|

Schwab sees strong 1Q

|

|

April 3, 2000: 10:50 a.m. ET

Says it will beat forecasts on heavy trading volume, gain from acquisition

|

NEW YORK (CNNfn) - Charles Schwab Corp., the nation's leading discount broker, said Monday it will exceed earnings estimates for the first quarter, due to heavy trading by its clients and a recent acquisition.

The San Francisco-based broker said it expects to report net income of between $265 million and $280 million, or 31 cents to 33 cents a diluted share, when it releases results in mid-April. Revenue is expected to hit $1.55 billion for the period.

Analysts surveyed by earnings tracker First Call forecast the company to earn 26 cents a share for the period. Net income for last year's first quarter was $143 million, or 17 cents a diluted share, on revenue of $952 million. Analysts surveyed by earnings tracker First Call forecast the company to earn 26 cents a share for the period. Net income for last year's first quarter was $143 million, or 17 cents a diluted share, on revenue of $952 million.

Analysts said they were pleasantly surprised by the result. While they might have expected the company to beat 26 cents a share in the period, few if any were looking for the latest guidance.

"I actually raised my estimate this morning from 23 to 27 cents, and then they pre-announced," said Gregory Smith, analyst with Chase, Hambrecht and Quist. "I had the direction right, just not the magnitude."

Both Smith and Amy Butte, analyst with Bear Stearns, say the volumes and profits are likely to slip in the second quarter, as the market turns more bearish.

"It was a fabulous quarter across the board. Everything came together for Schwab," said Smith. "It certainly bodes well for the rest of the group, E-Trade (EGRP: Research, Estimates), Knight/Trimark (NITE: Research, Estimates) and DLJ Direct (DIR: Research, Estimates). I've raised my estimates on each of those. Bottom line: online trading volumes continue to gain market share."

Discount brokers well positioned for bearish turn

Both analysts say that these numbers show the growth of online trading should help Schwab and other discount brokers ride out even a bear market.

"This shows they can continue to spend money and produce earnings," said Butte.

Schwab also issued positive earnings guidance in December that it would exceed fourth-quarter estimates, and then exceeded those estimates.

Schwab said customers' daily average revenue trades exceeded 320,000 in March, a record and more than twice the year-earlier level. The company said CyBerCorp Inc., which it recently bought for $488 million, generated over 18,000 daily average revenue trades.

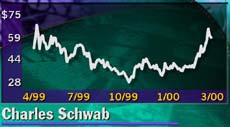

Shares of Schwab (SCH: Research, Estimates) gained 3-7/8 to 60-7/8 in early trading Monday.

|

|

|

|

|

|

Charles Schwab

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|