|

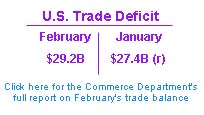

U.S. trade deficit widens

|

|

By Staff Writer M. Corey Goldman April 19, 2000: 8:51 a.m. ET

February gap widens to record $29.2B as imports surge; oil prices rise

|

NEW YORK (CNNfn) - The U.S. trade deficit widened in February as demand for consumer products produced abroad continued at a robust pace and oil prices surged, while exports declined for the second time in nine months, the government reported Wednesday.

The trade deficit, which measures the amount of money spent on imports coming into the United States versus the amount raked in from exports leaving the country, widened in February to a record $29.2 billion, the Commerce Department said. That was well above January's revised $27.4 billion deficit and above economists' estimates of a $28.5 billion deficit. February's figure was revised downward from the $28 billion first reported last month. The trade deficit, which measures the amount of money spent on imports coming into the United States versus the amount raked in from exports leaving the country, widened in February to a record $29.2 billion, the Commerce Department said. That was well above January's revised $27.4 billion deficit and above economists' estimates of a $28.5 billion deficit. February's figure was revised downward from the $28 billion first reported last month.

Exports slipped slightly in February as demand abroad for U.S.-made vehicles, aircraft, telecommunications equipment and industrial machinery declined, the Commerce Department said. Imports, meantime, surged to a record, mostly reflecting the rising cost of oil, which hit a peak during the month.

The trade deficit "continues to be a drag on growth, and it won't take the pressure off the Fed to raise rates," Peter Morici, a senior fellow with the Economic Strategy Institute in Washington, told CNNfn's Before Hours.

Resilient U.S. growth

The record trade imbalance provided yet another indication to analysts of the strength of the U.S. economy, currently in its record 109th month of uninterrupted expansion. That strength has been driven in large part by U.S. consumers' penchant to buy, something the Federal Reserve has been seeking to reign in by raising interest rates in quarter-point steps.

The reason the trade deficit is a threat to the economy is the striking imbalance between what American consumers and companies pull into the country and what they send back out to the rest of the world, something Fed officials including Chairman Alan Greenspan worry could create too much demand at home and too little supply from abroad.

Because of that, most analysts anticipate the Fed's policy setting arm, the Federal Open Market Committee, will raise interest rates another quarter point when they meet in Washington next month, a move intended to dampen consumer demand by making borrowing more expensive. The FOMC last raised rates March 21 by a quarter point to 6 percent. Because of that, most analysts anticipate the Fed's policy setting arm, the Federal Open Market Committee, will raise interest rates another quarter point when they meet in Washington next month, a move intended to dampen consumer demand by making borrowing more expensive. The FOMC last raised rates March 21 by a quarter point to 6 percent.

The Commerce Department said the price of imported crude oil rose to an average $25.01 per barrel in February from $23.18 the previous month, the highest level since December 1990. That increase helped push overall imports to a record $113.4 billion in February, up from $111.8 billion the previous month.

Exports weakened slightly to $84.2 billion in February from $84.3 billion in January, held back by civilian aircraft exports, which fell to $1.6 billion from $2.6 billion the previous month. A strike at No. 1 aircraft maker and exporter, Boeing Co. (BA: Research, Estimates), reduced aircraft shipments abroad.

Boeing Wednesday reported first-quarter earnings that trailed those of the year-ago period.

The U.S. dollar factor

To be sure, one factor that has helped propel the trade deficit to successive records is the strength of the U.S. dollar over other currencies, which makes imports cheap to buy for American consumers and makes U.S. goods more expensive in other countries.

Morici said the dollar's strength could continue to propel the trade deficit higher in the months ahead as consumers abroad continue to put off buying U.S.-made products that cost them more in dollars than alternative products they can buy in other countries. (306KB WAV) (306KB AIFF) Morici said the dollar's strength could continue to propel the trade deficit higher in the months ahead as consumers abroad continue to put off buying U.S.-made products that cost them more in dollars than alternative products they can buy in other countries. (306KB WAV) (306KB AIFF)

The trade deficit with Japan increased to $6.7 billion from $5.6 billion in January, while the deficit with China declined to $5.6 billion from $6.0 billion. Imports from Mexico were a record $10.4 billion. The deficit with Canada, the largest U.S. trading partner, narrowed to $3.3 billion from $4.1 billion.

Sherry Cooper, chief economist with brokerage Nesbitt Burns, said the record trade gap so far has only triggered concern among investors about the robust pace of the U.S. economy. Growth registered a whopping 7.3 percent in the fourth quarter, its strongest showing in 16 years.

If the deficit continues to widen, however, that could indicate that U.S. producers are losing their competitive edge, she said.

"Investors appear to view the growing shortfall as a natural by-product of robust U.S. growth and not a sign of flagging competitiveness," Cooper said. "The concern for financial markets is that if this view ever changes, the fallout would occur rapidly."

|

|

|

|

|

|

|