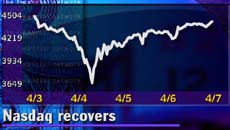

NEW YORK (CNNfn) - Technology stocks soared Friday, handing the Nasdaq composite index its biggest point gain on record and capping a bruising week on Wall Street.

The tech recovery kept the Dow Jones industrial average from suffering big losses in a quiet, orderly session that came as welcome contrast to the previous days.

"In the past four days prior to Friday we packed in two weeks worth of work," John Pickett, of LaBranche & Co. told CNN's Street Sweep. "On Tuesday people didn't just get hit; they got decked."

The Nasdaq Tuesday plunged 574 points, or 13.5 percent, before partially recovering. A day earlier the gauge fell nearly 350 points, a record.

But the index rose three times in the last three sessions, ahead of what should be a strong season for companies reporting earnings for the first three month of 2000.

News Friday that the U.S. labor market did not tighten appreciably last month helped soothe the market, easing fears that the Federal Reserve will aggressively hike interest rates next month.

That, plus some bargain hunting, lifted Nasdaq by 178.89 points, a gain of more than 4 percent, to 4,446.45. That tops the previous record: a 168.21 gain recorded on February 23.

Still, the index is down 2.7 percent this week. But it is up 9.40 percent for the year. Still, the index is down 2.7 percent this week. But it is up 9.40 percent for the year.

The Dow, meanwhile, fell 2.79 to 11,111.48 Friday. The index of 30 blue chip stocks is up 1.7 percent this week but down 3.75 percent in 2000.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped decliners 1,516 to 1,395, as trading volume reached 891 million shares. On the Nasdaq, winners beat losers 2,570 to 1,598. More than 1.5 billion shares changed hands.

In other markets, the dollar rose against the yen but was weaker against the euro. Treasury securities rose. In other markets, the dollar rose against the yen but was weaker against the euro. Treasury securities rose.

A busy week

The last five trading sessions left Wall Street reeling. Analysts cited no specific news behind the technology sell-off, linking losses to accelerating fears that high-flying share prices do not justify their lofty growth prospects.

A big tumble in Microsoft, which was ruled a monopoly by a federal judge Monday, didn't help.

"I'm quite frankly a little tired after this week," Brian Belski, chief investment strategist at George K. Baum, told CNNfn's Capital Ideas.

Belski sees short-term market stability ahead, unlike Tuesday when a massive 2.8 billion shares changed hands on Nasdaq, a record.

With earnings reporting season picking up steam next week, investors Friday rewarded companies with strong growth prospects.

Intel (INTC: Research, Estimates) rose 7 to 136-13/16, Dell Computer (DELL: Research, Estimates) jumped 3-5/8 to 55-3/16, and Cisco Systems (CSCO: Research, Estimates) surged 3-1/8 to 74-15/16.

Dow members Hewlett-Packard and IBM drew buyers. Hewlett-Packard (HWP: Research, Estimates) jumped 4-15/16 to 153-1/16. IBM (IBM: Research, Estimates) rose 5/16 at 123-1/16.

But losses to financials offset the gains. J.P. Morgan (JPM: Research, Estimates) fell 4-3/4 to 129-7/8, and American Express (AXP: Research, Estimates) and American Express shed 1-15/16 to 139-1/16.

Among other stocks in the news, Tommy Hilfiger Corp. (TOM: Research, Estimates) shed 4-7/16 to 9-3/8. The clothing maker cautioned that its fiscal year earnings would drop 30-to-40 percent, rather than gain the 10 percent forecast by analysts.

Jobs data boost stocks

In the week's mostly closely watched economic indicator, the jobs report for March failed to show the kind of strength that makes Wall Street fret about rising inflation.

While the U.S. economy created 416,000 jobs in March, above forecasts, the figures included one-time anomalies. The government hired 117,000 census takers in the period. And because March was five weeks long, another 50,000 to 100,000 positions were added to the total, the Labor Department said.

Wall Street focused more closely on news that the unemployment rate did not fall as expected, but held steady at 4.1 percent. Wage inflation, meanwhile, did not rise with any significance, climbing 0.4 percent.

Analysts said the news helped support the belief that the Federal Reserve will raise rates moderately, not aggressively, a welcome bit of certainty after a volatile week.

"The upshot is that perhaps the job the Fed is doing is working, and that's perceived as bullish by Wall Street," said Art Hogan, chief market strategist at Jefferies & Co.

Most expect the nation's central bank to raise rates a quarter percentage point in May, the sixth hike since last June.

|