|

Tiger Management closes

|

|

March 30, 2000: 6:59 p.m. ET

Julian Robertson plans to return money to shareholders after losses in value stocks

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Julian Robertson, once regarded as one of Wall Street's highest rollers, announced plans to liquidate all six of his Tiger Management funds Thursday, the latest in a series of setbacks for the highly volatile hedge fund market.

The move marks the downfall of a veteran hedge fund manager, whose bets on value stocks backfired as investors turned their attention to high-octane technology shares.

In a letter to investors, Robertson, Tiger's 67-year-old chief, blamed the fund's problems on the rush to cash in on the Internet craze.

"As you have heard me say on many occasions, the key to Tiger's success over the years has been a steady commitment to buying the best stocks and shorting the worst," he wrote. "In a rational environment, this strategy functions well. But in an irrational market, where earnings and price considerations take a back seat to mouse clicks and momentum, such logic, as we have learned, does not count for much."

Robertson said he had already largely liquidated Tiger's portfolio and was ready to return up to 75 percent of the $6 billion in assets to investors in cash immediately.

"This is one of the first big managers to close. There are not too many of his stature," said Bob Keck, president of the 6800 Capital Group, an alternative investment managing company. "Some investors are concerned in terms of exactly how the fund is being liquated and if it'll put undo pressure on the market. Because of the size of the positions, has it had impact on the market? No one knows."

A risky strategy

Hedge funds are unregulated pools of money that use riskier strategies like derivatives and short-selling to boost returns. By leveraging their investments, hedge funds can boast substantial returns. However, when the bets go against the fund, the losses can be huge.

In 1998, Long-Term Capital Management, the hedge fund run by former Salomon Inc. Vice Chairman John Meriwether, roiled markets when the fund made a bad bet on interest rates. The Federal Reserve stepped in to negotiate a $3.6 billion bail-out plan. The fund ultimately paid back $1.3 billion to investors, but many on Wall Street regarded the fund's near-collapse as a warning sign for high-flying hedge funds.

Unlike most mutual funds, hedge funds require substantial minimum investments of $500,000 to $1 million. The typical shareholders are foundations, pension funds, university endowments and wealthy investors. But even though most individual investors can't get into hedge funds, the funds can have a dramatic effect on Wall Street.

In Tiger Management's case, the Jaguar Fund had suffered sharp losses for more than a year, tumbling 7.8 percent in February and 13.8 percent year-to-date as of Feb. 29. Meanwhile, the fund's assets plunged from roughly $20 billion in 1998 to about $6.5 billion, analysts said.

For Tiger, the beginning of the end occurred almost two years ago, when the fund lost $2 billion on a bad bet against the Japanese yen. To make matters worse, the fund continued to stick to its diet of so-called "old economy" stocks last year even though investors were pumping billions of dollars into technology issues.

"When you own value stocks, you can't lose money in the last two years and stay in this business," said Robert Schulman, president of hedge fund consultant Tremont Advisors in Rye, New York.

Efforts to reach Robertson for comment were unsuccessful.

But in his letter to shareholders, Robertson spoke about the plunging prices of so-called "old economy" value stocks. While volatile technology stocks have soared, out-of-favor value stocks have been trading at bargain prices.

No quick end in sight

"The result of the demise of value investing and investor withdrawals has

been financial erosion, stressful to us all," Robertson wrote. "And there is no real indication that a quick end is in sight."

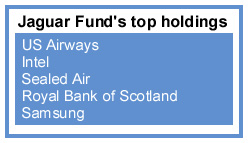

Among the fund's largest holdings are: U.S. Airways (U: Research, Estimates), Sealed Air (SEE: Research, Estimates) Intel (INTC: Research, Estimates), Royal Bank of Scotland and Samsung.

Another holding, auto parts supplier Federal Mogul Corp., is watching liquidation of Jaguar fund closely, company officials said Thursday. Jaguar owns about 8.8 million shares of Federal Mogul (FMO: Research, Estimates). Another holding, auto parts supplier Federal Mogul Corp., is watching liquidation of Jaguar fund closely, company officials said Thursday. Jaguar owns about 8.8 million shares of Federal Mogul (FMO: Research, Estimates).

"I'd rather not say that we're worried, but I guess I would say that they hold a fair amount of shares," company spokesman Steve Feeney said.

One former investor, Jaeson Dubrovay, chief investment officer with Carr Global Advisors in Chicago, held a stake in Tiger's Jaguar fund over the past ten years until December when he sold his position.

Dubrovay told CNNfn's Street Sweep on Thursday that Robertson has his shareholders in mind as he liquidates the funds. (249K WAV or 249K AIFF)

Keck, of 6800 Capital Group, pointed out that Tiger's assets represent a tiny part of a $500 billion industry. He predicted it would not have an impact on the hedge fund business.

"The keys for people who get into hedge funds is to understand the strategy that the manager is going to be using," Keck said. "And know how long you're tied up in these things."

--Reuters contributed to this story

|

|

|

|

|

|

|