|

Chase to buy Fleming

|

|

April 11, 2000: 3:12 p.m. ET

U.S. bank offers $7.7B for U.K. firm, eyes more European acquisitions

|

LONDON (CNNfn) - U.S. commercial bank Chase Manhattan agreed Tuesday to acquire privately held U.K. investment house Robert Fleming Holdings for $7.7 billion in cash and stock.

While analysts saw the price as generous, they said the deal gives Chase critical mass in wealth management and boosts its small investment banking operation, notably in Asia.

"What Fleming brings to us is one of the premium brands in asset management both in Asia and in Europe," Chase Chairman and CEO William Harrison told CNNfn.

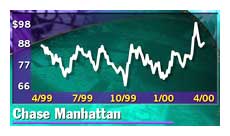

Harrison did not rule out further acquisitions, telling CNNfn he is "optimistic" about further deals. Chase (CMB: Research, Estimates) stock dipped 2-9/16 to 85-9/16 in early New York trade Tuesday.

|

| VIDEO |

CNN's Tom Bogdanowicz reports on how Fleming resisted the onward march of global giants until now.

CNN's Tom Bogdanowicz reports on how Fleming resisted the onward march of global giants until now.

|

| Real |

28K |

80K |

| Windows Media |

28K |

80K |

|

Harrison denied Chase had overpaid, describing the price as "fair" given Fleming's position in asset management and investment banking in Europe and Asia.

"We think if you like the growth potential in Asia and in Europe, then you'll like this deal," Harrison told CNNfn.

|

| VIDEO |

Chase Chairman and CEO William Harrison chats about the acquisition.

Chase Chairman and CEO William Harrison chats about the acquisition.

|

| Real |

28K |

80K |

| Windows Media |

28K |

80K |

|

He confirmed that a retention package will be offered to Fleming employees to prevent the bank from hemorrhaging staff, but would not comment on speculation they will be offered a one-time payment of four times their annual salary.

Chase revealed last month that it was in talks to buy Fleming, one of a handful of remaining independent U.K. investment banks. The Fleming board has recommended the takeover, which will result in the business being renamed Chase Flemings.

Chase last year paid $1.35 billion for San Francisco-based Hambrecht & Quist, renaming the specialist technology corporate finance company Chase H&Q.

Chase is offering £2.573 billion ($4.12 billion) in cash and $3.622 billion in stock for Fleming, and hopes to close the deal in three to four months. Fleming's Chief Executive William Garrett will head Chase Flemings.

Chase still is seen as a second-tier player in European investment banking, and was among a number of banks reported to be interested in Dresdner Kleinwort Benson (DKB), the investment banking arm of Germany's Dresdner Bank (FDRB). DKB became a potential target during the merger talks between Dresdner and Deutsche Bank (FDBK) which collapsed last week.

"We have been opportunistic in acquisitions in terms of size and we will continue to pursue small acquisitions [in Europe]," Harrison said.

Building on brands

Fleming's main strength lies in its wealth management unit, which had funds worth £66.7 billion ($109 billion) at the end of 1999, generating a pretax profit of £75.8 million for the year. The company's investment banking unit reported a £5.8 million loss. Chase already has $232 billion in assets under management, mainly in the United States.

"We are acquiring one of the premium asset management brands in Asia and Europe, and Fleming has a unique securities business, particularly in Asia," Harrison told a news conference in London.

The price is at the top end of estimates cited by analysts over the past week and almost twice the level suggested a month ago, and talks are reported to have dragged over the final offer terms. The price is at the top end of estimates cited by analysts over the past week and almost twice the level suggested a month ago, and talks are reported to have dragged over the final offer terms.

"The whole world is an expensive place to buy," Harrison told CNNfn.com, noting that the deal is expected to dilute earnings per share in the first year and enhance them after that.

The deal is the second in the shrinking U.K. independent investment banking sector this year, following Citigroup's (C: Research, Estimates) purchase in January of the investment banking arm of Schroders for £1.36 billion. The latest deal leaves Close Brothers and Cazenove as the only sizeable U.K. investment banks to remain independent.

As part of the Chase takeover, Fleming will sell its 50 percent stake in a fund management joint venture with T. Rowe Price to its U.S. partner for $780 million.

|

|

|

|

|

|

|