|

Veritas deal makes waves

|

|

March 30, 2000: 4:45 p.m. ET

CEO predicts exponential growth for company in the software industry

|

NEW YORK (CNNfn) - The decision by computer disk drive maker Seagate Technology Inc. to go private in a $20 billion deal -- the third largest technology deal in history -- is suddenly creating market ripples for independent software applications developer Veritas Software.

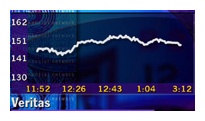

Shares of the Mountain View Calif.-based Veritas (VRTS: Research, Estimates), which makes software that stores and manages digital information, rose 2-3/4 to 145-1/4 at the close of Thursday trading on the Nasdaq, bolstered by Salomon Smith Barney's upgrading of the stock to "buy" from "outperform."

Mark Leslie, chairman and CEO of Veritas said the deal was a potential win-win opportunity for both Veritas and Seagate shareholders. "Veritas is in a unique position to create $8 billion in tax-free benefits by buying back $20 billion worth of shares of common stock that Seagate owns," Leslie told CNNfn's Market Coverage Thursday. Mark Leslie, chairman and CEO of Veritas said the deal was a potential win-win opportunity for both Veritas and Seagate shareholders. "Veritas is in a unique position to create $8 billion in tax-free benefits by buying back $20 billion worth of shares of common stock that Seagate owns," Leslie told CNNfn's Market Coverage Thursday.

Leslie said Veritas would buy the company that owns the Seagate shares, repatriate them to the Veritas treasury, and pay for the new company with the new Veritas shares, which would go to the Seagate shareholders. "This transaction creates a tax-free trade in a merger. Veritas shareholders get $3 billion in value while Seagate shareholders will get $5 billion," said Leslie.

The Scotts Valley, Calif.-based Seagate (SEG: Research, Estimates) announced Wednesday it was to be taken private in a two-stage deal, with Veritas acquiring the common stock Seagate holds in the first stage, in addition to certain securities and cash. In the second stage, an investor group led by Silver Lake Partners and Texas Pacific Group, would acquire Seagate's operating businesses for $2 billion in cash.

Seagate was down 7-1/2, ending at 66-1/2, at day's end on the New York Stock Exchange, after a roller-coaster ride in the market. Seagate was down 7-1/2, ending at 66-1/2, at day's end on the New York Stock Exchange, after a roller-coaster ride in the market.

Veritas's core business is developing data loss prevention software solutions designed to work across platforms. The company, already a leader in the Internet infrastructure sector, with reported annual revenue of $700 million in 1999, was positioning itself to corner more of the market, and expand its product portfolio.

"It's a robust market right now, and we want to create more customers," said Leslie. "This deal will give the disk business a new lease of life." With the additional cash generated from the transaction, Leslie said Veritas's objective would be to increase its investment in the venture business from $100 million to about half a billion.

|

|

|

Seagate

Veritas

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|