|

Europe rises pre-holiday

|

|

April 20, 2000: 1:49 p.m. ET

Paris, FTSE rise on strong media stocks; Dax in a slump behind SAP

|

LONDON (CNNfn) - Europe's top markets closed mostly higher Thursday, bolstered by shares of media and tobacco companies as a four-day holiday weekend got under way. Steel and computer-related stocks were among key losers.

The FTSE 100 in London, home to Europe's biggest exchange, rose 56.3 points, or 0.9 percent, to 6,241.2, lifting its gain for the abbreviated week to 1 percent. British American Tobacco (BAT) was the top percentage gainer, up 12 percent behind a late-session rally.

Leading Europe's charge thanks to a jump among media and telecom stocks was the CAC 40 in Paris, gaining 68.05 points, or 1.1 percent, to 6,234.51. For the week, the index also was also the leading Europe gainer, up 2.8 percent.

The Xetra Dax in Frankfurt fell 58.76 points, or 0.8 percent, to 7,157.95, with software company SAP [FSE:FSAP3] falling 9.4 percent following the resignation of its top U.S. executive late Wednesday. For the week, the Dax was up 0.7 percent.

Many investors sat on their hands ahead of the Good Friday and Easter holidays, edgy about making big moves following last week's tremors on Wall Street. The Nasdaq composite fell 25 percent last week only to climb back sharply Monday and Tuesday. That set the tone for Europe's markets.

"This is a market that will not do what may be obvious. It's sentiment-led, rather than value-led," Jerry Evans, a stock market strategist with Enskilda Securities, told CNNfn.com. "If we stabilize, people may try to cherry-pick in blue-chip and growth stocks, but if we head lower investors may get defensive again."

The FTSE Eurotop 300, a broader measure of the region's largest companies, added 0.8 at 1,589.92. Sub-indexes for tobacco and media stocks rose, while steel, automotive and technology companies were lower.

The computer sub-index fell 4 percent after jumping 6 percent Wednesday.

Wall Street, which has been the global market bellwether in recent weeks amid its volatility, offered little direction for European stocks Thursday. At the close of European trading, the Nasdaq composite was down 1 percent while the Dow Jones industrial average was up more than 1 percent.

In the currency markets, the euro traded at $0.9367, up slightly after tumbling to a record low of $0.9357 in U.S. trading Wednesday. The resignation of Italian Prime Minister Massimo D'Alema and concerns the European Central Bank will continue to let the single currency drift led to the euro's weakness in the U.S., traders said.

Rentokil, media give FTSE steam

Among the gainers in London was office services firm Rentokil Initial (RTO), jumping 9 percent after UK industrial plant rental company

Ashtead Group said it bought Rentokil's BET USA division for £320 million ($505.7 million).

Advertising agency WPP Group (WPP) rose 9 percent, pay-TV broadcaster BSkyB (BSY) added 7.4 percent. Among other media plays, Internet service provider Freeserve (FRE) jumped 9.8 percent in a late rally and Reuters Group (RTR) added 6.3 percent.

Energis (EGS), a provider of telecommunications services for businesses, rose 5.7 percent after its nevada tele.com joint venture with Northern Ireland utility Viridian said it was in discussions with Dublin-based business telecom provider Stentor that could lead to an offer for Stentor worth £45.8 million ($72 million).

Handheld computer maker Psion (PON) led losers, down 6.2 percent.

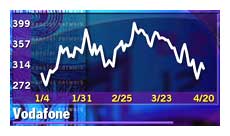

Vodafone AirTouch (VOD) slid 5.3 percent as its tense battle with British Telecommunications (BT-A) over a new-generation mobile-phone license left investors nervous about the high cost to the participants. Vodafone so far had made the highest bid for the most valuable of the five licenses on sale, offering nearly £6 billion ($9.5 billion).

Among other technology and telecom shares, Sage Group (SGE) fell 3 percent, Scottish telecom Thus (THUS) shed 6 percent, and biotech firm Celltech Group (CCH) dropped 5.7 percent.

SAP, Daimler dumped in Frankfurt

In Frankfurt, software publisher SAP [FSE:FSAP3] dragged down the benchmark Dax index with a 9.4 percent drop after its U.S. chief resigned unexpectedly Wednesday. That more than erased its 6.8-percent increase the previous day, following the company's earnings report.

Shares in Commerzbank (FCBK) fell 3.4 percent after Dutch holding company Rebon BV said it might raise its stake in Germany's fourth-largest bank, dampening recent speculation that Commerzbank might merge with a local rival.

Also lower was automaker DaimlerChrysler (FDCX), off 6.4 percent.

Other banks diverged. HypoVereinsbank (FHVM) fell 2.4 percent, dropping off from early-session gains while Dresdner Bank (FDRB) added 2.5 percent.

Leading the Dax were retailer Metro (FMEO), up 4 percent, and heavyweight Deutsche Telekom (DTE), which climbed 3.3 percent.

Media, deals lift Paris

The top gainer in Paris was Crédit Lyonnais (PCL), up 6.1 percent after Dresdner confirmed earlier Thursday that it owned 3.6 percent of the recently privatized French bank. Crédit Lyonnais, for its part, said it had not held any talks with Dresdner, which has faced rampant merger speculation.

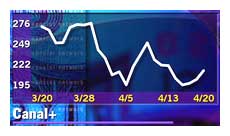

Paris also was lifted by a 6.7 percent rise in pay-TV operator Canal Plus (PAN) after government figures showed that cable TV penetration was increasing at a faster rate than last year. Thomson-CSF (PHO) gained 5 percent after selling its 1.5 percent stake in bank CCF.

Building materials producer Lafarge (PLG) rose 4 percent as investors bet that its raised 450-pence-per-share bid for Britain's Blue Circle Industries (BCI) would succeed.

Elsewhere in Europe, Dutch software maker Baan plunged 7.9 percent in Amsterdam after reporting its seventh consecutive quarterly loss. Baan said its first-quarter deficit widened from a year earlier even though proceeds from divestments boosted this year's first quarter.

The SMI in Zurich edged up 0.2 percent.

-- from staff and wire reports

|

|

|

|

|

|

|