|

OPEC fails to reach pact

|

|

March 28, 2000: 9:19 p.m. ET

Division among members leaves 9 of 11 agreeing to boost oil output

|

LONDON (CNNfn) - OPEC oil producers finished their meeting without a consensus Tuesday, as only nine of the group's 11 members agreed to open the pipeline to supply the world with about 1.7 million barrels a day of additional oil. Iraq and Iran opted not to be included in the pact.

The Organization of Petroleum Exporting Countries agreed to boost output by about 7 percent above current levels of production. The move reverses all of the cutbacks the cartel implemented a year ago, when oil prices were significantly lower and the bounty of supply appeared to be plentiful.

But members were not in agreement concerning how much oil should be released on to world markets -- one of the few times in the cartel's history where that has happened.

"We have agreed to raise production. OPEC will raise production without Iran," a senior delegate told Reuters. An Iranian OPEC delegate said Iran would hold its own briefing for reporters at the meeting.

At a press conference in Vienna, OPEC spokesman Farouk Muhammed said that nine of the 11 OPEC members had agreed to restore their production to their pre-march 1999 levels. Iran and Iraq were the exceptions. [136K WAV or 136K AIFF]

The agreement, which becomes effective April 1, sets OPEC's output at just over 21 million barrels or oil per day, Muhammed said. The group plans to meet again this summer to review the agreement.

At that same press conference, OPEC Secretary-General Rilwanu Lukman brushed off questions about whether there had been pressure from the United States to reach this agreement. [186K WAV, 186K AIFF]

Principles, not barrels

It was a stunning conclusion to an event that has drawn keen interest around the world as consumers, acutely aware of the startling rise in gasoline prices in recent months, awaited to find out if they'd be facing another "70s-style energy crunch.

Iran has been holding out against the wishes of other OPEC members for a 1.7 million barrel a day, or seven percent output increase, according to delegates at the meetings. Saudi Arabia led the call in OPEC for higher supplies to meet the wishes of the United States for lower oil prices. Iran has been holding out against the wishes of other OPEC members for a 1.7 million barrel a day, or seven percent output increase, according to delegates at the meetings. Saudi Arabia led the call in OPEC for higher supplies to meet the wishes of the United States for lower oil prices.

"In my view, OPEC is not an organization to rubber stamp the decision already made," Iran Oil Minister Bijan Namdar Zangeneh told reporters. "Our difference is on principles and not merely on a few barrels of oil."

He did not provide details on how Iran plans to supply its share of oil or whether it will head back to the bargaining table when OPEC members meet again in June to discuss further production quotas.

Oil will flow

"I think Iran is very unhappy about the size of the agreement, and I think they feel they're being pressured by the U.S. government and they're expressing their unhappiness with the situation," Dr. Gary Ross, an analyst with PIRA Energy Group, told CNNfn at the meetings in Vienna, Austria.

Iran had been holding up an OPEC agreement by asking that the cartel add 1.65 million barrels a day to cartel supply limits, a senior OPEC delegate told Reuters. That is just 50,000 barrels a day short of the volume all others in would like to agree for additional OPEC supply.

Nonetheless, the oil will still flow. Minister from the other nine OPEC countries were preparing to release a communiqué detailing the specifics of their agreement. A press conference is expected to follow.

"It was absolutely necessary for OPEC to boost production and there was no question they would do it -- the question now is whether the increases will be enough," said John Lichtblau, chairman of the Petroleum Industry Research Foundation in New York. "Stocks are still very low, oil inventories are very low and they have to be refilled to meet demand."

Well to refinery to pump

Indeed, the amount of time it takes to get the oil out of the ground, get it to the refinery and then get it to the gasoline station is somewhat lengthy. Most analysts expect prices at the pump will remain in the $1.60-to-$2-a-gallon range for at least six weeks. What's more, much of that extra supply will have to make its way to depleted reserves first, meaning the refineries will have to wait a bit before they get their hands on the much-needed oil.

"We are not going to see a significant impact overnight as a result of the OPEC agreement," said Calvin Schnure, chief economist with Chase Securities. "I don't see prices going any higher for the time being, but it will take some time to see the increase of supply push down the price of fuel." "We are not going to see a significant impact overnight as a result of the OPEC agreement," said Calvin Schnure, chief economist with Chase Securities. "I don't see prices going any higher for the time being, but it will take some time to see the increase of supply push down the price of fuel."

OPEC nations collectively produce about 40 percent of the world's oil supply, or about two of every five barrels of crude oil, with most of that going to the United States. All of the group's 11 members had agreed that some sort of increase was needed, though several of the countries -- notably Libya and Iran -- had disagreed over exactly how much additional reserves to let loose.

The 1.7 million barrels a day will be added to OPEC's official limits of 22.976 million barrels a day agreed to last March. The objective among the group is to provide enough oil to alleviate supply issues while keeping the price around the $25-a-barrel mark -- a level that economists and Federal Reserve Chairman Alan Greenspan have suggested would not pose an inflation threat to the U.S. economy.

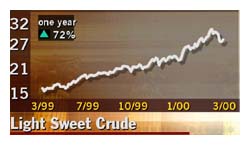

Crude prices triple

Supply curbs that OPEC members implemented over the past year have almost tripled the price of crude in that time. Higher prices have stirred up political pressure from the United States to urge OPEC to cut prices to avoid inflationary pressures in the already high-flying U.S. economy. Oil prices have risen as high as $32 a barrel compared to less than $10 a barrel last winter.

The surge in oil prices began after OPEC a year ago agreed to restrict output to 23 million barrels a day. The restrictions, combined with political infighting between supplying OPEC nations, bad numbers that accounted for too much Y2K stockpiling, a huge glut of missing oil and inaccurate projections about future needs all led to higher prices. The surge in oil prices began after OPEC a year ago agreed to restrict output to 23 million barrels a day. The restrictions, combined with political infighting between supplying OPEC nations, bad numbers that accounted for too much Y2K stockpiling, a huge glut of missing oil and inaccurate projections about future needs all led to higher prices.

OPEC members are now anxious to avoid re-opening the taps too much, expanding production so far that prices head back toward last winter's levels -- a move that would hurt their production efforts and force them to supply the world with oil at prices they felt were unfair, given the cost of production.

Little inflation risk

To be sure, prices have remained high even as some OPEC countries exceeded their quotas. The worst kept secret among OPEC members is that the cartel currently produces some 1 million barrels a day more than its official ceiling, meaning it has actually been spilling out 24 million barrels of oil a day this past year.

Crude oil for May delivery on the New York Mercantile Exchange fell as much as 78 cents, or 2.8 percent Tuesday, to $27.01 a barrel.

An increase of 1.7 million barrels is not expected to relieve near record-high energy prices. The independent International Energy Agency in Paris claims that a rise of 500,000 to 1 million barrels a day is needed just to balance current supply and demand, while an increase of 2.3 million barrels would have helped replenish reserves -- an amount the U.S. Energy Agency had been calling for. An increase of 1.7 million barrels is not expected to relieve near record-high energy prices. The independent International Energy Agency in Paris claims that a rise of 500,000 to 1 million barrels a day is needed just to balance current supply and demand, while an increase of 2.3 million barrels would have helped replenish reserves -- an amount the U.S. Energy Agency had been calling for.

All the same, few analysts and Fed Chairman Greenspan himself believe the situation as it stands will result in any kind of inflation pressures. Speaking to senators Monday, Greenspan said he did not see any evidence that rising prices for crude oil -- other than higher gasoline prices -- were having an effect on the broader economy.

Oil: not what it used to be

"Currently we do not as yet - emphasize: as yet -- see any significant indication that crude oil price increases are in the process of embedding themselves in other areas of the economy and inflating the general price structure," he said. "There is a question, of course, of how much this economy has lessened its need and tie to energy since we have become an increasingly high-tech, less energy-consuming nation," he said.

Indeed, as a percentage of U.S. economic output, oil does not count nearly as much as it used to. Oil accounted for roughly 6 percent of total gross domestic product in 1980, according to the U.S. Commerce Department; in 1999 it accounted for just over 2.5 percent of GDP.

Chase Securities' Schnure agrees that, if oil prices stabilize in the mid-$20 range, it shouldn't pose a significant threat to the U.S. economy. (496KB WAV) (496KB AIFF)

And then there's the price of gasoline itself. When adjusted for inflation, gasoline prices are actually lower than they were during the late '70s and early '80s, when prices were rising at a 12.5 percent year-over-year pace rather than the moderate 2.7-percent increase recorded in 1999.

"While the price is high compared to last year, it's still low in real dollar terms compared to what it was," the Petroleum Industry Research Foundation's Lichtblau said. "Adjusted for inflation this is by no means a record price."

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|