|

CDNow is strong, says CEO

|

|

April 18, 2000: 2:09 p.m. ET

CEO Jason Olim says music Web site still growing, but in dire need of cash

By Staff Writer Franklin Paul

|

NEW YORK (CNNfn) - For Jason Olim, the past year has been nothing short of mind boggling, as his company, CDNow, went from leading music Web site to the poster child for cash-poor, money-losing, "New Economy" companies poised to go belly up.

While Olim, 30, freely admits the Fort Washington, Pa.-based company is actively searching for a deep-pocket partner and a mechanism to trim its marketing costs, he shrugs off the doomsayers, and says his young company has merely been sidetracked.

Moreover, Olim insists that CDNow's (CDNW: Research, Estimates) financial health has been misunderstood and misrepresented by the press and the Wall Street community as a potential victim of a shakeout among Web retailers. Moreover, Olim insists that CDNow's (CDNW: Research, Estimates) financial health has been misunderstood and misrepresented by the press and the Wall Street community as a potential victim of a shakeout among Web retailers.

"I wouldn't characterize the company as struggling - that's an unfair characterization," Olim told CNNfn.com in an interview. "The company needs cash. That's the outcome of the unanticipated termination of our merger with Columbia House, as opposed to any characteristic of the company itself, in terms of its ability to do business."

In March, CDNow terminated its seven-month-old proposed merger with Time Warner Inc. (TWX: Research, Estimates) and Sony Corp.'s (SNE: Research, Estimates) Columbia House, saying that the mail-order music company couldn't satisfy CDNow's needs for cash to spur its growth. Time Warner is the parent company of CNNfn.

Back in July 1999, the deal was hailed as an opportunity to boost CDNow's marketing clout, and in turn, grow Columbia House's online business. Instead of a merger, CDNow got a $51 million investment from the media giants and a commitment to remain working partners.

But in March, inventors balked and CDNow's independent public accountant, Arthur Anderson LLP, voiced doubts in the company's annual report that CDNow could continue as a going concern.

Olim rebutted the concerns, saying the $51 million is sufficient to keep CDNow operating through the end of the year. He now says that he is "very optimistic that we are going to find a financing partner quickly."

Look beyond that rather large obstacle, if you can, and the company is fine, he said. "We continue to grow our traffic, we continue to grow our brand awareness, and revenue and gross profits," he said. "Aside from wanting cash, CDNow by no means is struggling."

Indeed, the site's traffic has grown, climbing to 3.5 million, including 528,000 new customers in the 1999 fourth quarter. Web-metering company Media Metrix said it was the fifth-most-popular shopping site in February.

Still the cash issue looms. Late last month, CDNow said that it had about $40 million dollars in the bank, and had funds sufficient to meet its payment obligations until about Sept. 30.

Shares slump to all-time low

The revelation of the cash shortage deflated CDNow shares. The stock, which can boasts of a 52-week high at 23, and which started the year at around 10, slipped on Tuesday morning to an all-time low of 3 a share.

"I think that the share price is largely reflecting both inaccurate press and inaccurate market sentiment, and of course the liquidity of the company," Olim said. "But my feeling is that the liquidity concern, while very real, is something that will be resolved very well and very quickly."

Jason Olim and twin brother Matthew in 1994 founded CDNow, a Web site that was transformed from a simple retail site, selling CDs and videos, to a community destination for music enthusiasts who seek industry news, reviews and other content.

The tempo of their expansion, and expenses, picked up about a year ago -- they introduced an expensive television ad campaign, acquired rival online music seller N2K, and set in motion a plan to bolster their operations in Europe and Asia with local content.

The name of the game then was grabbing customers - and CDNow succeeded, swelling its customer base to 2.3 million by early 1999 by offering discount prices and speedy shipment on popular music as well as rare and international discs.

That strategy helped propel several publicly traded consumer-oriented Web retailers to big customer lists and bigger revenues, fueling a rise in their share prices, even as their losses mounted.

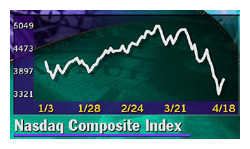

However, in recent weeks Wall Street investors have soured on those same companies and their thirst dampened for growth companies lacking the possibility of generating a profit. As a result, The technology-rich Nasdaq, home to the majority of those upstart technology companies with highflying valuations, has shed about one-third of its value.

Some market watchers see the market's slide as a precursor to an inevitable shakeout in the Internet retail industry. CDNow's name has been included in most of those discussions, and some analysts warn the company won't survive beyond September without a white knight possessing a stash of cash.

"They keep thinking we are a CD seller. We are turning our business into a destination, into a music portal."

-- CDNow CEO Jason Olim

Olim argues that CDNow may sell CDs, but it is not purely a CD seller, one that squeaks by on tiny margins and suffers huge losses as it woos customers.

"We have some of the highest gross margins of an e-commerce company, because we don't just sell CDs," he said. "Ad revenue is one of the real cornerstones of where our business is today. They keep thinking we are a CD seller. We are turning our business into a destination, into a music portal."

So-called "destination" sites are typically rich with content geared toward consumer's hobbies, which keep Web surfers on the sites longer - and viewing more ads -- than retail sites.

About 6 percent of the company's $53.1 million in revenues in the fourth quarter was derived from advertising. For the year, the company's revenues reached $147.2 million, up 161 percent from the previous year.

Not in competition with Amazon

Selling CDs is still the company's primary focus, but it also draws in enthusiasts with its music news, original content and other features, which soon will include Web radio and chat.

Olim said those features differentiate CDNow from leading e-tailer Amazon.com (AMZN: Research, Estimates), which is also the biggest online CD seller by revenue, making it similar to sites such as MTVi's network and music segments on Yahoo and Lycos' sites.

"Amazon is not a competitor of ours as a music site," Olim said. "My gross margins are substantially higher than theirs. I am not at all dissatisfied at how we are doing."

His eye may be on his competitors, but Olim knows his primary challenges are at home. Even if he gets the cash he needs, CDNow is still awash in red ink. For the full year 1999, the company's net loss was $119.2 million, or $4.32 a share, compared with $43.9 million, or $2.79 per share, for 1998.

He said the company will detail its  targets for profitability after its first-quarter results are released in a few weeks. targets for profitability after its first-quarter results are released in a few weeks.

"CDNow is a business ... that can get to profitability in a reasonable order, with relatively low cash need," Olim said. "Having not closed the deal with Columbia House, it finds itself needing cash, but it is not a company that will have difficulty getting to profitability."

"If it has the cash, its in the bag."

|

|

|

|

|

|

CDNow

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|