|

Sonera ends UK mobile bid

|

|

April 4, 2000: 9:34 a.m. ET

Finnish telecom operator says bids in U.K. wireless auction not justified

|

LONDON (CNNfn) - Finnish telecom operator Sonera said Tuesday that its 67 percent-owned venture SpectrumCo would not raise its bid in the British government's auction of next-generation mobile-phone licenses, calling the high value of offers for the licenses unjustified.

The sale, which has drawn bids from leading companies and business figures from around the world, is set to raise more than twice the figure originally expected. The value of the leading bids for the five licenses on offer topped £10.9 billion ($17 billion) Tuesday.

SpectrumCo's other backers include Richard Branson's Virgin Group, U.K. food retailer Tesco (TSCO) and IT company Marconi (MNI). Virgin, which launched a mobile phone service in the U.K. in September and plans to extend the operation to mainland Europe and Australia, could not immediately be reached for comment. SpectrumCo's other backers include Richard Branson's Virgin Group, U.K. food retailer Tesco (TSCO) and IT company Marconi (MNI). Virgin, which launched a mobile phone service in the U.K. in September and plans to extend the operation to mainland Europe and Australia, could not immediately be reached for comment.

In the first auction of its kind in Europe, 3GUK, a unit of Ireland's eircom, and Crescent Wireless, whose shareholders include U.S.-based fiber-optic network operator Global Crossing (GBLX: Research, Estimates), also dropped out this week as the bidding intensified among operators aiming to offer Internet and video over mobile phones.

The bidders, such as Australia's one.tel, which is backed by Kerry Packer's Publishing and Broadcasting and Rupert Murdoch's News Corp. (NCP: Research, Estimates), are betting that demand for video and Internet access over hand-held gadgets will reap huge dividends in Britain, and believe that lessons they learn in that market could prove useful globally.

With the value of the top bids already more than twice the £5 billion that the government originally expected, U.K. Chancellor of the Exchequer Gordon Brown is looking forward to a cash bonanza to add to the £12 billion budget surplus for this year that he has already forecast. The government will receive half the bid money immediately and the rest over ten years.

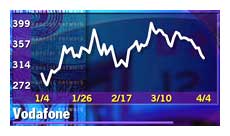

The U.K.'s four existing cellular network operators - Vodafone Airtouch (VOD), BT Cellnet, Orange and One2One - are all still in the competition, and are joined by eight overseas companies. The government is almost certain to offer next-generation licenses to the four existing incumbents, analysts said, leaving the other candidates to fight it out for one remaining license. The U.K.'s four existing cellular network operators - Vodafone Airtouch (VOD), BT Cellnet, Orange and One2One - are all still in the competition, and are joined by eight overseas companies. The government is almost certain to offer next-generation licenses to the four existing incumbents, analysts said, leaving the other candidates to fight it out for one remaining license.

The auction, which began in early March, has already lasted longer than analysts anticipated, and will continue until only one bidder remains for each of the five licenses available. The government imposed limits on the minimum and maximum amounts by which a participant may raise the stakes in any bidding round.

In round 96 of bidding -- there are five a day -- the world's largest mobile company Vodafone outbid local rival British Telecommunications (BT-), the owner of BT Cellnet, with a £2.4 billion bid for license B on Tuesday. Failure to win this license would not prevent either company from winning one of the other licenses that the government is offering. Licenses differ in the details of permitted operations, but all allow owners to provide essentially similar services.

The highest offer from an overseas company came from Spain's Telefónica, which offered £2.21 billion for license A, which is reserved for a new operator.

Britain's third-biggest mobile phone operator Orange led bidding for license E with an offer of £2.08 billion. Orange was allowed to enter bids for a mobile license despite objections from other bidders that said that the purchase of Mannesmann, Orange's owner, by Vodafone, meant it should be excluded from the auction.

Canada's Telesystem International Wireless (TIWI: Research, Estimates), which emerged as the surprise highest bidder in round one, bid more than £2 billion for license C. U.S. telecom giant MCI WorldCom (WCOM: Research, Estimates) topped Nasdaq-listed cable company NTL Corp. (NTLI: Research, Estimates) by offering £2.1 billion for license D.

|

|

|

|

|

|

|