|

Wesley Jessen courts suitor

|

|

April 24, 2000: 3:39 p.m. ET

Target of Bausch & Lomb takeover says it began talks with possible suitor

|

NEW YORK (CNNfn) - Contact lens maker Wesley Jessen VisionCare Inc., the target of a takeover bid by eye care firm Bausch & Lomb Inc., announced Monday that it opened talks with an unidentified third party about "a possible transaction."

Wesley Jessen, the No. 1 producer of tinted specialty contact lenses, is already in a pact to buy smaller rival Ocular Sciences Inc. The pact was originally valued at about $413 million when announced on March 20, but has risen to about $650 million as the value of Wesley's stock has surged amid Bausch & Lomb's takeover bid, which is worth $600 million in cash.

Last week, Wesley Jessen rejected Bausch & Lomb's bid, but said it would open talks with the company to try to negotiate a better offer. Last week, Wesley Jessen rejected Bausch & Lomb's bid, but said it would open talks with the company to try to negotiate a better offer.

Shares in all three companies rose Monday afternoon amid the speculation.

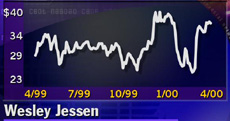

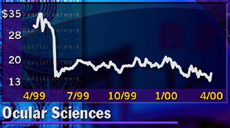

Wesley Jessen (WJCO: Research, Estimates) shares climbed 1-13/16, or 5 percent, to 39, while Ocular Sciences (OCLR: Research, Estimates) stock jumped 2-5/8, or 19 percent, to 16-9/16, and Bausch & Lomb (BOL: Research, Estimates) rose 5 percent, gaining 2-3/16 to 56-1/4.

The Des Plaines, Ill.-based Wesley Jessen said the third-party "preliminary discussions" are being held with Ocular Sciences' consent and that the two companies' merger pact remains "in full force and effect."

Shareholders in both firms are scheduled to vote June 23 on the deal, which would create the world's second-biggest soft contact lens producer, behind Rochester, N.Y.-based Bausch & Lomb.

A Wesley Jessen spokesman declined to elaborate on the company's statement.

Ocular Sciences, based in South San Francisco, Calif., did not immediately respond to a request for comment from CNNfn.com. Ocular Sciences, based in South San Francisco, Calif., did not immediately respond to a request for comment from CNNfn.com.

The company's chief financial officer, Greg Lichtwardt, told Reuters news agency that the intention of Wesley's third-party talks was to devise a three-way deal that would save the proposed merger of Wesley and Ocular Sciences.

"The intention here is to find a third party that would find the combined Ocular-Wesley business of value," Lichtwardt was quoted as saying.

Industry analysts have speculated that Wesley Jessen might receive a buyout offer from another company, as contact lens manufacturers try to position themselves to dominate the lucrative specialty soft contact lens sector.

One company previously mentioned by analysts as a potential suitor for Wesley is health care giant Johnson & Johnson (JNJ: Research, Estimates). J&J stock gained 2-5/16 to 83-15/16 Monday afternoon.

|

|

|

|

|

|

|