|

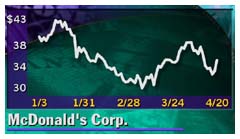

McDonald's tops target

|

|

April 20, 2000: 3:53 p.m. ET

Strong overseas sales give fast-food chain a 12% profit gain from year ago

|

NEW YORK (CNNfn) - McDonald's Corp. edged past first-quarter earnings estimates Thursday, driven partly by strong growth in overseas sales.

The Dow component also announced a $1 billion increase to its $4.5 billion share repurchase program to run through next year. The company has repurchased 51 million shares for $1.8 billion since the start of the repurchase program last year.

The Oak Brook-Ill.-based fast-food chain reported a 12 percent gain in net income to $450.9 million, or 33 cents a diluted share. Analysts surveyed by earnings tracker First Call predicted the company to earn 32 cents a share in the quarter. The company earned $402.7 million, or 29 cents a share, a year earlier.

System-wide sales for McDonald's (MCD: Research, Estimates) rose to $9.5 billion from $8.8 billion. U.S. sales grew 5 percent while sales in overseas markets increased 12 percent. System-wide sales for McDonald's (MCD: Research, Estimates) rose to $9.5 billion from $8.8 billion. U.S. sales grew 5 percent while sales in overseas markets increased 12 percent.

Sales at company-operated restaurants rose 12 percent to $2.4 billion, while revenue from franchise and affiliated restaurants gained 6 percent to $903.9 million. That brought company revenue to $3.3 billion, up 10 percent from $3 billion a year earlier. Excluding the impact of currency fluctuations, revenue rose 13 percent in the quarter.

McDonald's also added $1 billion to its share repurchase program, raising its total share repurchase budget to $4.5 billion through 2001.

In reaction to the acceleration of this program, Duff & Phelps Credit Rating Co. lowered its rating of McDonald's senior notes to 'AA' from 'AA+' and also lowered its rating of subordinated debt from 'AA' to 'AA-', noting that the share repurchase will be debt financed and will result in a "modest weakening of the company's credit measures."

But Duff & Phelps noted McDonald's strong cash flow makes the share repurchase program "highly discretionary."

Of the 17 Dow components that have reported results so far, all but Philip Morris Cos. (MO: Research, Estimates) beat estimates; Philip Morris met the forecast.

Shares of McDonalds gained 2-9/16, or about 6 percent, to 35-5/8 in trading late Thursday.

|

|

|

|

|

|

McDonald's

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|