|

Lehman tops 1Q forecasts

|

|

March 20, 2000: 11:33 a.m. ET

Broker cites record revenues from trading services, investment banking

|

NEW YORK (CNNfn) - Surging revenues propelled Lehman Brothers Holdings Inc.'s fiscal first-quarter earnings significantly above forecasts, raising hopes of more good earnings news from Wall Street's leading investment banks this week.

Record revenue from equities and investment banking along with strong results from fixed-income and private client services propelled the firm to top analysts' estimates by 29 percent, the company said. Lehman is the first of a series of major brokerage firms set to report financial results this week.

Frenetic activity in the stock market and a record number of initial public offerings helped aid Lehman's bottom line. All three leading market indicators ended 1999 at record highs, and underwriting activity -- particularly for technology firms -- rose to a record at year's end. Like all brokerages, Lehman earns a percentage on each trade, as well as on a portion of the proceeds it raises from IPOs that it underwrites.

"There is no question these are great numbers," said Steven Eisman, an analyst with CIBC World Markets. "We know the period was extremely strong, driven by technology underwriting and activity and Europe, and Lehman is very strong is both of those areas." Eisman said he expects Lehman's stock price "could easily reach 100." He currently rates it a "strong buy."

Surging stock price

Lehman (LEH: Research, Estimates) shares gained 13/16 to 92-1/4 in mid-morning trading. In pre-market trading, the stock was indicated as high as 95. Lehman shares have risen a whopping 47 percent since mid-February.

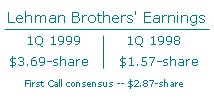

The company reported income of $541 million, or $3.69 a diluted common share, for the quarter ended Feb. 29. Analysts surveyed by earnings tracker First Call forecast $2.87 a share. In the year-earlier period, Lehman earned $211 million, or $1.57 a diluted common share.  Revenue rose to $2.2 billion from $1.1 billion a year earlier. Revenue rose to $2.2 billion from $1.1 billion a year earlier.

Lehman has easily cleared forecasts for the past several quarters. It more than doubled its pretax earnings from investment banking, capital markets and client services. Client services, the unit that deals with high net worth clients, posted a near five-fold increase in pretax earnings. The company said it also diversified its revenue by geographic region in the quarter, namely by broadening its business in Europe.

The results were the best in the firm's history in revenues, net income, operating margin and return on equity. "The firm is clearly hitting on all cylinders," said Richard S. Fuld Jr., chairman and chief executive officer.

Return on equity

Lehman's return on equity was 36.8 percent, more than double the 17.2 percent of a year ago. Return on equity measures the financial performance of the company and how much in percentage terms that performance is being reflected back towards shareholders.

Lehman employees benefit from the firm's success, as well. Compensation and benefits almost doubled from a year ago, rising to $1.15 billion from $567 million. That accounted for 52 percent of the company's net revenue compared to 50.7 percent in the year-earlier period. In its fourth quarter, when bonuses are typically handed out on Wall Street, compensation and benefits totaled 50.7 percent of net revenues.

Other major Wall Street brokerage firms that are expected to report results this week include, Goldman Sachs Group Inc. (GS: Research, Estimates) Tuesday, and Morgan Stanley Dean Witter (MWD: Research, Estimates) Thursday. Both are forecast to post improved results.

"The group as a whole looks very strong," Eisman said. "I expect we'll see several earnings releases this week that surprise to the upside."

|

|

|

|

|

|

Lehman Brothers

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|