|

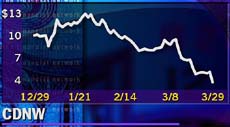

CDNow woes get worse

|

|

March 29, 2000: 2:21 p.m. ET

Web music retailer's stock tumbles amid growing concerns of its viability

|

NEW YORK (CNNfn) - Shares of CDNow Inc. tumbled more than 25 percent Wednesday morning after the Internet music retailer's independent accountant said it has substantial doubts about CDNow's ability to continue as a going concern.

Shares of Fort Washington, Pa.-based CDNow (CDNW: Research, Estimates) fell 1-3/8 to 3-11/16, on volume of about 2.6 million shares, more then 4 times its daily average.

In documents filed Tuesday with the Securities and Exchange Commission, CDNow's accountant, Arthur Andersen LLP, said its doubts were based on the company's recurring losses from operations, a working capital deficiency and significant payments due in 2000 related to marketing agreements. In documents filed Tuesday with the Securities and Exchange Commission, CDNow's accountant, Arthur Andersen LLP, said its doubts were based on the company's recurring losses from operations, a working capital deficiency and significant payments due in 2000 related to marketing agreements.

In the same document - the company's annual report - CDNow said believes its current cash and cash equivalents are sufficient to meet its payment obligations until about Sept. 30.

But while it hopes to find a third party financing agreement, CDNow said it cannot assure that it will be able to obtain the financing necessary to continue supporting its business.

A CDNow spokeswoman said that company executives were not immediately available to comment on the news.

Following the March 13 termination of its proposed merger with Columbia House, which is owned jointly by Time Warner Inc., the parent of CNNfn.com, and Sony Corp., CDNow hired Allen & Co. to explore its strategic options. Following the March 13 termination of its proposed merger with Columbia House, which is owned jointly by Time Warner Inc., the parent of CNNfn.com, and Sony Corp., CDNow hired Allen & Co. to explore its strategic options.

Under the anticipated deal, agreed to in July 1999, Sony (SNE: Research, Estimates) and Time (TWX: Research, Estimates), would have owned 37 percent of the newly formed company, with CDNow's existing shareholders owning the remaining 26 percent.

Time Warner and Sony opted instead to commit $51 million to CDNow, including $21 million in cash as an equity investment.

CDNow said the merger fell apart due to is disappointment with Columbia House's financial position, saying that its cash flow position and debt level were not what it had anticipated.

Market experts suggested that perhaps Time Warner had lost interest in the CDNow deal, following Time Warner's agreement in January to combine with America Online.

In an effort to shed costs, CDNow said it would cut marketing and advertising and scale back its coupon programs. The strategy was seen shrinking quarterly operating expenses by $10 million-to-$12 million, but would cut into second quarter revenue.

|

|

|

|

|

|

CDNow

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|