|

GM, Fiat to take stake in each other

|

|

March 13, 2000: 7:53 a.m. ET

U.S. automaker gets 20% of Italian firm's auto unit; Fiat gets 5% of GM

|

LONDON (CNNfn) - General Motors Corp., the world's biggest automaker, disclosed a strategic alliance Monday with Italy's Fiat SpA's auto unit, marking the latest phase in consolidation in the global auto industry where competition has spurred companies to forge together to cut costs.

For GM, an alliance with Fiat offers the extra leverage to expand its presence in the European and Latin American markets, where Fiat already has a stronghold. GM currently has alliances involving minority shareholdings in several Japanese carmakers. Earlier this year, GM increased its holding in Sweden's Saab to 100 percent from 50 percent.

For Fiat, it breathes new life into the company's struggling auto unit, and provides new avenues for sales and marketing of its cars in Europe, Latin America and even North America, where its fabled though technology-plagued Alfa Romeo ragtop has been off the market for many years.

"These synergies will help each of us formulate our brands," GM CEO Jack Smith told reporters in a conference call from Turin, Italy, Fiat's headquarters. "We want to work together to reduce our cost structure by generating synergies. So far we've seen significantly opportunity to reduce costs and we think that's absolutely necessary in order to compete in this global arena."

Extra leverage

Under terms of the deal, GM will swap 5.1 percent of its stock, worth roughly $2.4 billion, for 20 percent of Fiat's auto business. GM will offset the new issuance through $2.4 billion in new repurchases of common stock, which it expects to complete before year-end. Specifically, GM will increase by $1 billion to $9 billion the size of its announced exchange offer in which it will use GM Hughes Electronics' stock to acquire GM common shares.

GM's board also authorized a new $1.4 billion cash repurchase program to begin in the second half of this year, which is expected to make the deal accretive to GM shareholders within two years. GM's board also authorized a new $1.4 billion cash repurchase program to begin in the second half of this year, which is expected to make the deal accretive to GM shareholders within two years.

Also as part of the agreement, GM will have rights of first refusal of the remaining 80 percent of Fiat Auto if Fiat decides it wants to sell it off down the road. The transaction values all of Fiat Auto at $12 billion, based on GM's closing share price Friday. Fiat Group's other sectors, including Ferrari and Maserati, are not involved in this transaction.

GM and Fiat will set up a series of joint ventures in Europe and South America geared toward trimming production costs in those markets. At the same time, each company will be left to independently assemble, market and sell its cars, though everything from sales networks to parts will be shared.

Working independently

"This is cooperation between two companies that want very much to remain independent," Fiat Chairman Paolo Fresco said. "We are offering our shareholders further confirmation of the fact we want to grow and keep our fate, our destiny, under control," he said.

Nicholas Potter, European capital goods analyst at SG Securities in London, said the price offered by GM for a stake in Fiat's sluggish auto unit was "generous, to say the least." On paper it valued the unit at 45 percent of its annual sales, which generate an operating margin of 1.5 to 2 percent.

The alliance will involve setting up joint ventures in both purchasing and powertrain businesses of both companies.

In the area of purchasing, Fiat Auto and GM will team up to market their products and service options more effectively, particularly in Europe and Latin America. Fiat Auto and GM, along with Isuzu, will also leverage their resources to improve powertrain offerings, performance and cost.

As for automotive financing, a lucrative segment of both GM's and Fiat's businesses, GMAC and Fiat Auto Fidis will pursue operating synergies and growth opportunities in Europe and Latin America -- boosting the amount of consumer and promotional lending they do.

Return of the Alfa?

A steering committee co-chaired by both CEOs will define the joint ventures and identify new areas of cooperation, including the possible return of the famed Alfa Romeo brand to the U.S. as well as e-business opportunities such as in-vehicle communications involving GM's OnStar and Fiat's Viasat.

Savings from the combined companies are expected to total an estimated $1.2 billion annually by the third year, and grow to an estimated $2 billion annually by the fifth year, helping boost GM's bottom line. The alliance is subject to anti-trust clearance in both the U.S. and European Union. Savings from the combined companies are expected to total an estimated $1.2 billion annually by the third year, and grow to an estimated $2 billion annually by the fifth year, helping boost GM's bottom line. The alliance is subject to anti-trust clearance in both the U.S. and European Union.

Fiat, a pillar of Italy's post-World War II economy, is believed to have been courted by a number of suitors, including German-American automaker DaimlerChrysler (DCX: Research, Estimates), which was intent on enticing Fiat away from the GM negotiating table.

The Agnelli family, which founded Fiat, will retain control under terms of the alliance with GM. But some Fiat analysts believe the GM gambit could sound the death knell for the family's influence, which epitomizes the dynastic model that is a hallmark of Italy's post-World War II corporate landscape.

Indeed, the Agnellis' grip could slacken if GM seeks to increase its stake in the future. The Agnellis have been reluctant to relinquish their grip over Fiat, which accounts for roughly 5 percent of Italy's economic output. Fiat is the world's seventh-biggest automaker.

Joint ventures abound

The alliance will include a joint venture centering on car engines and components and joint investments in Europe, where GM owns Adam Opel and its British unit, Vauxhall. Fiat also may take part in GM's planned online auto-parts exchange Internet venture with DaimlerChrysler and Ford (F: Research, Estimates) Motor.

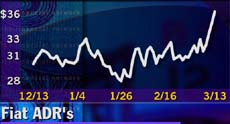

Fiat's shares, which were suspended Monday in Milan pending an announcement, have risen more than 20 percent since January amid speculation about a partnership or merger.

Fiat's American depositary receipts traded in New York gained 9/16 Monday to 35-7/16. GM (GM: Research, Estimates) shares fell 9/16 to 77-1/4. GM's (GMH: Research, Estimates) class "H" shares declined 1-5/16 to 128-3/8.

|

|

|

|

|

|

General Motors

Fiat

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|