|

Anadarko sets $4.4B merger

|

|

April 3, 2000: 10:10 a.m. ET

Deal for Union Pacific Resources to create independent oil, natural gas giant

|

NEW YORK (CNNfn) - Anadarko Petroleum Corp. agreed to acquire Union Pacific Resources Group Inc. for $4.4 billion in stock Monday, continuing the ongoing consolidation in the worldwide oil exploration and production industry.

The deal creates an independent energy powerhouse boasting proved reserves of nearly 2 billion barrels of oil and 11.7 trillion cubic feet of natural gas, primarily drawn from U.S.-based assets. Based on current figures, the combined company would rank as North America's sixth-largest natural gas producer and among the top independent oil production companies.

"The new Anadarko will have the financial strength to aggressively pursue a broader portfolio of projects," said Robert Allison Jr., Anadarko's chairman and CEO, who will retain those posts following the merger. "Given the current outlook for energy markets, now is the time to step up the pace of drilling for new energy reserves, particularly North American natural gas."

Terms of the agreement call for Houston-based Anadarko (APC: Research, Estimates) to exchange 0.455 share of its common stock for each Union Pacific (UPR: Research, Estimates) share. Based on Anadarko's closing price Friday, that represents a 21 percent premium above Union Pacific's closing price of 14-1/2.

Following the merger, Anadarko shareholders will control 53 percent of the company's outstanding shares, with Union Pacific controlling 47 percent. The companies said the deal will be immediately accretive to earnings and cash flow.

Shortly after the opening bell Monday, United Resources shares jumped 1-1/2 to 16 while Anadarko shares were held for trading at their 38-11/16 level Friday.

Oil consolidation continues

The deal comes in the midst of a worldwide oil industry consolidation. In the past six months, Phillips Petroleum Corp. paid $7 billion for Atlantic Richfield Co.'s Alaskan oil-producing assets, helping clear the way for the BP Amoco-Arco merger, and Exxon Corp. completed the acquisition of Mobil Corp. for $82 billion.

In Union Pacific Resources, Anadarko acquires more than 7 million acres of oil- and natural gas-rich land, most of which was granted to its former parent company, Union Pacific Railroad, by the U.S. government in exchange for constructing a nationwide railroad system in 1800s.

Union Pacific's strengths include its efficient drilling procedure, in which, instead of sitting on its proved fields until prices are high as most oil companies do, quickly exhaust the company's reserves while it continues exploring. Union Pacific's strengths include its efficient drilling procedure, in which, instead of sitting on its proved fields until prices are high as most oil companies do, quickly exhaust the company's reserves while it continues exploring.

Like Anadarko, the company's assets lie predominately on U.S. soil, where it has ranked as the No. 1 domestic driller during each of the last seven years.

Fort Worth, Texas-based Union Pacific posted income from continuing operations of $89.2 million, or 36 cents per share, last year and dramatically decreased its heavy debt load by cutting costs and selling non-core assets.

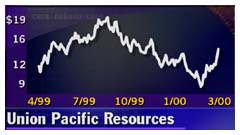

Still, although it has rebounded somewhat of late, the company's stock has been in a gradual freefall for most of the last year and remains well off it's 52-week high of 19-3/8

Anadarko, meanwhile, currently ranks as one of the world's largest independent oil and natural gas exploration and production companies. It has shifted its asset base gradually from being focused almost predominately on natural gas production to an equal split with crude oil, which it accomplished recently by uncovering new reserves in the Gulf of Mexico and the Sahara Desert.

Like Union Pacific, Anadarko has been discarding non-core assets, but also has been outspending its cash flow to keep up with its recent reserve discoveries.

|

|

|

|

|

|

|