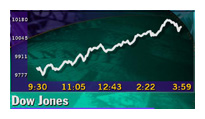

NEW YORK (CNNfn) - The Dow Jones industrial average posted its biggest point gain in 17 months Wednesday as investors dumped high-flying technology stocks, replacing them with beaten-up drug makers and financials.

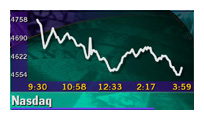

The asset shift handed the Nasdaq composite index, down 9.2 percent this week, its third loss in three sessions.

"All of a sudden, you turn your back and the old names are going up," William Roe, money manager at Melhado Flynn & Co., told CNNfn's market coverage.

Old names like Johnson & Johnson, Merck, J.P. Morgan and American Express -- all down more than 15 percent in the last three months -- surged Wednesday. But Yahoo!, eBay, Applied Materials and PMC-Sierra -- all up more than 30 percent in the last three months -- faltered.

Ahead, Roe sees tech stocks like these resuming the lead.

"I think technology is the way of the future and I think technology is going to come back," he said.

Just not Wednesday. The Dow Jones industrial average surged 320.17 points, or 3.3 percent, to 10,131.41. That's the fourth-biggest point surge on record and the highest rise since Oct. 16, 1998.

"It's not unusual to see a rotation back into some of these traditional stocks," Stuart Freeman, chief equity strategist at A.G. Edwards, told CNNfn's market coverage.

But the Nasdaq fell 123.94, or 2.6 percent, to 4,582.69. From its high, which was set last Friday, the index is off nearly 10 percent -- the point that Wall Street considers a correction.

The broader S&P 500, meanwhile, jumped 33.01, or 2.4 percent, to 1,392.16.

Market breadth was mixed. Advancing shares on the New York Stock Exchange beat decliners 1,905 to 1,129. Trading volume topped 1.29 billion shares. But Nasdaq losers trounced winners 2,748 to 1,543. More than 1.8 billion shares changed hands.

In other markets, the dollar rose against the yen but was little changed versus the euro, and Treasury securities were little changed.

Dow flexes its muscles

Twenty-seven of the Dow's 30 stocks rose Wednesday.

Among the big drivers, Johnson & Johnson (JNJ: Research, Estimates) surged 4-3/16 to 76-5/16 and rival Merck (MRK: Research, Estimates) climbed 3-5/16 to 59-13/16.

American Express (AXP: Research, Estimates) gained 5-7/16 to 132-7/8 and J.P. Morgan (JPM: Research, Estimates) surged 6-7/16 to 117-1/2.

But except for noting how cheap these stocks had gotten, analysts cited no fresh news behind the buying. And despite Wednesday's surge the Dow is still off 11.8 percent this year, hurt by fears of rising interest rates.

As such, Terrence Gabriel, stock market strategist at IDEAglobal.com,

doesn't see the Dow stocks remaining strong until the Federal Reserve finishes raising interest rates.

Gabriel expects Thursday's producer price data for February to show surprising strength, giving Fed inflation fighters one more reason to tighten credit in the months ahead. Stock investors fret that higher rates, because it makes borrowing more expensive, will crimp corporate profits.

Nasdaq slumps

Chipmakers and Internet firms led the sell-off. Applied Materials (AMAT: Research, Estimates) fell 7-9/16 to 171-3/16, while PMC Sierra (PMCS: Research, Estimates) plunged 32 to 186.

Yahoo! Inc. (YHOO: Research, Estimates) dropped 10-1/4 to 158-1/2 and eBay Inc. (EBAY: Research, Estimates) shed 21-1/2 to 189-1/2. The drops came after a published report said the Internet portal and online auctioneer had ended merger talks.

"We've had a startling reversal in technology stocks," Peter Mancuso, specialist at Buttonwood Securities, told CNN's Street Sweep.

Still, the Nasdaq is up 11 percent year-to-date, lifted as investors chase the companies whose growth is expected to outpace the rest of the economy's.

This surge has led Alan Greenspan, the Fed chairman, to warn that interest rates may need to be raised if soaring stock prices fuel excessive consumer spending.

No wonder Peter Green, technical analyst at Gerard Klauer Mattison & Co., told CNN's Talking Stocks that there was at least one person pleased with this week's Nasdaq slump.(348K WAV) (348K AIFF).

Biotechnology stocks, which plunged Tuesday, moved mostly higher Wednesday. Human Genome Sciences (HGSI: Research, Estimates) rose 1/8 to 123-5/8, Biogen (BGEN: Research, Estimates) climbed 1-1/4 to 78-3/16 and Amgen (AMGN: Research, Estimates) gained 6-1/4 to 58-1/2.

The day's data

In economic indicators, production at U.S. mines, factories and utilities rose 0.3 percent in February, the Federal Reserve said, much slower than January's increase and below Wall Street forecasts of 0.6 percent. Industry ran at 81.7 percent of capacity, also weaker than forecasts.

Separately, business inventories rose 0.5 percent in January, ahead of expectations.

The figures, considered second tier by Wall Street, had no apparent market effect.

|