|

Aerospace auctions?

|

|

March 24, 2000: 4:30 p.m. ET

Boeing, Lockheed, Raytheon, and BAE seen forming online marketplace

|

NEW YORK (CNNfn) - Four of the largest aerospace and defense firms -- Boeing, Lockheed Martin, Raytheon, and British Aeronautics -- are nearing an agreement on a Web-based marketplace for the sale of industry products, CNNfn has learned.

"The site will be a marketplace for buyers and sellers," a source close to the negotiations told CNNfn. "It will also have auctions etc. The products available run the gamut of civil, defense, and aerospace industries."

Both Seattle-based Boeing (BA: Research, Estimates) and Bethesda, Md.-based Lockheed (LMT: Research, Estimates) were developing parallel business-to-business Web ventures independently.

Boeing, which recently formed a special unit in part to investigate Web opportunities, was working toward a commercial aircraft-based site, and Lockheed was working on a defense and aerospace site.

When the companies realized what the other was doing, it was a logical move to link their operations, the source said. An announcement is expected early next week.

The Lockheed-Boeing-Raytheon-BAE site will be open to airlines, parts suppliers, the U.S. defense department and European governments, among others, according to sources.

A Raytheon (RTN.A: Research, Estimates) spokesman refused to confirm reports of the alliance, but said Lexington, Mass.-based Raytheon has been looking at opportunities for so-called B2B enterprises.

Representatives from the other companies were not immediately available for comment.

Industrial giants flock to online B2B markets

Other business-to-business Web portals have been announced by industry players, including a site sponsored by major parts suppliers United Technologies Corp. (UTX: Research, Estimates) and Honeywell (HON: Research, Estimates), and one by parts broker AAR Corp. (AIR: Research, Estimates) and air transport telecommunications cooperative SITA.

Industries such as chemicals, construction and pharmaceuticals have also launched business-to-business marketplaces as companies aim to move their supply chain online to reduce the paperwork and time involved in purchasing, manufacturing and inventory.

One of the leading companies supporting these initiatives is Commerce One Inc., which will reportedly provide transaction software to the aerospace marketplace. In the past year, Commerce One has developed similar systems for buyers and sellers of telecommunications gear, and the automotive industry.

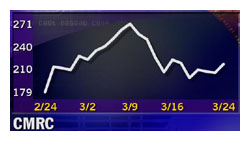

Shares of Walnut Creek, Calif.-based Commerce One (CMRC: Research, Estimates) jumped after the deal was revealed on Friday, leaping more than 8 percent to a session high of 226-1/2 before closing at 223-11/16 up 18-11/16.

"They are participating in yet another massive business-to-business exchange as the technology provider, and investors love it," said analyst Bob Austrian, of Banc of America Securities in San Francisco, though he admitted that he had no confirmation of the deal.

Multi-billion dollar markets

The aerospace B2B sites are generally not intended for huge purchases like aircraft or complete engines, but rather for aftermarket parts, components, and other supplies and services. These alone still comprise a multibillion-dollar industry annually.

While the size of this market is difficult to quantify, analysts suggested it would likely be in the tens or even hundreds of billions, with a software provider like Commerce One in a position to reap benefits from most transactions.

"In general, they tend to get (up to) one-and-a-half percent of traffic, so you sign up a couple billion-dollar exchanges and you are in good shape," said Austrian.

Commerce One Chief Financial Officer Peter Pervere refused to comment on the report of the deal, or on the movement of the company's stock. He noted that generally, major players in large industries have been seeking to build the biggest possible marketplace which benefits from the leverage of its many participants.

"Both General Motors and Ford were going to build two separate exchanges," he told CNNfn.com. "Both General Motors and Ford were going to build two separate exchanges," he told CNNfn.com.

"Then they realized that 'maybe its better to get together and offer this out to our whole industry,' particularly when they have common suppliers. They are thinking of this as 'bigger is better.'"

Shares of the Lockheed gained 11/16, to 17-3/4, on the New York Stock Exchange this afternoon. Boeing gained 5/8 to 35-3/4. Raytheon Class A shares rose 5/8, to 19-1/8.

-- from staff and wire reports

|

|

|

|

|

|

|