|

Peapod CEO steps down

|

|

March 16, 2000: 3:27 p.m. ET

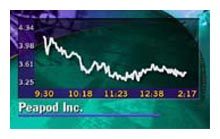

Investors drop slated $120M in financing; stock plummets 56 percent

|

NEW YORK (CNNfn) - Peapod Inc.'s CEO resigned suddenly on Thursday, prompting investors to pull $120 million in financing, a move which could threaten the Internet grocer's future.

Investors reacted swiftly in trading, sending shares of the troubled company down 4-13/32 to 3-13/32, a 56 percent drop.

Peapod said that its board of directors directed financial advisers Wasserstein Perella & Co. to find alternative financing for the troubled Net grocer, including a possible sale of the company. It also said it cannot make assurances that it has the necessary resources to continue its operations. Peapod said that its board of directors directed financial advisers Wasserstein Perella & Co. to find alternative financing for the troubled Net grocer, including a possible sale of the company. It also said it cannot make assurances that it has the necessary resources to continue its operations.

Peapod (PPOD: Research, Estimates) CEO Bill Malloy cited health concerns for his resignation. The Chicago-based Web grocer said that Andrew Parkinson, current chairman and co-founder, will assume the CEO role vacated by Malloy.

"Bill was brought in there just a few months ago and was a real shot in the arm there, and it's a tragedy to lose him for health reasons," said Piper Jaffray analyst George Dahlman. "This is a clear setback."

Following the resignation, a group of investors including Apollo Management pulled $120 million in financing, which they agreed in February to provide. The transaction had been slated to close this month.

"I can understand why those people would want to pull out, because Bill was a very talented and key person. I'm sure they'll re-examine what they want to do and maybe they'll come back in under different terms -- or potentially sell the company," Dahlman said.

Peapod serves eight metropolitan markets in the United States such as Boston, Dallas, Chicago and San Francisco. However, it faces stiff competition from NetGrocer and Foster City, Calif.-based Webvan (WBVN: Research, Estimates), which has investors including Softbank, Sequoia Capital and Benchmark Capital Partners.

Rival HomeGrocer.com (HMOG: Research, Estimates) of Kirkland, Wash., made its initial public debut last week, showing only slight gains above its opening price of $12.

Peapod (PPOD: Research, Estimates) said it has experienced substantial operating losses since its beginning, and now has roughly $3 million on hand before outstanding debts for merchandise.

In February, Peapod reported a widened fourth-quarter loss of $9.1 million, or 50 cents a share, versus a loss of $8 million, or 47 cents a share, in the year-earlier quarter. Analysts polled by First Call had expected a loss of 51 cents a share. The company's sales increased to $21.6 million from $17.2 million, with a 46 percent gain in orders.

Southwest Securities analyst Arvind Bhatia cut Peapod's stock rating Thursday to "neutral" from "buy."

|

|

|

|

|

|

Peapod

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|