|

Tommy's profits to tumble

|

|

April 7, 2000: 8:07 a.m. ET

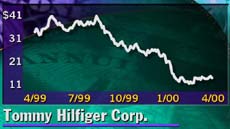

Tommy Hilfiger warns 2001 profit will drop 30%-40%, rather than rise 10%

|

NEW YORK (CNNfn) - Clothing manufacturer Tommy Hilfiger Corp. warned investors Friday to expect a 30 to 40 percent drop in the current fiscal year's earnings, rather than the 10 percent gain currently forecast by analysts.

The company also announced a share buy-back program that would repurchase about 11 percent of shares based on Thursday's closing price. But that may come as bad news to some investors as well, since the move was the result of a review of various strategic options for the company, and some shareholders may have been looking for more dramatic action.

Analysts surveyed by First Call forecast the company to post earnings from operations of 39 cents a share for the fourth quarter of fiscal 2000, ended March 31, down from 48 cents a share a year earlier. Analysts surveyed by First Call forecast the company to post earnings from operations of 39 cents a share for the fourth quarter of fiscal 2000, ended March 31, down from 48 cents a share a year earlier.

The company said it expects to post profits at the lower end of an earlier guidance of 35 to 45 cents a share for the just completed quarter. It said preliminary estimates of special charges for the period now stand at $65 million, pre-tax, or about 50 cents a share.

But the real change is for the fiscal year that began this week. Analysts had forecast earnings of $2.43 a share for the year, up from the $2.20 a share it will earn if it hits the 39-cent forecast. The company now says revenue for the year will be flat to down 5 percent, and that earnings will fall 30 to 40 percent, or to between $1.32 and $1.54 a share, if the company earns $2.20 in the just-completed year.

The company said the new guidance on earnings comes from various market-related factors, including lower-than-expected performance of men's and women's retail apparel and increased emphasis on inventory control in the coming year.

"We recognize that fiscal 2001 will be a transitional year for company, as we re-adjust our product mix to reflect a challenging retail environment and pursue other exciting opportunities for growth," the company said.

The company said it plans to spend $150 million on the share repurchase program over the next 18 months. That would represent 10.8 million of its 95.5 million shares outstanding at current market prices.

Shares of the Tommy Hilfiger (TOM: Research, Estimates) gained 13/16 to 13-13/16 in trading Thursday.

|

|

|

|

|

|

Tommy Hilfiger Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|