|

Aerospace B2B takes off

|

|

March 28, 2000: 6:28 a.m. ET

Boeing, Raytheon, Lockheed, BAE Systems join sites offering parts online

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Four leading aerospace manufacturers, including Boeing Co. and Lockheed Martin Co., announced plans Tuesday for an online market for potentially hundreds of billions of dollars worth of aircraft parts, the latest in a string of industries seeking a joint solution on the Internet to link with suppliers.

Boeing, the world's largest commercial aircraft maker, and defense contractor Lockheed (LMT: Research, Estimates) are being joined by competitors Raytheon Co. (RTN.A: Research, Estimates) and British aerospace concern BAE Systems in the effort. Commerce One Inc. (CMRC: Research, Estimates) won the contract to be the technology partner in the effort.

The venture follows the model of some leaders in other industries, such as autos and retail, to join together leading manufacturers and link with a common supplier base through the Internet. These efforts expect to drive down both transaction costs and pricing.

This latest effort may be smaller than those of some other sectors, such as automakers, which expect to transact close to $1 trillion on their joint site. But the aerospace joint venture will dwarf any business-to-consumer e-commerce effort, and improve profits in a sector with notoriously tight profit margins.

"Each of us has come to share the same point of view, that a global e-marketplace is absolutely essential if we are to drive new levels of efficiency for the industry," Boeing (BA: Research, Estimates) Chairman and CEO Phil Condit said.

The four partners estimate they spend about $200 billion annually buying parts and supplies, according to Condit. They hope to move all those purchases to the site starting the middle of this year. The four partners estimate they spend about $200 billion annually buying parts and supplies, according to Condit. They hope to move all those purchases to the site starting the middle of this year.

In addition, aerospace manufacturers sell about $50 billion a year in after-market parts to airlines and defense customers, with the four partners already using the Internet to sell hundreds of millions of parts. They expect to move that business to the joint venture as well.

Condit and other executives who joined at the announcement said they should be able to save billions of dollars by moving many of those purchases to the site. Analysts said they believe those estimates are realistic, if not this year, then probably starting as soon as 2001 or 2002.

"It improves competitiveness overall," said Chris Mecray, analyst with Deutsche Banc Alex. Brown. "The more people that participate, the more powerful it becomes. It clearly benefits the buyers."

The savings for the manufacturers are expected to come from lower transaction costs, better inventory control and in some cases reduced prices due to increased competition or joint bidding for some parts. There are about 37,000 aerospace suppliers who the manufacturers hope to link with using the exchange.

Executives say suppliers will be helped, not hurt

The executives said there could be significant savings even in cases where there is only one supplier certified to supply a part or a long-term supplier contract is in place, simply through reduced transaction costs.

While suppliers may be nervous that this is a way to drive down their prices, Condit said the exchange also will offer them a chance to save money on transaction costs, as well as expand their potential base of customers by giving them easier links to new manufacturers. (487KB WAV) (487KB AIFF)

Their technology partner, Commerce One, also is participating in a similar joint effort by the Big Three automakers for an auto parts site along with Oracle Corp.

"We've all been independently exploring how to take advantage of e-commerce, and it became clear that the most benefit would come from joint effort," said Richard Evans, chairman of BAE.

But the combination could raise some anti-trust problems in the United States or Europe. The U.S. Federal Trade Commission reportedly has started an inquiry into the automakers' joint venture, although agency officials would not comment on its views of the effort.

The companies would not give estimates of initial costs of the effort or their investment in the effort.

"This is a $400 billion business, and the cost is nominal in this context," said John Weston, chief executive of BAE.

Shared equity in new venture

The partners' equity interest will be based on the volume of business they do through the exchange the first three years, giving them extra incentive to move transactions online.

The executives all say they want other aerospace manufacturers to participate in the exchange, and they are saving some of the equity in the company for such additions. There are competing efforts by major parts supplier United Technologies Corp. (UTX: Research, Estimates) and Honeywell International (HON: Research, Estimates), and another by parts broker AAR Corp. (AIR: Research, Estimates) and air transport telecommunications cooperative SITA. But the manufactures say their breadth and position in the market should let their effort become the key site for such transactions.

One manufacturer conspicuous by its absence at this point is the European Aeronautical Defense Space Co., the company being formed by the merger of German, French and Spanish aerospace firms. They own the 80 percent of Airbus Industrie not owned by BAE, their partner in that consortium.

Condit said discussions have been held with EADS officials, but the need to complete that merger had stopped it from joining at the outset.

The venture will be operated as an independent company with a board of outside directors who will hire management. Operations are expected to start at some point in the middle of the year. An initial public offering for the company is planned at some point in the future.

The selection of Commerce One is a major loss for Oracle, which reportedly had been involved in discussions with Boeing about being the technology provider. The two technology competitors are partners in the automaker's joint effort because Oracle was selected by Ford Motor Co. and Commerce One by General Motors Corp. before the two decided to join efforts and include DaimlerChrysler.

"Yet again Commerce One has snatched a piece of real estate from under the nose of Oracle," David Garrity, analyst at Dresdner Kleinwort Benson told Reuters. "Oracle's performance in actually landing these (sites) has been, to date, underwhelming."

Commerce One, Oracle and Ariba Inc. (ARBA: Research, Estimates) all are fighting for a share of the growing market for B2B online sites. Oracle has announced plans to help set up an online exchange with Sears Roebuck & Co. and other major global retailers, as well as a deal to set up an online exchange for convenience stores.

-- Reuters contributed to this report

|

|

|

Aerospace auctions? - Mar. 24, 2000

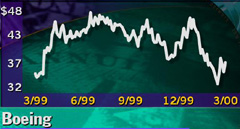

Boeing expects recovery - Mar. 21, 2000

Strike about to hit Boeing 1Q profits - Mar. 08, 2000

Lockheed 4Q profit down - Jan. 28, 2000

Raytheon misses estimate - Jan. 25, 2000

FTC probing Big Three e-commerce joint venture - Mar. 22, 2000

GM, Ford join B2B e-commerce efforts - Feb. 25, 2000

Automakers in B2B pacts - Jan. 13, 2000

B2B business boom - Jan. 11, 2000

|

|

|

|

|

|

|

|