NEW YORK (CNNfn) - Shares electronic games retailer Funco Inc. jumped more than 42 percent after news of a merger agreement with Electronics Boutique, in which Electronics Boutique will acquire Funco.

News of the collapse of settlement talks in the U.S. government's antitrust suit against Microsoft took that company's shares down almost 15 percent.

Here are some of the biggest market movers in Monday trading:

Monday's winners

Funco Inc. (FNCO: Research, Estimates) up 5 to 16-7/8.

Electronics Boutique Holdings Corp. and Funco Inc. jointly announced a definitive merger agreement, under which Electronics Boutique will acquire Funco. Electronics Boutique is among the world's largest specialty retailers of electronic games. Funco, a Minneapolis-based electronic games retailer, markets interactive home entertainment through its stores and Web site, primarily through the purchase and resale of new and previously played video games, related hardware and accessories. The combined company will become the largest specialty retailer of electronic games in the world.

American National Can Group (CAN: Research, Estimates) up 3-15/16 to 17-1/16.

Rexam PLC and American National Can Group Inc. announced they have entered into a definitive agreement, under which Rexam will acquire all outstanding shares of American National Can for $18.00 per share payable in cash, a premium of 44 percent to American National Cans' average March 2000 closing price. American National Cans is a holding company that, through its subsidiaries, manufactures metal beverage cans.

Monday's losers

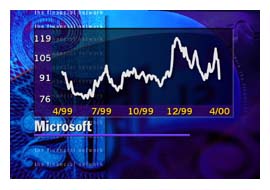

Microsoft Corp. (MSFT: Research, Estimates) down 15-3/8 to 90-7/8.

Shares of Microsoft fell following the collapse of settlement talks in the U.S. government's antitrust suit against the software company over the weekend. The judge mediating the case said on Saturday that he was ending his efforts, saying the "quest proved to be fruitless."

Legato Systems Inc. (LGTO: Research, Estimates) down 24-5/8 to 20.

Storage management software maker Legato Systems said it expects its reported revenue for 1999 will be reduced after it completes a review of its results with outside auditors. The company said in a statement it learned that some of its sales representatives, acting outside their authority, had entered into side agreements involving about $7 million of fourth-quarter 1999 revenue.

Starbucks (SBUX: Research, Estimates) down 2-15/16 to 41-7/8.

Merrill Lynch downgraded Starbucks from "buy" to "near term accumulate."

Lehman cut it to "outperform" from "buy," based on valuation. Lehman Brothers analysts say they're still bullish on the stock, insisting the company's share price has only gotten ahead of its fundamentals.

Lands' End (LE: Research, Estimates) down 6-3/8 to 54-15/16.

First Union is cutting the retailer to buy from strong buy. An analyst at First Union said the stock jumped 85-percent in March, aided by a rebound in the retail group. The analyst said the stock has moved further than near-term fundamentals justify. But she said long-term, the company looks good. She is cutting the first-quarter earnings per share estimate by 3-cents to 15-cents per share, based on lower sales expectations than previously forecast.

Pacific Gateway Exchange (PGEX: Research, Estimates) down 4-13/16 to 9-7/8.

Pacific Gateway Exchange, a provider of international telecommunications services, late Friday disclosed that it has cash problems. The company is restating each quarter from last year, which means audited year-end earnings won't be the same as those reported a mere 31 days earlier. The new numbers will be 41 cents per share rather than 48 cents.

VerticalNet Inc. (VERT: Research, Estimates) down 11-9/16 to 56-7/16.

NECX.com LLC, an electronics industry marketplace and a wholly-owned subsidiary of VerticalNet Inc., announced that it has completed the previously announced acquisition of Real World Electronics, a privately held electronics exchange.

Louis Dreyfus Natural Gas Corp. (LD: Research, Estimates) down 5-1/4 to 28-3/4.

J.P. Morgan said analyst Waqar Syed cut his rating on Louis Dreyfus Natural Gas Corp. to "market performer." He said stock had reached its $30 price target. "We believe on a risk/reward basis the stock has become rich," the analyst said.

Entrade Inc. (ETA: Research, Estimates) down 5-3/16 to 25-11/16.

Entrade Inc., a creator of business-to-business e-commerce marketplaces, announced today the appointment of Norman Smagley as Chief Financial Officer. Shares of Entrade went down 11 percent. A company spokesman said the decline in the stock price was because of recent market trends and had nothing to do with the new CFO appointment

Veritas Software (VRTS: Research, Estimates) down 19-3/16 to 111-13/16.

Shares in Veritas Software and Seagate Technology fell on Monday, despite after-hours strength on Friday. Last week both companies announced a deal to take Seagate private, selling its operating assets and returning Veritas's share back to it.

Net2000 Communications Inc. (NTKK: Research, Estimates) down 3-3/8 to 20-3/8.

Donaldson Lufkin & Jenrette said that analyst W. Todd Scott had started coverage of high-speed telecommunications services company Net2000 Communications Inc. with a "buy" rating.

-- compiled by Staff Writer Lucy Banduci from wire reports

|