|

United, TWA, AA fly high

|

|

April 19, 2000: 1:38 p.m. ET

AMR swings to profit despite surge in fuel prices; United raises guidance

|

NEW YORK (CNNfn) - The owner of United Airlines, the nation's largest carrier, reported an unexpected gain in first-quarter income and raised its earnings guidance for the remainder of the year.

Another major carrier, Trans World Airlines, reported a smaller-than- expected loss for the period, although it was wider than the year-earlier deficit. Troubled carrier U.S. Airways Group posted a larger-than-expected loss for the quarter, during which it faced the threat of a strike by flight attendants. And AMR Corp., the owner of the nation's second-largest airline, swung to a profit in the first-quarter and managed to beat analysts expectations.

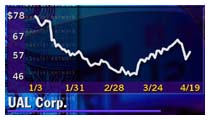

United's parent UAL Corp. (UAL: Research, Estimates) earned $191 million, or $1.61 a share, excluding two one-time charges. Analysts surveyed by earnings tracker First Call had expected earnings to fall to $1.37 a share in the period from the $187 million, or $1.54 a diluted share, it earned from operations in the year-earlier period.

United projected a better-than-expected result March 27, prompting analysts to raise the consensus forecast from 98 cents a share at that time. United projected a better-than-expected result March 27, prompting analysts to raise the consensus forecast from 98 cents a share at that time.

The company again steered analysts higher for the remainder of the year, saying it now expects to earn between $2.60 and $3.00 a share in the second quarter, and between $8.00 and $10.00 a share for the year. The First Call forecast calls for $2.42 a share in the second quarter and $8.24 a share for the year.

UAL took a $209 million after-tax charge for a change in accounting practices related to its frequent flyer program. Other carriers reported similar charges in the period. It also took a $26 million after-tax charge for write-down of a commuter aircraft. Those charges left the company with a net loss of $44 million, or 39 cents a diluted share, for the quarter.

Revenue rose 9 percent to $4.5 billion from $4.2 billion a year earlier.

Fuel costs increased 36.5 percent to $539 million, but that was less severe than at many other carriers because they were mitigated by greater use of long-term fuel contracts than some competitors.

The company made up for the fuel hikes by cutting commissions paid by 12 percent to $249 million, and reducing employee stock ownership plan compensation expense in half to $91 million. The airlines all have cut the fees paid to travel agents and are trying to migrate more ticket purchases the Internet.

TWA posts smaller-than-expected loss

Trans World Airlines (TWA: Research, Estimates) reported a loss of $63.9 million, or 98 cents a share, before an accounting change. While that was wider than the 62 cents a share loss it reported a year earlier, it was below the First Call forecast of a $1.37 a share loss.

Including the charge for a change in accounting practices in the most recent quarter and a gain from sale of investment in the year-earlier quarter, the company reported a net loss of $76.1 million, or $1.16 a share, up from $21.6 million, or 42 cents a share.

The St. Louis-based carrier's revenue rose 5.8 percent to $809.0 million from $764.6 million, due in part to higher fares. Most major airlines instituted fuel surcharges during the quarter to deal with fuel piece hikes. The St. Louis-based carrier's revenue rose 5.8 percent to $809.0 million from $764.6 million, due in part to higher fares. Most major airlines instituted fuel surcharges during the quarter to deal with fuel piece hikes.

Fuel costs nearly doubled for TWA to $140.4 million from $72.6 million a year ago. Labor costs climbed 8 percent to $25.3 million under a new labor agreement. But commissions fell by 30 percent, saving $13.4 million.

Labor troubles, fuel hikes plague US Airways

US Airways (U: Research, Estimates) went to the brink of a shut-down last month before reaching a contract agreement with its flight attendants. But preparations for that possible shut-down and the loss of traffic to other carriers cost the troubled airline, which also was hit with some of the steepest fuel increases in the industry.

The Arlington-Va.-based carrier reported a loss of $108 million, or $1.72 a diluted share, well above the First Call forecast of $1.48 a share. A year earlier, the company posted net income of $46 million, or 56 cents a diluted share, but 7 cents of that came from the sale of its share of the industry-wide Equant communications network.

With the change in accounting practices, US Airways' net loss came to $211 million, or $3.27 a diluted share.

US Airways' average fuel price rose 105 percent to 88.8 cents a gallon from 43.3 cents a year earlier. That hike, and increased flights, drove total fuel expenses up 113 percent to $253 million. While commissions fell 26.5 percent, that saved the carrier only $30 million.

Revenue was basically flat for the period, rising 0.9 percent to $2.1 billion from $2.0.

US Airways said that with fuel prices starting to decrease and labor disputes finally settled, the rest of the year should show improvement. US Airways said that with fuel prices starting to decrease and labor disputes finally settled, the rest of the year should show improvement.

"The unique challenges US Airways faced over the past year are largely behind us," President and CEO Rakesh Gangwal said.

AMR Corp. (AMR: Research, Estimates), the parent of American Airlines, posted a profit of $89 million, or 57 cents and share, from a loss of $2 million, or 1 cent a share, in the year earlier period. Analysts polled by First Call forecast it would make 39 cents a share in the quarter.

The Fort Worth, Texas-based company, was hit by a pilots walkout in the first-quarter last year, but AMR posted a profit this quarter despite a 60 percent surge in fuel cost to $553 million. Revenue rose 14.2 percent to $4.5 billion.

"Although fuel costs were up sharply from last year, the increase was dampened to a large degree by our ongoing fuel hedging program," said Donald Carty, AMR's chief executive officer.

Airline shares have performed relatively well in the face of downward pressure on stocks the last few weeks, driven by lower fuel costs.

Shares of UAL gained 1-9/16 to 58-5/16 in morning trading Wednesday, while TWA rose 3/16, or 10 percent, to 2-1/16. Even US Airways shares gained despite missing forecasts, rising 7/8 to 26-7/16. AMR shares gained 1-7/16 to 35-5/16.

|

|

|

|

|

|

|