|

VW buys Scania stake

|

|

March 27, 2000: 7:12 a.m. ET

Europe's No. 1 auto firm buys 19% of truck maker after Volvo-Scania tie nixed

|

LONDON (CNNfn) - Volkswagen, Europe's largest carmaker, agreed Monday to buy 18.7 percent of Swedish truck maker Scania for about 13.84 billion crowns ($1.6 billion), just weeks after the European Union blocked a merger between Scania and rival truck and bus maker Volvo.

Volkswagen's (FVOW) move was widely anticipated after VW's chairman last week pledged to expand the company's truck division.  The purchase gives VW 18.7 percent of Scania's capital but 34 percent of the company's voting rights. The purchase gives VW 18.7 percent of Scania's capital but 34 percent of the company's voting rights.

The German automaker bought 37.4 million Scania "A" shares for 370 crowns each. The "A" shares, which each carry one vote, are not widely traded.

"Volkswagen has made a strategic decision to expand in the area of heavy commercial vehicles, in line with our long-term strategy," Chairman Ferdinand Piech said.

The European Commission, the EU's executive arm, earlier this month blocked Volvo's plan for a 60.7 billion kronor ($6.95 billion) merger with Scania, citing the dominant share in the Nordic truck market that the combined company would have. DaimlerChrysler is the largest truck maker over the entire European market.

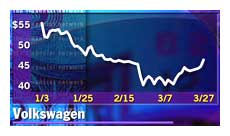

Scania's more widely traded "B" shares, which carry 0.1 vote per share, rose one crown at 264. Scania has 100 million "A" shares and 100 million "B" shares. Scania "A" shares climbed 3.5 crowns to 261 in Stockholm, while Volkswagen rose 3.6 percent to Scania's more widely traded "B" shares, which carry 0.1 vote per share, rose one crown at 264. Scania has 100 million "A" shares and 100 million "B" shares. Scania "A" shares climbed 3.5 crowns to 261 in Stockholm, while Volkswagen rose 3.6 percent to  46.30 in Frankfurt. 46.30 in Frankfurt.

Volvo remains the biggest shareholder on Scania with 45.6 percent of the capital and 30.7 percent of the voting rights. Investor, the investment vehicle of Sweden's Wallenberg family, will keep a 9.1 percent in Scania, carrying 15.3 percent of the votes, for at least two years.

--from staff and wire reports

|

|

|

|

|

|

|