) jumped 3-1/2 to 54 after PaineWebber upgraded Dell to "buy" from "attractive."

Microsoft (MSFT: Research, Estimates), a Dow member and Nasdaq's biggest mover, rose 1-15/16 to 101-7/8, after the software maker said it is entering the computer game business, unveiling the X-Box videogame that will pit it against Sony's PlayStation2.

American depositary receipts of Sony (SNE: Research, Estimates) fell 14-116 to 245.

Qualcomm (QCOM: Research, Estimates), 1999's best performing stock, jumped 9-1/8 to 136-1/8.

Still, Joseph Battipaglia, stock strategist for Gruntal & Co., told CNN's Ahead of the Curve he forecasts a bumpy ride ahead for the Nasdaq with corrections along the way. (274K WAV) (274K AIFF).

Dow can't catch a break

Among the Dow losers, Merck (MRK: Research, Estimates) fell 1-1/8 to 60, and Johnson & Johnson �(JNJ: Research, Estimates) shed 2-3/216 to 70-1/2. J.P. Morgan (JPM: Research, Estimates) lost 2-3/16 to 106-1/16, and Citigroup (C: Research, Estimates) fell1-7/16 to 48-115/16.

The Dow's biggest problem this week was clear: Procter & Gamble (PG: Research, Estimates). An earnings warning by the consumer products maker on Tuesday knocked off a third of the company's market value. The news touched off a 374-point drop in the Dow on fears that other firms also will have earnings trouble.

Those fears materialized Friday. Consumer products maker Dial Corp., warned that its 2000 earnings and sales would be below year-earlier results. Dial (DL: Research, Estimates) dropped 3-1/4 to 11. P&G's sell-off continued Friday, dropping 4-3/4 to 53.

Qwest's quest ends

Global Crossing �(GBLX: Research, Estimates) surged 3-9/16 to 58-13/16, and Tellabs (TLAB: Research, Estimates) jumped 3-11/16 to 58-5/16, on speculation they could be a takeover targets after a closely watched telecom merger failed.

Qwest Communications International (Q: Research, Estimates) plunged 8, to 52, after it announced that it and U S West (USW: Research, Estimates) had ended talks with a "major telecommunications company" considering an offer to buy both companies. Published reports identified that firm as Deutsche Telekom. U S West dropped 5-7/8 to 70-5/8.

Hours after the announcement, the Federal Communications Commission��� approved the Qwest/US West merger.

|