|

Palm beats the Street

|

|

March 28, 2000: 7:02 p.m. ET

Handheld computer maker sees revenue growth slowing moving ahead

|

NEW YORK (CNNfn) - Palm surprised Wall Street Tuesday, reporting fiscal third-quarter operating earnings that topped analysts' expectations as sales more than doubled.

But executives at the company said they expect growth to slow in the current quarter and into the next fiscal year.

Before one-time items, the 3Com spin off, which went public on Nasdaq earlier this month, reported net income of $15.5 million, or 3 cents per share. Analysts polled by earnings tracker First Call had expected Palm to post a penny-per-share profit during the quarter, which ended Feb. 25.

Accounting for one-time charges - which include separation costs of $8.2 million and purchased in-process technology of $2.1 million -- Palm, which makes the popular "Palm Pilot" handheld computing devices, earned $11 million, or 2 cents per share, on sales that rose 116 percent from the year-ago quarter to $272.3 million.

Executives at Palm in Santa Clara, Calif., said the most recent quarter's results were especially noteworthy because business typically falls off during that period.

"Our third-quarter revenue growth was particularly impressive because this quarter is traditionally our seasonally slowest and has typically been down sequentially from the second quarter," said Judy Bruner, Palm's chief financial officer.

However, in a conference call with analysts Tuesday evening, Bruner told analysts not to expect a repeat performance in the current quarter or during the upcoming fiscal year.

During the fiscal fourth-quarter, Bruner said Palm expects revenue in the range of $280 to $295 million, which would be a 61 percent to 69 percent increase from the same period last year.

Bruner said that part of the reason for the slowdown in growth is a shortage of key components, which has been spawned by increased demand for wireless phones.

And that shortage is likely to continue to affect sales moving into fiscal 2001, according to Bruner. "We do not expect suppliers to meet overall demand for at least two quarters," she said.

In fiscal 2001, Bruner said the company expects to have revenue growth of 40 percent to 50 percent.

Palm's expenses also will increase substantially over the next 12 to 18 months as the company moves more aggressively into new product areas and new geographic markets, Bruner said.

Already, the company has broken into the Japanese market. Earlier this month, Palm established of a wholly owned subsidiary, Palm Computing K.K., to provide branded sales, marketing and support for handheld computing customers in Japan.

The company also has been pouring research and development dollars into new products such as smartphones, "infotainment devices" and wireless Internet access devices. The company has forged strategic alliances with technology heavyweights such as America Online (AOL: Research, Estimates), IBM (IBM: Research, Estimates), Motorola (MOT: Research, Estimates), Nokia (NOK: Research, Estimates), and Sony (SNE: Research, Estimates).

Tuesday's earnings report was Palm's first as an independent company.

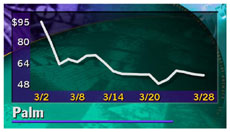

Palm shares slipped 9/16 to 54-13/16 in Nasdaq trade ahead of the earnings release Tuesday. In extended-hours trading Palm stock rose to 56-3/4.

Since they made their debut earlier this month, Palm shares have fallen sharply, slipping more than 40 percent from their first-day close of 95-1/16.

Palm, which raised $1.17 billion from its IPO, is now flush with cash and will likely use some of it to make some acquisitions in the months ahead, according to Bruner.

Subsequent to the IPO, 3Com (COMS: Research, Estimates) owns roughly 94 percent of the company's outstanding shares. 3Com expects to distribute those shares to 3Com shareholders before Sept. 1, 2000, Bruner said.

|

|

|

|

|

|

|