|

Websense a first day hit

|

|

March 28, 2000: 4:05 p.m. ET

Web traffic monitoring co. jumps more than doubles on lackluster IPO day

|

NEW YORK (CNNfn) - Web traffic monitoring company Websense Inc. soared in its market debut Tuesday, even as investors greeted a host of other new offerings with little more than indifference.

The San Diego-based Websense, which develops software that allows companies to monitor which Web sites their employees are surfing, jumped as high as 24-1/6, or 137 percent, to 42-1/16 early Tuesday afternoon, ranking it among the Nasdaq's top gainers of the day.

Analysts said the company's gigantic lead in developing software that allows employers to prevent unauthorized personal use of the company Internet system caused investors' excitement.

"Companies will typically have policies, but they didn't really have a way of monitoring it until Websense brought out its software," said Corey Ostman, chief technology officer with Alert! IPO, an initial public offering tracking firm.

"So from a business standpoint, it's a very, very compelling story. They have no major competition out there at the moment."

"There are very few competitors in this space that sell to the corporate market," Websense Chairman and CEO John Carrington told CNNfn. "We have 200 of the Fortune 500 companies that are our clients and probably also have over 50 percent of the market share." "There are very few competitors in this space that sell to the corporate market," Websense Chairman and CEO John Carrington told CNNfn. "We have 200 of the Fortune 500 companies that are our clients and probably also have over 50 percent of the market share."

Carrington said he planned to use the $72 million in proceeds from the offering to boost the company's marketing and advertising efforts (334K WAV) (334K AIF).

By mid-afternoon, Websense (WBSN: Research, Estimates) had slipped off its highs somewhat and traded at 39, up 21. The company priced its offering of 4 million shares at $18 per share late Monday, above its expected range of $14 to $16 per share.

Comptel still excites...

Among the day's other five IPOs, investors remained intrigued by Comptel Europe NV.

The Dutch local exchange provider priced 27.2 million American depository receipt shares slightly above its expected range at $17.09 late Monday, raising $464.8 million in what is expected to be the week's largest IPO.

By mid-afternoon Comptel (CLTL: Research, Estimates) climbed to 23-9/16, down slightly from its high of the day of 25.

Comptel is one of several burgeoning competitive local exchange carriers that formed in Europe following the recent deregulation of the telecom industry there.

...but other deals draw tepid response

Investors took a ho-hum reaction toward four other new issues that began trading Tuesday, however, including one biotechnology company that was expected to lead several industry players to market this week.

IntraBiotics Pharmaceuticals Inc., a developer of new antibacterial drugs, had barely budged off its $15 per share pricing level by mid-afternoon, climbing 1/8 to 15-1/8.

The company's lackluster performance follows a weak showing by several other new biotech last week, leading analysts to speculate the market for such stocks could remain weak throughout the week, an ominous sign for companies like Rigel Pharmaceuticals and Luminex Corp. that expect to start trading later this week.

Still, there was some hope IntraBiotics performance was an isolated event.

"Like most biotech's, this offering is highly speculative," said Irv DeGraw, research director with WorldFinanceNet.com, who actually had predicted the company would gain 20 percent to 40 percent in its first day of trading and then erode. "While the drug potential is scientifically attractive, they are still a long way from reality.

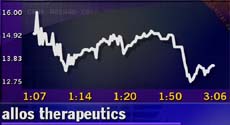

Other first day duds included Allos Therapeutics (ALTH: Research, Estimates), a developer of small molecule drugs. After pricing 5 million shares above its expected range at $18 per share late Monday, Allos shares fell 4-5/8 to 13-3/8 in mid-afternoon trading. Other first day duds included Allos Therapeutics (ALTH: Research, Estimates), a developer of small molecule drugs. After pricing 5 million shares above its expected range at $18 per share late Monday, Allos shares fell 4-5/8 to 13-3/8 in mid-afternoon trading.

Also falling was Internet music network ArtistDirect Inc. (ARTD: Research, Estimates), which shed 1-3/4 to 10-1/4 after the company raised $60 million by pricing 5 million shares at $12 per share.

Moldflow Corp. (MFLO: Research, Estimates), a designer of computer-assisted plastic injection molds, fared a little better, adding 1-5/8 to 14-5/8 after pricing 3 million shares in the middle of its expected range at $13 per share.

|

|

|

|

|

|

|