|

Europe takes a bruising

|

|

April 3, 2000: 12:59 p.m. ET

Frankfurt and Paris fall more than 2% as Microsoft drags techs lower

|

LONDON (CNNfn) - European stock markets fell sharply Monday, with technology stocks suffering after the collapse of Microsoft's U.S. antitrust talks. Frankfurt and Paris fell more than 2 percent and London dropped more than 1 percent, but Zurich bucked the trend with 1 percent gain.

Telecom and technology stocks rolled with the punches thrown by investment banks. Lehman Brothers cut its exposure to telecom stocks saying valuations don't match growth prospects, while Credit Suisse First Boston warned the dominance of new economy tech stocks is drawing to an end.

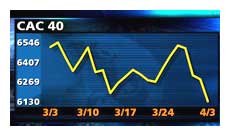

Frankfurt's Xetra Dax fell 2.2 percent to 7,429.22, weakened by Deutsche Telekom, which priced its T-Online Internet unit. Paris' CAC 40 index slumped 2.6 percent to 6,122.24, despite a multibillion-dollar deal for a major French bank.

London's benchmark FTSE 100 index ran into a technical hitch for more than half the trading day but was eager to make up on lost time, falling 1.2 percent to 6,462.1. Zurich's SMI rose 1.3 percent to 7,522.8 led by insurer Zurich Allied, which posts 1999 earnings Wednesday. London's benchmark FTSE 100 index ran into a technical hitch for more than half the trading day but was eager to make up on lost time, falling 1.2 percent to 6,462.1. Zurich's SMI rose 1.3 percent to 7,522.8 led by insurer Zurich Allied, which posts 1999 earnings Wednesday.

The pan European FTSE 300, a broader index of the region's largest stocks, fell 0.79 percent to 1,614.17, with computer, media and technology components all falling more than 5 percent.

The Nasdaq composite index fell sharply early Monday, hurt by losses in Microsoft Corp., which plunged after antitrust settlement talks with the government broke down over the weekend. Just before 1 p.m. ET, the Nasdaq was down 254.14 to 4,318.69, a more than 5 percent tumble that more than

reversed Friday's 114.94 point rise. But the Dow, home to many so-called "old economy" stocks, was up 131.85 to 11,053.77.

After a delayed opening, shares of Crédit Commercial de France jumped 16.25 percent in Paris after global banking powerhouse HSBC disclosed plans Saturday to buy the French bank for at least $10.6 billion in cash and stock. Shares of HSBC fell 6.2 percent. Leading the Paris blue chips was

Crédit Lyonnais (PCL), which also has been considered a possible takeover target, up 7.3 percent, while Société Générale (PSG) tacked on 6.9 percent.

Pechiney [FRA:PPEC], the French aluminum producer, added 5.4 percent

after announcing it will sell a 45.5 percent stake in American National Can to Britain's Rexam (REX) for 1.3 billion pounds ($2.04 billion). Rexam shares jumped 7.5 percent.

French computer consultant Cap Gemini (PCAP) fell 8.1 percent after announcing that the partners of Ernst & Young in 15 countries have approved the acquisition of the accounting firm's consulting businesses. Other media companies, such as Lagardere (PMMB), Vivendi (PEX) and Canal Plus (PAN) all fell more than 10 percent. Paris heavyweight France Telecom (PAN) dropped 6.2 percent.

In Frankfurt, Deutsche Telekom [FRA:FDTE] shed 10.1 percent after it announced it will price In Frankfurt, Deutsche Telekom [FRA:FDTE] shed 10.1 percent after it announced it will price

the initial offering of its T-Online Internet unit at a lower-than-expected range of 26 to 32 euros, which will raise up to 3.2 billion euros ($3.06 billion). The stock was the biggest decliner on the index.

Technology stocks remained weak, with electronics firm Siemens [FRA:FSIE] dropping 5.3 percent and Europe's biggest business software maker, SAP [FRA:FSAP], falling 7 percent.

In London, information technology services group CMG [LSE: CMG] was the biggest loser on the FTSE benchmark index after investment bank Donaldson Lufkin & Jenrette downgraded its rating on the company to market performer from buy. CMG shares slumped 19.6 percent after the company recently announced the acquisition of rival Admiral for 1.4 billion pounds.

British American Tobacco (BAT) fell 5.3 percent after announcing plans to take a $130 million first-quarter charge related to its deal to buy Japanese trading house Sumitomo Corp.'s cigarette business. British American Tobacco (BAT) fell 5.3 percent after announcing plans to take a $130 million first-quarter charge related to its deal to buy Japanese trading house Sumitomo Corp.'s cigarette business.

Britain's telecom heavyweights dragged the index down further. Vodafone AirTouch (VOD) fell 4.2 percent while British Telecommunications

(BT-) dropped 2.4 percent.

Britain's Railtrack [LSE: RTK] rose 6.3 percent after denying a Sunday

report that the rail services company has dropped its "profit agenda" because of regulatory pressure. Railtrack CEO Gerald Corbett told the Observer newspaper the company is caught between the needs of shareholders and demands of the nation's rail authority.

Neglected insurance companies were on the rebound, led by Legal & General, which topped the FTSE 100 gainers, rising 7.8 percent.

In currency markets, the euro was little changed against the dollar at 95.23 cents, after trading at 95.57 cents late Friday.

-- from staff and wire reports

|

|

|

|

|

|

|