|

AOL beats expectations

|

|

April 18, 2000: 8:04 p.m. ET

Leading Internet service provider cites strong ad and commerce revenues

|

NEW YORK (CNNfn) - America Online reported Tuesday a better-than-expected fiscal third-quarter profit that more than doubled year-ago levels, reflecting strong advertising and commerce revenue for the world's leading Internet service provider.

Excluding one-time items, the company earned $271 million, or 11 cents a share for the three months ended March 31, compared with $104 million, or 4 cents a share, in the year-ago quarter. Revenue rose 47 percent to $1.8 billion from $1.25 billion for the same three months in 1999.

A consensus of Wall Street analysts surveyed by earnings tracker First Call/Thompson Financial had expected AOL (AOL: Research, Estimates) to earn 9 cents a share in the quarter. The estimates ranged from 8 cents to 11 cents, First Call said.

AOL's net income rose to $438 million, or 17 cents per diluted share, up from $411 million, or 16 cents per diluted share, in the year-ago third quarter. The net income includes one-time gains from the sale of investments totaling $275 million in the current quarter.

The quarter was powered by a leap in revenue outside of AOL's core subscription service, which provides consumers with access to the Internet for a fee of between $5 and $22 a month. Revenue from advertising and commerce climbed 103 percent over the year ago period to $557 million. That marks a record $120 million, or 27 percent increase over this year's second quarter.

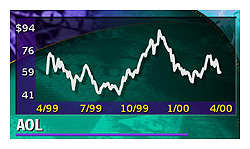

Time Warner merger still on track

Shares of America Online, which earlier this year announced plans to merge with Time Warner Inc. (TWX: Research, Estimates), the parent of CNNfn, closed Tuesday at 59-17/32 up 25/32. America Online released its results after the closing bell Tuesday.

The company reiterated that it expects the deal to close on schedule in the fall, and that the companies' executives have been diligently working on their plan to blend the two giant businesses.

"The more we meet, the more we realize that we have a common vision, because both companies are focused on consumers," said AOL President and Chief Operating Officer Bob Pittman.

Addressing reports of disagreement in the merger discussions, AOL Chairman and CEO Steve Case said the two companies realize they have different perspectives on certain businesses, like the distribution of music over the Internet, but are working on solutions that satisfy both parties.

"They have to continue to run their businesses, and we have to figure out how to invent new businesses and find common ground between those two," Case said in a conference call with analysts.

Growth in membership

Dulles, Va.-based AOL said that its membership ranks grew to record levels and that its customers stayed connected for a longer period of time, an important indicator to advertisers.

AOL said it added 2 million new subscribers worldwide in the quarter and ended the period with 25.8 million subscribers to its family of online services, including the CompuServe service and Gateway Inc.'s service, which is managed by AOL.

The flagship AOL service added 1.7 million new members, and finished the quarter with 22.2 million subscribers. AOL members averaged 64 minutes daily online during the quarter, an increase of 16 percent over last year's third quarter.

"America Online's business has never been more robust," Case said.

He also noted that this quarter's results underscore the strength of America Online's operations, and demonstrate that "we are on a clear path to continued strong growth and increased profitability."

Advertisers and marketers continued to scramble for access to AOL's growing subscriber base, the company said. AOL's backlog of advertising and commerce revenue stood at $2.7 billion on March 31, up from $2.4 billion at the end of the prior quarter.

|

|

|

|

|

|

America Online

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|