|

Bristol pulls drug filing

|

|

April 19, 2000: 4:12 p.m. ET

Shares plummet after company withdraws its FDA filing for hypertension treatment

|

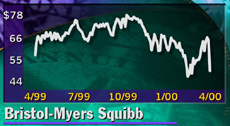

NEW YORK (CNNfn) - Bristol-Myers Squibb Corp. on Wednesday withdrew an application for a key drug in its pipeline, hypertension treatment Vanlev, triggering a 22 percent drop in the pharmaceutical company's shares.

The stock slid 14-11/16 to 50-7/16 in afternoon trading, after falling as low as 46-5/16. Bristol-Myers shares were the most actively traded issue on the New York Stock Exchange late Wednesday afternoon, with about 41.1 million shares trading hands.

The Princeton, N.J.-based company said it pulled its filing after the U.S. Food and Drug Administration raised safety concerns about the proposed treatment. The federal agency has asked for more data on a potential side effect known as angioedema - a swelling in the face, throat, lips or tongue -- among people who took the drug in clinical studies.

Industry analysts have said Vanlev could be a blockbuster drug with billions in annual sales.

The company has billed the drug as its next big product -- after the cancer drug Taxol and Glucophage, a top-selling diabetes drug, said Herman Saftlas, pharmaceuticals analyst with S&P Equity Group.

"It's a big disappointment, obviously," said Saftlas, who maintains a "hold" rating on Bristol-Myers stock. "They were relying on this thing."

But, he said, the company still has one of the strongest new drug pipelines of any pharmaceutical company.

Bristol-Myers (BMY: Research, Estimates) said it hopes to re-file its application for Vanlev with the FDA early next year. Regulatory filings in other countries are "proceeding as planned," the company said in a statement.

Vanlev is designed to block two key enzymes, reducing blood pressure. The FDA granted the drug "priority review" status in January, which can speed up the approval process for new treatments.

The withdrawal of the Vanlev application is the latest disappointment for Bristol-Myers, the No. 3 U.S. drug maker. Earlier this month, a federal judge struck down the company's patents on Taxol, ruling in favor of generic drug makers who want to produce cheaper versions of the medication. The decision is being appealed.

The company is slated to release its first-quarter earnings results Thursday, with Wall Street analysts projecting operating profit of 60 cents per diluted share, from 53 cents in the year-earlier period.

|

|

|

|

|

|

Bristol-Myers Squibb

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|