|

Market gives IPOs the chills

|

|

April 4, 2000: 3:41 p.m. ET

If the technology tumble continues, analysts predict new offerings will tail off

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - The once red-hot IPO market got a case of the chills Tuesday, as the sudden downward lurch in technology-related issues led industry analysts to predict a significant slowdown in new issues hitting the open market for the next few days, if not weeks.

As the Nasdaq shed more than 10 percent of its value while most Wall Street traders were still returning from lunch, IPO experts said several new issues could get a cold shoulder from investors in the next few weeks as technology shares look to regain their footing.

"You are going to see the IPO market underwriters really become selective in what they let out," said Jeffrey Hirschkorn, senior market analyst with IPO.com. "The turbulence really could cripple the IPO market in the short-term."

A slew of IPOs on tap this week

In many ways, the market's volatility could not come at a worst time for companies looking to go public. A whopping 21 companies are slated to debut this week, the highest weekly total so far this year.

That tally includes six companies that were originally slated to price their offerings last week, but held off because market conditions were weak.

Indeed, after a largely stellar first quarter, that saw a record $32.1 billion raised in first-time offerings, the IPO market had already cooled substantially before the Nasdaq began its freefall shortly after the opening bell Monday.

Click here for CNNfn's weekly IPO calendar

This week's slump "definitely gets people's attention," said Corey Ostman, chief technology officer with Alert! IPO. "At this point, if the underwriters see this as a correction phase, they'll delay their offerings a couple of days or even a week or more."

In some cases, the delay could be even more severe. Several industries, including e-tailing and biotech sectors, have been largely ignored by investors during the past few weeks as the market returned to the safety of large, more established companies with proven earnings pedigrees.

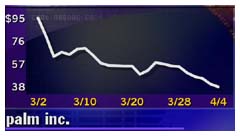

Even some of the first quarter's strongest IPOs have come tumbling quickly back to earth. For example, by mid-afternoon Tuesday, Palm Inc. (PALM: Research, Estimates), the maker of handheld computers which climbed as high as 165 during its first day of trading last month, had tumbled below its initial pricing level of 38 to trade at 32. Even some of the first quarter's strongest IPOs have come tumbling quickly back to earth. For example, by mid-afternoon Tuesday, Palm Inc. (PALM: Research, Estimates), the maker of handheld computers which climbed as high as 165 during its first day of trading last month, had tumbled below its initial pricing level of 38 to trade at 32.

Despite such examples, there remain some more encouraging signs.

The day's one new issue Tuesday, Cabot Microelectronics Corp. (CCMP: Research, Estimates), a semiconductor supply company, remained in positive territory during even the market's strongest downdraft and traded up 4 at 24 by mid-afternoon.

"I don't think there is anything to be freaking out about," said Gail Bronson, an analyst with IPO Monitor. "The markets will come back and they will move upward again."

Tech issues drive 1Q results

That was certainly the case during the first quarter, where continued strong interest in technology and Internet shares helped shatter the record for first-quarter proceeds, according to data compiled by IPO.com.

While the number of initial public offerings doubled from 1999's record-breaking quarter, the total proceeds generated from those offerings nearly tripled to $32.1 billion as a number of large issues -- including Infineon Technologies' (IFX: Research, Estimates) $5.2 billion offering and John Hancock Financial Services Inc.'s (JHF: Research, Estimates) $1.7 billion offering -- hit the Street. While the number of initial public offerings doubled from 1999's record-breaking quarter, the total proceeds generated from those offerings nearly tripled to $32.1 billion as a number of large issues -- including Infineon Technologies' (IFX: Research, Estimates) $5.2 billion offering and John Hancock Financial Services Inc.'s (JHF: Research, Estimates) $1.7 billion offering -- hit the Street.

Technology issues continued to lead the way. B2B software company Webmethods Inc. (WEBM: Research, Estimates) posted the quarter's strongest first-day gain, climbing 508 percent, followed by Japanese e-mail service provider Crayfish Inc. (CRFH: Research, Estimates), which jumped 414 percent on its first day.

Crayfish's success was mimicked by a number of international companies that made the journey onto Wall Street during the quarter.

Analysts said the strong performance of companies like Germany's Infineon, Japan's Crayfish and China's AsiaInfo Holdings Inc. (ASIA: Research, Estimates) will likely spur even more foreign companies to tap the American markets for additional capital during the second quarter.

"You had a lot of foreign deals come to the United States because the valuations on the Nasdaq are pretty good right now," Hirschkorn said.

Refusing to throw caution into the wind

But with the market searching for leadership at the moment, analysts said investors should become more particular about investing in IPOs.

Most important, analysts suggest looking harder for companies that either boast strong balance sheets or some proprietary technology that gives them an edge over competitors.

Proven brand names, like this week's expected $2.5 billion offering of MetLife Inc., will also likely fare better than some of the more obscure technology companies, even if their long-term prospects aren't as strong, analysts said.

"As an overall philosophy, you want to come out in the most robust market as possible and this ain't it," Bronson said. "The public has finally figured out that they shouldn't abandon the companies that make up the bulk of the economy."

But in many cases, investors may find the more established underwriters will do most of their work for them, bringing out the companies they consider to be more of a "sure thing" and holding back or even canceling those that need a more forgiving market to hold their own.

One company, Modus Media Inc., already took that route, calling off its IPO Monday, citing unfavorable market conditions.

|

|

|

|

|

|

|