|

Paris stages lone rally

|

|

March 27, 2000: 12:22 p.m. ET

French media stocks up; OPEC hits U.K. oil stocks, Frankfurt posts loss

|

LONDON (CNNfn) - Stocks in Paris rallied Monday, adding more than 1.3 percent amid strength in media-related stocks, while the leading indexes in Frankfurt and London closed lower due to losses for oil, telecommunications and financial stocks.

The CAC 40 in Paris rose 1.36 percent to 6,450.85, powered by media issues Lagardère and Vivendi. The FTSE 100 in London fell 0.8 percent to 6,687.2, Frankfurt's Xetra Dax slipped 0.5 percent to 7,892.49, and Zurich's SMI fell one percent to 7,366.

The stocks of leading British oil companies drifted lower as OPEC oil ministers prepared for a meeting Monday evening to discuss production hikes. Greater output could bring down oil prices, which have risen sharply over the last and boosted oil producers' profits as a result.

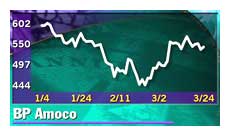

However, the buzz surrounding oil-sector merger deals was the primary spur to the stock-price moves in the sector Monday. BP Amoco (BPA), which fell 5.1 percent, dragged on the FTSE in the wake of a lawsuit filed Friday by rival Exxon Mobil Corp. (XON: Research, Estimates) to block the U.K. company's $29 billion takeover of Atlantic Richfield (ARC: Research, Estimates).

On the upside, however, was BG (BG-), which rose 6.3 percent after a news report Sunday said Anglo-Dutch oil powerhouse Royal Dutch/Shell is considering a buyout bid.

Internet-related companies were one bright spot in London trading.

Irish-based Internet security software company Baltimore Technologies (BLM) was a leading gainer on the London market, up 8.8 percent, while Internet service provider Freeserve (FRE) rose 4.4 percent after inking a deal with Barclays (BARC) bank to sell e-commerce services to small businesses. Freeserve's majority owner, electronics retailer Dixons (DXNS), rose 7 percent.

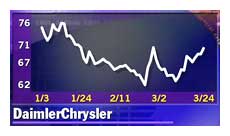

Declines in German bank shares outweighed gains by DaimlerChrysler (FDCX) and Volkswagen (FVOW). All of Germany's major banks fell, with merger partners Deutsche Bank (FDBK) and Dresdner Bank (FDRB) both down after saying over the weekend that they did not plan any acquisitions in the private banking sector.

Deutsche Bank fell 1.8 percent and Dresdner shed 1.7 percent.

Deutsche Telekom (FDTE) was 1.6 percent lower after agreeing to acquire 51 percent of DaimlerChrysler's software consulting unit Debis for an undisclosed sum. Telekom said it valued the whole of Debis at  5.5 billion. 5.5 billion.

A published report suggested Telekom also planned to acquire U.S. computer services provider Unisys (UIS: Research, Estimates).

DaimlerChrysler (FDCX) rose slightly to  70.30 after agreeing to pay 70.30 after agreeing to pay  2.1 billion ($2 billion) for a 34 percent stake in Mitsubishi Motors, Japan's fourth-largest automaker. 2.1 billion ($2 billion) for a 34 percent stake in Mitsubishi Motors, Japan's fourth-largest automaker.

Rival Volkswagen (FVOW) rose 1.6 percent after it bought a 34 percent voting stake in Swedish truck maker Scania for $1.6 billion from investment company AB Investor. European antitrust regulators this month blocked Volvo's planned takeover of Scania. Rival Volkswagen (FVOW) rose 1.6 percent after it bought a 34 percent voting stake in Swedish truck maker Scania for $1.6 billion from investment company AB Investor. European antitrust regulators this month blocked Volvo's planned takeover of Scania.

Paris thinking media

Investors in French stocks looked past the first major shake-up in the three-year-old government of Prime Minister Lionel Jospin to focus on hot stocks in the media sector. Finance Minister Christian Sautter resigned after failing to see through his tax reform plan, which faced the opposition of French unions. Three other top ministers also stepped down.

Media shares led the market higher in Paris. The benchmark index's leading gainer was publishing and defense company Lagardère (PMMB), which rallied 7.1 percent as investors praised its conversion into a "new economy" company. Dresdner Kleinwort Benson upped its rating to "buy" from "hold."

Vivendi (PEX), a water utility with interests in Internet, media and telecommunications, rallied 3.5 percent after denying a report it is in merger talks with Canada's Seagram Co. (VO: Research, Estimates) and Cox Communications (COX: Research, Estimates), the fifth-largest U.S. cable company.

Canal Plus (PCAN), a pay-TV operator in which Vivendi has a 49 percent stake, rose 2.8 percent. Data communications provider Equant (PEQU) was 3.8 percent higher, continuing to rise on details released last week of its e-commerce joint venture with U.K. financial information provider Reuters (RTR).

Oil producer Total Fina (PFP) fell 1.6 percent to  139.1, following other oil companies lower on concern OPEC would bring oil prices down. 139.1, following other oil companies lower on concern OPEC would bring oil prices down.

In the currency markets, the euro was little changed against the dollar at $0.9677.

-- from staff and wire reports

|

|

|

|

|

|

|