|

BP Amoco-Arco deal OK'd

|

|

April 13, 2000: 2:59 p.m. ET

FTC approves $27B merger creating world's third-largest oil company

|

NEW YORK (CNNfn) - The U.S. Federal Trade Commission has given final approval to the $27 billion mega-merger between BP Amoco and Atlantic Richfield Co., the companies announced Thursday, giving the green light to a deal that will create the world's third-largest oil company.

The merger, which the companies first announced a year ago, will create a company with a market capitalization of $200 billion and combine the assets of Britain's BP Amoco PLC, which produce 450,000 barrels of Alaskan crude a day, and Atlantic Richfield's assets, which produce 350,000 barrels a day.

Both companies said they planned to close the deal on Tuesday. The last day of trading in Atlantic Richfield (Arco) common stock will be Monday.

"We are very pleased to have received FTC approval," Sir John Browne, BP's chief executive said in a prepared statement. "We will now close the deal and rapidly implement the plans we have in place to integrate our operations worldwide. We intend to move quickly to deliver the significant value of this union to the shareholders of the new group." "We are very pleased to have received FTC approval," Sir John Browne, BP's chief executive said in a prepared statement. "We will now close the deal and rapidly implement the plans we have in place to integrate our operations worldwide. We intend to move quickly to deliver the significant value of this union to the shareholders of the new group."

The FTC had given preliminary approval Wednesday to BP Amoco's bid to acquire Arco after overcoming an undisclosed glitch.

The FTC had initially sued to stop the deal because the merged company would control 70 percent of Alaska's oil production. BP Amoco solved that problem by agreeing to divest all of Arco's Alaska holdings to Phillips Petroleum Co. (P: Research, Estimates) for about $7 billion. Exxon Mobil (XOM: Research, Estimates) has sued to stop the transfer of Arco assets. The FTC had initially sued to stop the deal because the merged company would control 70 percent of Alaska's oil production. BP Amoco solved that problem by agreeing to divest all of Arco's Alaska holdings to Phillips Petroleum Co. (P: Research, Estimates) for about $7 billion. Exxon Mobil (XOM: Research, Estimates) has sued to stop the transfer of Arco assets.

"It's about time," Eugene Nowak, an analyst with ABN AMRO Inc. said of the FTC approval. "This was supposed to be a quick and easily executed merger. In other industries, these mergers do take years, but not in the oil industry."

Nowak said he believes the market has had time to absorb the merger since it was first announced a year ago, and that the FTC's approval should not have a significant impact on either company's stock price.

Ian Fowler, a BP Amoco spokesman, said initial terms of the deal remain the same including plans to eliminate about 2,000 jobs, 800 of which are in the Los Angeles area.

The company's main headquarters will be at BP Amoco's offices in London with key centers in Houston and Chicago, Fowler said.

Shares of BP Amoco (BPA: Research, Estimates) were down 13/16 to 51-5/16 in late afternoon trading on the New York Stock Exchange Thursday.

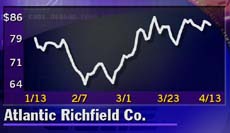

Arco (ARC: Research, Estimates) shares slipped 5/16 to 83-7/8 on the NYSE Thursday afternoon.

|

|

|

|

|

|

|