|

Wall Street preps for Fed

|

|

March 19, 2000: 9:03 a.m. ET

After Dow's run-up and techs' revival, Greenspan lurks, with rate hikes likely

By Staff Writer Jamey Keaten

|

NEW YORK (CNNfn) - A festive, drink-up-stocks and be-merry mood pervaded on Wall Street last week - appropriately coinciding with the St. Patrick's Day celebration - but investors will need to sober up quickly for a date with Alan Greenspan and company, who are likely to hike interest rates.

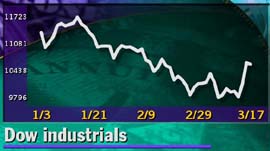

It was nothing less than a historic week on Wall Street, highlighted by a banner 499-point surge in the Dow industrial average Thursday when for the first time in many moons, the hot-to-trot technology stocks played second fiddle to the "old economy" companies with their a slower, more stable tune.

A market-friendly report on producer prices Thursday set the beat for the run-up, in part because inflation pressures seem distant enough that economists are forecasting just two interest rate hikes in the near term - as per the many warnings from Fed Chief Greenspan. The Fed uses higher interest rates to cool the economy, which is red-hot, and ward off inflationary pressures.

Most economists expect the Federal Open Market Committee to hike the federal funds rate to six percent, from a current 5.75 percent, when it meets Tuesday. It would be the first time the fed funds rate -- the rate banks charge each other for overnight loans - has hit six percent in five years. Most economists expect the Federal Open Market Committee to hike the federal funds rate to six percent, from a current 5.75 percent, when it meets Tuesday. It would be the first time the fed funds rate -- the rate banks charge each other for overnight loans - has hit six percent in five years.

Also on the slate of economic data are reports on the nation's trade deficit, also scheduled for Tuesday, and durable goods orders Friday, but the FOMC meeting will garner the most market attention.

"On the economic plate, next week's really pretty light. The big event is the big event, four letters: F-O-M-C," said Robert Brusca, chief economist at Ecobest Consulting. "After the week we just had, we about cleaned up everything; we now have plenty of time to focus on the Fed."

A week of superlatives

Volatility shook Wall Street for most of the week, pumping up blue-chip investors and giving high-technology stock buyers a reality check. The tech-heavy Nasdaq composite index plunged nine percent over the first three days of the week, dropping momentarily into correction territory - usually defined by market experts as a decline of 10 percent or more from all-time highs.

But the Dow, with its Thursday surge, emerged from its correction with a

vengeance with its near five-percent gain Thursday. The Dow closed down 35.37 points to 10,595.23 Friday, leaving the blue-chip average with a record one-week point gain of 666.41 points, or 6.7 percent, on the week.

The buying spree snapped the Nasdaq out of its brief doldrums, with a triple-digit gain Thursday and a rise of 80.74 points to 4,798.13 on Friday. For the week, the Nasdaq was down 250.49 points, or 4.9 percent. The swings were wide -- in four of the week's five days, the index was up or down more than 100 points. The buying spree snapped the Nasdaq out of its brief doldrums, with a triple-digit gain Thursday and a rise of 80.74 points to 4,798.13 on Friday. For the week, the Nasdaq was down 250.49 points, or 4.9 percent. The swings were wide -- in four of the week's five days, the index was up or down more than 100 points.

The S&P 500 index rallied 6 points to 1,464.47, ending the week up 69.40 points, or 4.8 percent.

But one market watcher said Wall Street's ebullience, powered by stock-pumping day traders who are forcing the hand of top investment funds and money managers in pursuit of big gains, isn't likely to slow down if the Fed takes a bit-by-bit approach to rate hikes.

"When you get a move like that in the last few days, it tends to continue," said Jim Melcher, founder and president of Balestra Capital. "A [single] Fed rate hike isn't going to stop this market - it's not enough. The question is will the Fed keep raising rates until the market corrects itself."

Gaining credence with the Dow's bounce were words like "redemption" - or cashing in of strong gains - and "rotation," or the shifting of holdings among many sectors to diversify a portfolio. That would be a boon to more traditional investment funds that preach diversification and are wedded to the blue chips.

"The value managers have been smiling all week that finally they thought there was rotation coming to stocks, where earnings matter," John Brennan, chairman and chief executive of The Vanguard Group, told CNN's Moneyline. "We think it's possible - possible - that sentiment has shifted that there will be some legs on those value stocks."

The bond market continued its rebound. The 30-year Treasury issue rose 20/32 in price, driving the yield, which moves in the opposite direction to the price, down to 5.99 percent just before 3 p.m. ET Friday - driving it under the six percent mark for the first time in a half-year.

Investors: the Three Little Pigs?

Investors fed their voracious appetites by reading positively a series of economic reports last week - in what some economists called self-denial about the risks lurking in the economy.

The Labor Department said the Producer Price Index jumped 1 percent in February, its fastest rate in 10 years, but stripping out the volatile food and energy costs, the "core" index rose just 0.3 percent - in line with economists' expectations. Rising crude oil and tobacco prices were cited for the PPI rise.

That was followed by Friday's Consumer Price Index report, the Fed's most-watched inflationary gauge, which rose 0.5 percent last month, slightly more than economists anticipated. But the rise in the CPI's core index was modest - up 0.2 percent, as expected.

One economist said the booming gains on Wall Street, which came despite the rising PPI and CPI figures, are a sign investors continue to believe in the so-called "Goldilocks" economy - not too hot, not too cold - and are ignoring warning signs of a overheating economy.

"This market is wiling to brush away bad news because it doesn't believe in it," said Brusca. "Compare it to the Three Little Pigs, when there's a warning they say 'we've heard this before.' But one of these days, there is going to be a warning that the market should have listened to."

Sooner or later, Brusca said, the Fed rate hikes will catch up with investors wearing rose-colored glasses about stocks. "Everybody knows what the Fed is doing, but no one knows which move is going to impact the market. I call it a version of Federal Reserve water torture: a drop at a time and after a while it will drive you absolutely batty."

The Nasdaq has risen 18 percent since the Fed last raised interest rates in February.

On tap this week

The earnings picture will be decidedly colorless this week, but top Wall Street brokerages will be looking to follow Bear Stearns (BSC: Research, Estimates), which handily beat earnings forecasts last week. Lining up will be Lehman Brothers (LEH: Research, Estimates) on Monday, Goldman Sachs (GS: Research, Estimates) on Tuesday, and Morgan Stanley Dean Witter (MWD: Research, Estimates) on Thursday.

On the docket in the technology sector: Micron Technology (MU: Research, Estimates), the memory chip maker, which is expected to post a profit of 78 cents a share for its second quarter; and networking equipment maker 3Com (COMS: Research, Estimates), forecast to post a fiscal third-quarter profit of 25 cents a share, according to a poll of analysts by First Call Corp.

Click here for CNNfn.com's IPO calendar

Also next week, a raft of new issues in the hot biotechnology sector is scheduled for launch in the market for initial public offerings. Among them: Aclara BioSciences Inc. (ALCA), a purveyor of technology that moves fluids through a microchip's channels; InterMune Pharmaceuticals Inc. (ITMN), a licensee of drugs used to treat children; and IntraBiotics Pharmaceuticals Inc. (IBPI), a developer of antibiotics and anti-fungal treatments.

In the software sector, debuts are expected from: Blaze Software Inc. (BLZE), a developer of software that helps companies target customer requirements; and Caldera Systems, (CALD), whose software helps allow the deployment of servers made by VA Linux Systems (LNUX: Research, Estimates).

|

|

|

|

|

|

|