|

TriZetto-IMS deal panned

|

|

March 29, 2000: 3:52 p.m. ET

Health-care IT company plunges after deal to acquire IMS Health

By Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - The stock of Internet health-care company TriZetto Group plunged Wednesday after it agreed to buy the much larger and more established IMS Health, a provider of prescription drug sales analysis.

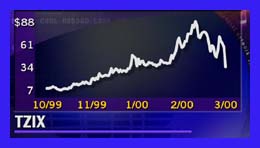

Under the merger agreement, IMS shareholders will receive 0.4655 share of TriZetto for each IMS Health share. Based on TriZetto's (TZIX: Research, Estimates) closing price Tuesday, the offer values each IMS Health share at $27.03, some 25 percent higher than Tuesday's closing price of IMS stock.

However, the stock of Newport Beach, Calif.-based TriZetto plunged 23-1/8 to 34-15/16 in late afternoon trading Wednesday, a 40 percent loss that lowers the value of the transaction to about $16.30 per IMS share, or a total of $5 billion. IMS (RX: Research, Estimates) stock declined 4-7/8 to 16-3/4 in late afternoon trading, making the deal a drag on both the buyer and the acquired.

The merger, which has been approved by the boards of both companies, is another case of a mouse roaring in the Internet area. TriZetto, an application service provider and Internet portal for the health-care business, was founded in 1997 and had only $33 million of revenue in 1999. At the time of its initial public offering last October, TriZetto's CEO, Jeffrey Margolis, was 36 years old, and the company's vice president of finance and treasurer was 33. TriZetto recorded a net loss of $8.4 million last year.

By contrast, IMS Health, based in Westport, Conn., has been in business for more than 40 years, had revenue of $1.4 billion last year, and is highly profitable, with 1999 net income of $259 million. IMS processes $165 billion of transaction records each month and tracks 99 percent of all drug prescriptions filled, providing valuable marketing information to pharmaceutical companies.

After the merger is completed, the new company will issue three securities to its investors. The first, to be called IMS Health, will represent IMS' core pharmaceutical market research and sales management businesses. The second, called TriZetto, will represent the faster-growing businesses of the current TriZetto and IMS' Erisco unit. Erisco provides application software and services to the healthcare industry. The third, to be called Strategic Technologies, will represent an IMS unit that provides automated sales support technologies to the pharmaceutical industry.

The purpose of slicing and dicing the company is to take advantage of the higher stock-market valuations that are attached to Internet companies, versus so-called "old economy" firms. TriZetto's stock rocketed to a high of 91-1/4 on March 1 from a low of 6-1/2 last October, a 14-fold gain. Shares of IMS, by contrast, have declined 35 percent over the past 52-weeks.

While IMS has created a Web portal to provide some of its database information previously distributed on paper or CD-ROM, the company has been slower to embrace the Internet than investors and analysts had wanted.

"IMS has been migrating their products to the Web through their Internet portal, but they probably needed some outside Internet expertise to achieve the pace they needed," Lehman Brothers analyst Robert Rouse said. "TriZetto, for its part, gets access to IMS' larger customer base. Like most start-ups, TriZetto's customer base was concentrated, based on a couple of big contracts."

Given that IMS shareholders will own about 85 percent of the combined company, IMS is essentially taking over TriZetto, even though the transaction is legally structured the other way around, Rouse said. Under the terms of the agreement, IMS' chief executive, Victoria Fash, will be CEO of the combined company. IMS's chairman, Robert Weissman, will become chairman of the combined company. TriZetto's Margolis will be vice chairman and president.

The two companies expect to complete the merger in the third quarter of this year. Goldman Sachs advised IMS Health and Warburg Dillon Read advised TriZetto.

-- Click here to send email to David Kleinbard

|

|

|

Trizetto

IMS Health

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|