|

European markets wilt

|

|

March 29, 2000: 12:08 p.m. ET

Techs, telecoms drag Paris, London down; weak bank stocks hit Frankfurt

|

LONDON (CNNfn) - Europe's leading stock indexes closed lower Thursday, as technology and telecommunications stocks dragged down Paris and London, but Frankfurt's index succumbed to weakness in banking issues.

London's FTSE-100 benchmark fell 0.9 percent to 6,598.8, with top names in Britain's Internet and media sectors taking blows. A drop among blue-chip technology stocks drove Paris's CAC 40 into the red after two days of gains, as the index dropped 0.3 percent to close at 6,505.48.

But the day's leading loser was the Xetra Dax in Frankfurt, which fell 0.9 percent to 7,863.52 due to a sell-off in banks. On the upside, Zurich's SMI closed up 0.4 percent at 7,401.5.

Stocks of "old economy" companies such as airlines, oil producers and automobile makers were among the bright spots across Europe. Dominating market sentiment was Tuesday's tech sector dip on Wall Street, an oil production accord among OPEC countries, and investors' portfolio readjustments for tax reasons as the first quarter 2000 ends.

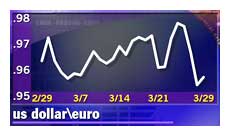

In the currency market, the euro fell to four-week lows against the dollar, dropping as low as 94.79 cents before rising back up to 95.32 cents. Investors began to expect no rate hike from the European Central Bank when policy makers meet Thursday. Economists said a wage pact Tuesday in Germany that limits salary increases will help keep European inflation in check, reducing the need for the ECB to raise interest rates.

BAA in a nosedive

British airports operator BAA (BAA) fell 7.9 percent following talk, which the company subsequently denied, that it had quietly delivered a warning to analysts that its earnings might not hit forecasts. BAA allegedly told analysts at a dinner meeting that it had failed in its effort to impose a new levy on airlines; the levy would have sought to make up for revenue lost because of falling sales at airport shops after the European Union scrapped duty-free shopping for travelers between EU countries.

The FTSE's Internet components retreated. Access provider Freeserve (FRE) fell 7.2 percent and Web security firm Baltimore Technologies (BLM) fell 5.9 percent. Satellite TV operator BSkyB (BSY) sank 8.4 percent after announcing a $540 million share sale to fund its plan to buy about a one-quarter stake in Germany's KirchPayTV.

Plowing ahead again was Capita Group (CPI), up 6 percent, after Morgan Stanley Dean Witter raised its rating on shares of the business services company to "strong buy" Tuesday. Support services firm Hays (HAS) rallied 10.1 percent.

Paris rejuvenates 'old economy'

In Paris, "old economy" stocks fared well, with supermarket operator Casino (PCO) adding 4.2 percent, while an upbeat earnings forecast boosted TotalFina (PFP) to a 3.5 percent gain.

Air France (PAF) shares took off, up 3.9 percent on hopes that OPEC's pact will help cut the price of jet fuel, one of the biggest cost burdens for an airline. Elsewhere in Europe's aviation sector, Lufthansa (FLHA) rallied 1.7 percent, but British Airways (BAY), Europe's largest carrier, fell 1.4 percent.

Leading technology stocks retreated. Computer consulting firm Cap Gemini (PCAP) shed 2.3 percent, data network provider Equant (PEQU) dropped 5.3 percent, and chipmaker STMicroelectronics (PSTM) fell 3.9 percent.

Automaker Renault (PRNO) shed 2.2 percent after saying its three-month effort to create a joint venture with South Korea's Samsung had fallen apart.

Commerzbank quashes takeover talk

In Frankfurt, business software publisher SAP [FSE:FSAP3] sank 8.2 percent. Traders cited a poor reaction to an analysts' briefing in the United States.

Commerzbank (FCBK), Germany's fourth-biggest bank, shed two percent after saying it sees no likelihood of a hostile takeover bid for the company, despite mounting pressure to craft a deal. Rival Dresdner Bank (FDRB) fell 2.2 percent and would-be merger partner Deutsche Bank (FDBK) lost 1.2 percent.

Engineering firm and steel maker Thyssen Krupp (FTKA) added 2.7 percent as it awaited a response to its offer to acquire the engineering and auto units of Mannesmann. The whole of Mannesmann is set to be bought by Britain's mobile phone operator Vodafone AirTouch (VOD).

In the auto sector, BMW (FBMW) rose 3.8 percent on expectations that the luxury carmaker's earnings will improve after the sale of its money-losing British subsidiary Rover. Rival Volkswagen (FVOW) rose 2 percent.

Elsewhere in Europe, the troubled Dutch software company Baan (BAANF: Research, Estimates), whose American depositary receipts also trade in New York, rose 10 percent in Amsterdam after it said it will issue stock for its e-commerce subsidiary and announced that securities firm Bear Stearns has committed up to  150 million ($143.5 million) to the company. Baan is Europe's No. 2 software maker after SAP. 150 million ($143.5 million) to the company. Baan is Europe's No. 2 software maker after SAP.

-- from staff and wire reports

|

|

|

|

|

|

|