|

Bank One names CEO

|

|

March 27, 2000: 6:25 p.m. ET

Former Citibank president Dimon to head troubled Bank One

|

NEW YORK (CNNfn) - Bank One Corp., the nation's fourth biggest bank, on Monday said it named former Citigroup president James Dimon, 44, as Bank One's chairman and chief executive officer, filling the seat left vacant after John McCoy retired in December.

Acting chief executive Verne Istock will remain president and director of Chicago-based Bank One (ONE: Research, Estimates), which has assets of more than $265 billion.

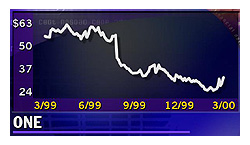

As an apparent gesture of his commitment and leadership, Dimon will buy 2 million shares of Bank One stock, which, at today's closing price of 31-1/2, is less than one-half of its 52-week high, achieved in May 1999.

"Jamie Dimon's business experience, management skills and strategic thinking will lead our outstanding franchise in the new century," said John Hall, the non-executive chairman of the board who led the CEO search. "Jamie Dimon's business experience, management skills and strategic thinking will lead our outstanding franchise in the new century," said John Hall, the non-executive chairman of the board who led the CEO search.

In addition to Dimon's tenure as president of Citigroup, he also served as chairman and co-chief executive officer of Salomon Smith Barney Holdings, Inc. Prior to the formation of Citigroup (C: Research, Estimates), Dimon was president and chief operating officer of Travelers Group for seven years.

"I am excited by Bank One's powerful franchise," Dimon said in statement. "Together, we will help our stock realize its value as we continue the momentum of our three strong lines of business and continue to rebuild our large credit card business."

Dimon, once the protégé of Citigroup co-CEO Sanford "Sandy" Weil, and heir to the chief executive seat, had held a variety of positions during his 13-year career as Weill's right-hand man. Dimon, once the protégé of Citigroup co-CEO Sanford "Sandy" Weil, and heir to the chief executive seat, had held a variety of positions during his 13-year career as Weill's right-hand man.

While he left Citigroup as the company began to restructure its ailing corporate banking businesses, Dimon will be charged with turning around a struggling ship at Bank One, which some industry experts say may be a takeover target.

Just this month, the company encouraged analysts to lower their first-quarter earnings estimates to 60 cents a share, down from a previous estimate of 65 cents.

The warning was Bank One's fourth since last summer, when its First USA credit card operation, which it bought in 1997 for over $7 billion, became troubled due to rising interest rates that cut into profit margins. Customers defecting to rivals after it imposed more late fees also hurt the bank.

Last week, Bank One said it would sell a $2.15 billion real state portfolio to Household Financial Corp. as part of its reorganization program.

|

|

|

|

|

|

Bank One

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|