|

Nasdaq takes a plunge

|

|

March 20, 2000: 5:20 p.m. ET

Investors shed high-flying tech but park funds in proven leaders, lifting Dow

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index posted its third-biggest point drop on record Monday, extending last week's losses, as investors dumped high-flying flying Internet, biotechnology and wireless equipment makers, replacing them with the most proven of technology firms.

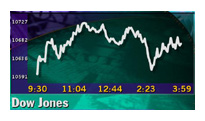

This shift into blue chips such as Intel, IBM, AT&T and Hewlett-Packard lifted the Dow Jones industrial average to its third gain in four sessions.

"I think it was a very healthy movement in the markets today," Drew Cupps, portfolio manager at Strong Funds, told CNN's Street Sweep. "Investors gravitated to companies with solid earnings and shied away a bit from those that don't have that."

The nervousness toward the unproven firms comes hours ahead of a closely watched Federal Reserve meeting on interest rates. Trading volume slowed appreciably ahead of the Federal Reserve gathering as investors showed reluctance to place big bets.

"People are scared in front of this FOMC meeting," said Brian Finnerty, managing director at C.E. Unterbridge Towbin, referring to the Fed's policymaking arm.

Analysts expect the central bank to raise rates by a quarter percentage point, bringing its target lending rate to 6 percent. Stock investors fret that more rate hikes ahead could crimp corporate profits by making it more expensive to borrow money.

The Nasdaq fell 188.13 points, or 3.9 percent, to 4,610. But the Dow rose 85.01 to 10,680.24. The broader S&P 500 fell 7.84 to 1,456.63.

Peter Coolidge, senior trader at Brean Murray, described the day's action as a continuation of last week's, when the Dow rose 666 points, lifted by many "old economy" stocks that had been battered for most of the year. During the same period, the Nasdaq dropped 250 points.

"I think it's more of the same from last week," Coolidge said. "Out with the new and in with the old."

Coolidge and others said a recent Barron's article warning that some Internet companies may be running out of cash, coupled with an announcement that little-known MicroStrategy Inc. will restate financial results to show a loss instead of a profit, added to the tech negativity.

In market breadth, more stocks fell than rose. Decliners on the New York Stock Exchange outpaced advancers 1,602 to 1,384, as volume topped 868 million shares. Nasdaq losers beat winners 3,015 to 1,293. More than 1.4 billion shares changed hands. That's about three-quarters of normal volume.

In other markets, the dollar fell against the yen but finished little changed versus the euro. Treasury securities edged higher.

Amazon, eToys fall

Analysts Monday sifted through the Barron's article, which argued that some Internet companies might not succeed in raising money, forcing them to be bought or go bankrupt.

In his take, Paul Cook, portfolio manager at Munder Capital Management, told CNN's In the Money that investors are frustrated with some Internet companies' progress toward profitability. (309K WAV) (309K AIF).

At least one tech firm disappointed investors Monday. MicroStrategy Inc. (MSTR: Research, Estimates) plunged 140 to 86-3/4 after the Internet software company said it would downwardly restate financial results for the last two years.

Several of the most actively traded Internet firms also lost value. Amazon (AMZN: Research, Estimates) lost 5/8 to 64-3/16, and eToys (ETYS: Research, Estimates) plunged 1-11/16 to 11-15/16.

Qualcomm (QCOM: Research, Estimates), the maker of digital wireless communications products and last year's best performing stocks, fell 6-5/8 to 129-5/8. JDS Uniphase (JDSU: Research, Estimates), which makes fiber-optic telecommunications equipment, lost 8-11/16 to 121-3/8.

Biotechnology firms, hard hit last week, also lost value. Amgen (AMGN: Research, Estimates) fell 5-1/8 to 58, Genome Therapies (GENE: Research, Estimates) dropped 7-5/8 to 24-3/8, and Sequenom (SQNM: Research, Estimates) plunged 12-11/16 to 57-9/16.

Industry analyst Sushant Kumar, of Mehta Partners in New York, said the selling reflected continued profit taking. Investors also are growing more and more uneasy about the outlook of companies involved in mapping the human genetic code, he said.

3Com (COMS: Research, Estimates) was a rare Nasdaq gainer. The networking solutions provider rose 9/16 to 68-9/16. 3Com after the close of trading Monday posted fiscal third-quarter net income of $94 million, or 27 cents per share, topping Wall Street estimates.

Dow flexes muscles

Blue chip techs stocks rose Monday, lifting the Dow.

Among the leaders, IBM (IBM: Research, Estimates) jumped 3 to 113 and Intel (INTC: Research, Estimates) surged 5-1/8 to 135. The world's biggest chipmaker Monday launched new Pentium III processors designed to power the delivery of audio, video, animation and 3-D over the Internet.

Hewlett-Packard (HWP: Research, Estimates) climbed 5-3/16 to 114. Investors appeared relieved that the computer and printer maker announced it has reached a settlement with Xerox (XRX: Research, Estimates) to end patent lawsuits that have dragged on for nearly two years. Xerox rose 3/16 to 26.

AT&T (T: Research, Estimates) surged 3-11/16 to 56-7/8.

With less than a month to ago before companies begin reporting financial results for the first three months of 2000, John Eade, director of equity research at Argus Research, told CNNfn's market coverage he sees strong earnings from financial service firms and health-care companies.

One big broker, Lehman Brothers (LEH: Research, Estimates), may have started that trend. The New York-based firm reported profit of $3.69 a diluted share for its first quarter, well above Wall Street forecasts of $2.87 a share and nearly double the brokerage's results a year earlier. Net revenue soared as income from trading, commissions and other sources nearly doubled to about $1.5 billion.

Lehman shares, up earlier Monday, fell 3-5/8 to 87-13/16.

Goldman Sachs (GS: Research, Estimates) fell 3-1/16 to 113-7/16 and Morgan Stanley Dean Witter (MWD: Research, Estimates) gained 11/16 to 89-9/16. Both Wall Street firms report quarterly results later this week.

|

|

|

|

|

|

|