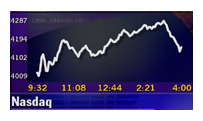

NEW YORK (CNNfn) - Technology stocks rose Wednesday, breaking a brutal two-day losing streak for the Nasdaq composite index, as investors cautiously moved back into shares cheapened by the sell-off.

"You are seeing a little bit of rebound in some of the worst-hit sectors," said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum. "It's clearly a short-term attempt at trying to find some stabilizing level."

But the buying was selective and narrow. And the Dow Jones industrial average fell for the second straight session, as losses to Microsoft and Intel offset gains in IBM and Hewlett-Packard.

Traders encountered another roller-coaster ride Wednesday, but one less severe than Tuesday's tailspin. The Nasdaq moved within a 277-point range while the Dow traveled a 216-point path.

In the end, the Nasdaq rose 20.33, or 0.50 percent, to 4,169.22, chipping away at the 423 points lost Monday and Tuesday.

Wednesday's was only the Nasdaq's second gain in eight sessions, leading some to say its worst losses may be over.

"At this point, so much air has been let out of tech names," Terence Gabriel, stock market strategist for IDEAglobal.com, told CNNfn's Talking Stocks.

But blue chips had more air to let out. The Dow fell 130.92, or 1.20 percent to 11,033.92, adding to its 57.09 drop Tuesday.

The S&P 500 shed 7.36 to 1,487.37.

For a change, more stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 1,663 to 1,306 as volume rose to 1.1 billion shares. Nasdaq winners beat losers 2,269 to 1,983, as more than 2 billion shares changed hands.

In other markets, the dollar slipped against the euro and yen. Treasury securities edged higher.

Buyers nibble on tech

Investors cautiously moved into beaten-up tech shares Wednesday, particularly chipmakers and Internet business-to-business providers.

Applied Materials (AMAT: Research, Estimates) jumped 6-1/16 to 104-3/16 and PMC Sierra (PMCS: Research, Estimates) rose 4-7/8 to 170-13/16.

Ariba (ARBA: Research, Estimates) climbed 3-7/16 to 102-1/16 and I2 Technologies (ITWO: Research, Estimates) surged 10-9/16 to 105.

But some of Nasdaq's highest flyers continued to fall Wednesday. Qualcomm (QCOM: Research, Estimates), 1999's best performing stock, shed 5-3/8 to 141-1/4, and Intel (INTC: Research, Estimates) tumbled 2-7/8 to 129-7/8.

Microsoft Corp. (MSFT: Research, Estimates), which has fallen about 17 percent this week, continued to falter. It dropped 2-3/16 to 86-3/8. The federal judge who found Microsoft, a Dow component, in violation of antitrust law, said Wednesday that all parties agreed to a "fast track" approach for determining final penalties.

Strong 1Q ahead

Despite the day's selective gains, analysts Wednesday were reluctant to call the Nasdaq's sell-off over. Still, many expect a strong first-quarter earnings season to boost stocks.

"With earnings season on the horizon, the bottom line could prove to be our catalyst back to the upside, as lofty expectations have been deflated with stock prices over the past few days," Brian Piskorowski of Prudential Securities wrote in a note to clients.

Stronger-than-anticipated earnings from Yahoo! -- reported after the market closed on Wednesday - could do the trick.

The leading internet portal beat analysts' expectations by 1 cent in the first quarter, reporting earnings of 10 cents per share. Yahoo! (YHOO: Research, Estimates) fell 1-13/16 to 165-9/16 in regular trading.

Abby Joseph Cohen, Goldman Sachs' chief investment strategist told CNNfn's Talking Stocks she sees strong first-quarter earnings triggering another good year in the markets. (376K WAV) (376K AIFF).

Technology companies in the S&P 500 are expected to increase profits by a cumulative 26.2 percent in the first quarter, outpacing the 18.4 percent gain for the overall index, according to First Call/Thomson Financial.

Bill Meehan, senior market analyst for Cantor Fitzgerald & Co., told CNN's In the Money that investors are looking at the choppiness as a buying opportunity. (265K WAV) (265K AIFF).

Buyers certainly moved into Hewlett-Packard (HWP: Research, Estimates), which surged 4-3/4 to 142-7/8, and IBM (IBM: Research, Estimates), which gained 2-7/16 to 123-5/8.

Words from Federal Reserve Chairman Alan Greenspan, meanwhile, did nothing to rattle the markets.

Speaking at a White House conference on the "new economy," Greenspan said the central bank is not targeting stock prices with its decisions on monetary policy.

In stocks in the news, Sears Roebuck and Co. (S: Research, Estimates) surged 7-3/16 to 37-11/16 after the No. 2 U.S. retailer Wednesday forecast first-quarter earnings of 62 to 67 cents a share, well above Wall Street forecasts of 46 cents a share and year-earlier results.

|