|

Soccer eyes media match

|

|

April 5, 2000: 11:40 a.m. ET

Battle to broadcast U.K. football will set a benchmark for future sports deals

|

LONDON (CNNfn) - British supporters call it "the beautiful game". However, the upcoming battle among broadcasters for television and new media rights to England's elite soccer matches promises to deteriorate into an ugly midfield standoff between clubs, media companies and supporters.

At stake is a deal with a price tag that analysts estimate could reach £2 billion ($3.1 billion) over three years, a three-fold increase over the English soccer league's current TV-only contract. This would make it the richest TV sports deal in Europe outside the Olympics.

It will also set a benchmark for the growing financial clout and audience reach for sports coverage from new media outlets such as third-generation mobile phones and high-speed Internet alongside traditional TV coverage.

Andrew Morris, a sports lawyer at London-based sports business consultancy Sportscast, said the most lucrative part of the next soccer-rights contract will continue to be the rights to show games on TV companies, but Net-based firms, including those offering cellular access, will account for an enlarged share when the rights come up for auction again in three years. He predicts that the contracts on offer then could go for double the prices now being bid, with new media funding the bulk of the increase. Andrew Morris, a sports lawyer at London-based sports business consultancy Sportscast, said the most lucrative part of the next soccer-rights contract will continue to be the rights to show games on TV companies, but Net-based firms, including those offering cellular access, will account for an enlarged share when the rights come up for auction again in three years. He predicts that the contracts on offer then could go for double the prices now being bid, with new media funding the bulk of the increase.

The impact of the U.K. deal, expected to be finalized in May, carries far beyond the British football market. Other media companies in the region are queuing up to exploit the right to broadcast European soccer, the continent's most widely watched sport. The lure of the European game, which also attracts huge audiences in Asia, is pushing the cost of rights ever higher.

Mark Oliver, a media consultant at London-based Oliver & Ohlbaum, believes that the Internet market in particular is relatively untapped and could generate annual revenues of up to $3 billion within 10 years, including the rights to screening games and potential revenue from merchandising and football-based gambling.

Formula One leads the way

The English soccer authorities are setting the pace which the rest of Europe is expected to follow. The latest auction, launched Monday, will run for the three seasons starting in August 2001, divides the rights into seven distinct packages. Interested parties can bid for the right to screen games live, to broadcast packages of match highlights, or to show matches on the Internet or cellphones.

Analysts said that the Premier League, which is managing the auction on behalf of leading clubs, has followed the example set by grand prix motor racing in seeking to expand revenues by seeking to exploit new media.

"The pioneer in the whole broadcast arena has been Formula One [grand prix racing]," said Morris.

Bernie Ecclestone, the British motor racing promoter who effectively controls Formula One broadcast rights, has turned the tournament into a global circus commanding multi-million dollar TV and merchandising rights. That's seen as a significant achievement in a sport that just a decade ago was seen as a niche attraction. Ecclestone invested heavily in technology to roll out digital and pay-TV services, seeking to parcel up audiences to maximize revenues.

The Premier League is following suit, but shrugs off criticism that fans will foot the bill. The rising cost of TV rights in recent years has been accompanied by soaring players' wages and match ticket prices, as well as a fragmentation of the outlets where football can be seen.

"We feel this is a balanced set of agreements," English Premier League Chief Executive Richard Scudamore told a news briefing to launch the auction Monday. "Primarily football wins, but it also allows consumers more choice and clubs more flexibility."

The Premier League has set the deadline for bids at May 10.

Media firms square up

Football's resurgent popularity in Britain - attendances are at their highest level since the 1950s - has been matched by the flow of media riches into the sport.

BSkyB (BSY), the satellite TV operator controlled by Rupert Murdoch's News Corp., made football coverage the cornerstone of its expansion. It paid £670 million for a contract that gives it exclusive rights to screen live matches from the English soccer leagues in the four years ending in August 2001, broadcasting 60 matches a season. The state-run British Broadcasting Corporation paid £73 million for the rights to show game highlights.

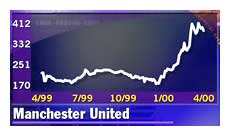

The run-up to the latest auction has seen media firms scramble to take equity stakes in leading soccer clubs in a bid to give them influence over the increasingly lucrative media rights. BSkyB has minority stakes in Manchester United (MNU), the worl'd most valuable sports club, as well as Chelsea, Leeds United, Sunderland and Manchester City. U.K. antitrust officials last year blocked its attempted takeover of United. The run-up to the latest auction has seen media firms scramble to take equity stakes in leading soccer clubs in a bid to give them influence over the increasingly lucrative media rights. BSkyB has minority stakes in Manchester United (MNU), the worl'd most valuable sports club, as well as Chelsea, Leeds United, Sunderland and Manchester City. U.K. antitrust officials last year blocked its attempted takeover of United.

BSkyB's main rival for the main live-match broadcast contract is Nasdaq-listed cable operator NTL (NTLO: Research, Estimates), which has stakes in Middlesbrough, Aston Villa and Newcastle United. The BBC has ruled itself out of bidding for live matches.

Gareth Thomas, a media analyst at Commerzbank in London, believes that BSkyB has less to lose from the auction than its cable rival.

"BSkyB's share price should not be overwhelmingly dependent on winning," said Thomas.

Thomas said that the company could be expected to recoup most of the estimated £670 million a year annual cost of the rights by selling them on to cable operators.

Thomas believes the final sale price will probably be nearer £1.5 billion. While that would represent a two-thirds increase on the cost of the previous deal, an alternative auction system could have pushed the price even higher, said Thomas. He said that the large component of rights reserved for free-to-air channels could have been reduced to boost pay-per-view sales.

Football clubs could certainly do with a lift. With the exception of Manchester United, shares in almost all of the listed clubs have performed poorly over the past year as rising wage bills have eroded earnings. United benefited from a new sponsorship deal with Vodafone AirTouch (VOD), by which the mobile operator Vodafone will offer mobile phone and wireless Internet services to Manchester United's worldwide supporter base in a deal worth £30 billion over four years. Football clubs could certainly do with a lift. With the exception of Manchester United, shares in almost all of the listed clubs have performed poorly over the past year as rising wage bills have eroded earnings. United benefited from a new sponsorship deal with Vodafone AirTouch (VOD), by which the mobile operator Vodafone will offer mobile phone and wireless Internet services to Manchester United's worldwide supporter base in a deal worth £30 billion over four years.

Regulators tune in

Premier League bosses have learned another lesson from Formula One, namely that antitrust chiefs are taking an increasing interest in the deals being struck. Ecclestone is being probed by European regulators over the deal that gave him sole rights to negotiate the sale of media rights to grand prix racing. Meanwhile, Germany's football league authority is under investigation by domestic antitrust chiefs over the deal that allows it to negotiate exclusively on behalf of German clubs.

"[The Premier League] has taken a very careful approach to the regulators," said Morris. Under the main 66-game package, which corresponds to BSkyB's current deal, broadcasters will have first pick of games, while the buyer of the pay-per-view rights will have second choice.

The league has resisted the calls from larger clubs to keep ownership of Internet rights to their own games rather than deal collectively, but allowed clubs to negotiate pay-per-view rights to their own matches.

It has also skirted criticism that live football is being priced out of the reach of many fans by distributing different screening-rights packages among a variety of media.

"We want to optimize value, but that doesn't necessarily mean the maximum bid will win," said Scudamore.

Thomas said the league is unlikely to meet its goal.

"If I were BSkyB, NTL or anyone else bidding, I would say 'Let's collude' and hold a meeting in a [highway] café."

|

|

|

|

|

|

|